So, you’re interested in becoming a CPA. That’s awesome! Careers opportunities for CPAs are nearly endless. Whether you are interested in accounting, personal finance or wealth management, or aiming for the C-Suite, getting your CPA license can help you reach your goals.

The demand for accounting services is virtually unlimited.

CPAs play vital roles in financial reporting, taxation, and even some finance specialties. As a result, CPAs enjoy an extremely low unemployment rate – around ~2%! Further, CPAs can command higher-than-average compensation due to the demand for their expertise. With a median income of ~$120,000 (before bonus), CPA’s earn ~3x the median salary of other occupations requiring a Bachelor’s degree.

Not only is accounting a stable (and relatively lucrative) career path, CPAs are trusted business advisors.

CPAs and accountants are employed across every industry to provide valuable financial services. For individuals, CPAs are an indispensable resource to assess tax implications and other aspects of financial planning. CPAs in public accounting ensure corporations are appropriately recording and disclosing their financial records to investors.

As a result, the accounting profession has become a respected industry as individuals and businesses understand the need for quality CPAs.

Some CPAs are employed beyond traditional accounting roles and specialize in valuation or financial due diligence and perform extensive financial modeling. Moving from accounting to finance may not be easy. However, there are strategies for transitioning from accounting to finance.

According to the World Economic Forum, accountants are the 7th most respected profession.

However, just like any other career path, there are disadvantages to consider.

Before committing to pursue accounting or the CPA designation, you should first assess the issues and ensure the accounting profession is right for you.

1. Obtaining the CPA license is very difficult

The journey to become a Certified Public Accountant (CPA) is quite long and arduous.

Just like doctors must pass their boards and lawyers must pass the bar, accountants wishing to get the most out of their career will need to sacrifice both time and money to obtain those three little letters behind their name.

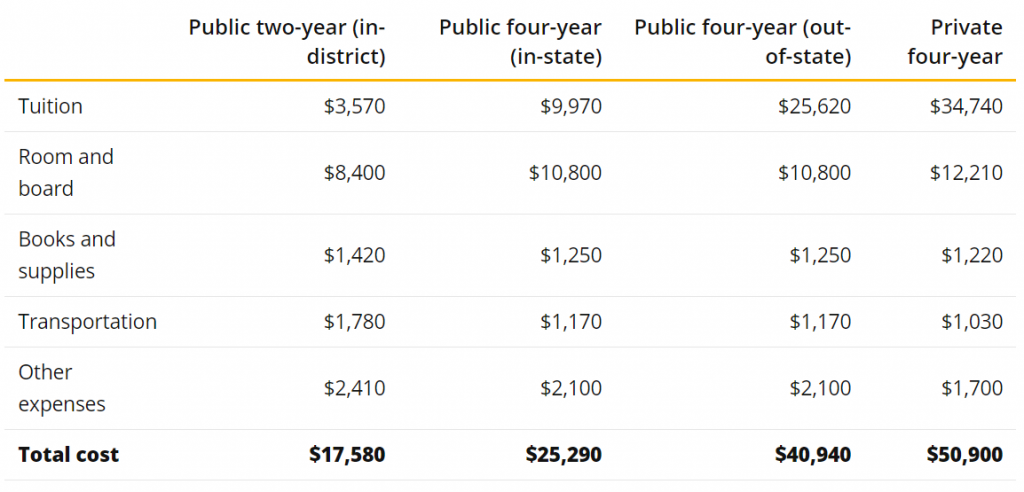

Most states require CPA candidates to earn 150 credit hours and complete specific courses in higher-level accounting and ethics.

Since most students only earn 120 credit hours to obtain a Bachelor’s degree, those who wish to take the Uniform CPA Exam generally enroll in Master’s degree programs to earn the necessary hours.

Plus, many graduate programs are geared towards helping students pass the exam.

Clearly, an extra year in college comes with added costs on top of the expense of obtaining a $100,000+ 4-year degree.

Passing the Uniform CPA Exam isn’t guaranteed

Even if you invested $125,000+ in both a Bachelor’s and Master’s degree program, all this education doesn’t guarantee you’ll become a CPA.

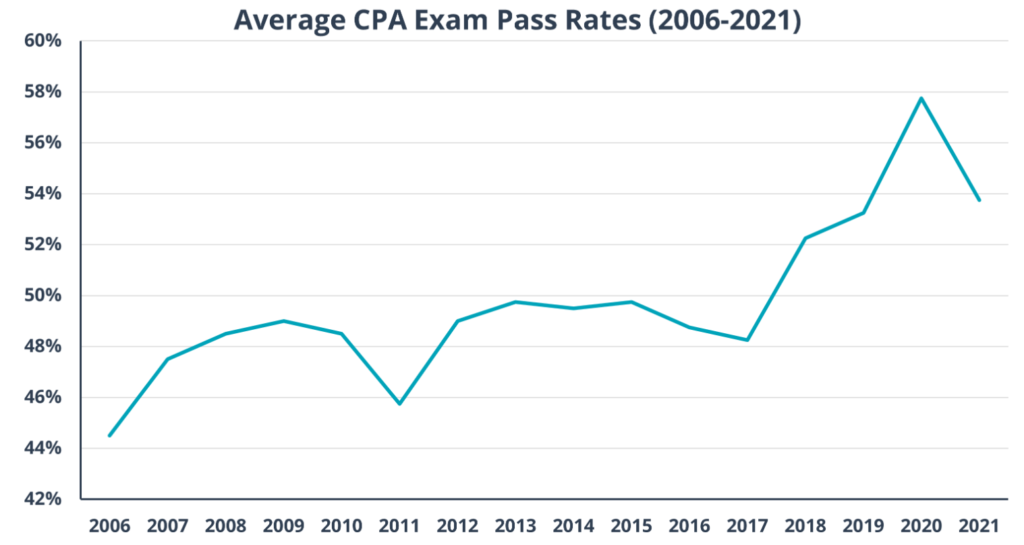

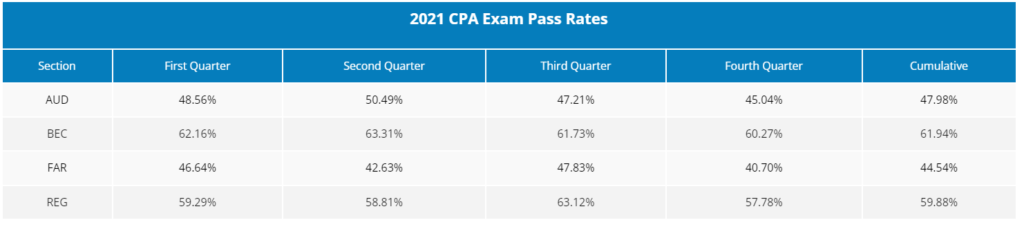

After all, the pass rate on the CPA Exam is very low. Historically, only around 50% pass each section of the exam.

The difficulty stems from candidates needing to pass all four parts within an 18-month window. On top of school or work commitments, finding time to invest the necessary hours can be difficult.

Further, some sections of the exam may come easier while candidates may struggle with certain topics. This is why the pass rate varies by section and time of the year.

The Uniform CPA Exam is EXPENSIVE

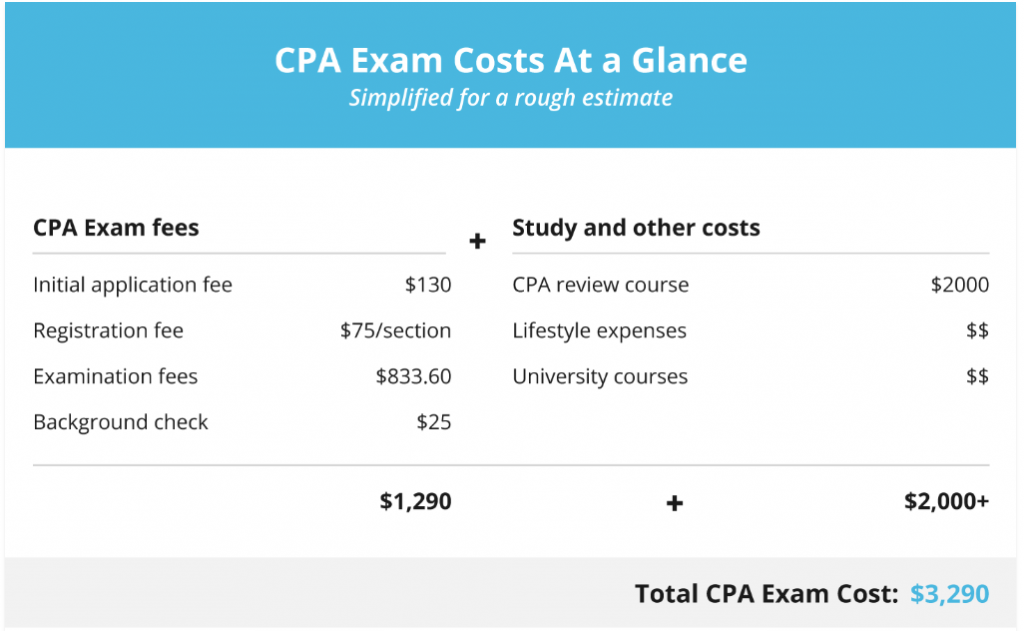

On top of the cost of obtaining 150 credit hours (in most states), candidates will face additional expenses to prepare for the CPA Exam.

Application, registration, and exam fees can total over $1,000. If you do not pass a section, you will continue to incur expenses each time you make another attempt.

In order to increase the likelihood of passing, CPA Exam review courses are highly recommended.

Having in-depth, targeted material can help you refresh your knowledge on topics likely to be tested. This can end up saving you months of your time and even money in the long run.

If you’re interest in pursuing your CPA license, investing in a CPA review course is highly recommended. This can save both time and money in the long run while helping you achieve your goal of becoming a CPA.

2. The CPA license requires lifelong continuing education

Okay, so you’ve managed to pass the Uniform CPA Exam. Congrats!

You’ve graduated with a Master’s degree and passed the Uniform CPA Exam. However, your education isn’t over.

In order to maintain your CPA designation, your state board requires continuing professional education (CPE). These courses are designed to help you maintain your competency level and continue providing professional service.

Many states require upwards of 120 credit hours to be completed over a certain period of time (i.e. 3 years). Additionally, many states require a minimum threshold each year (such as a minimum of 20 credits). Further, a certain number of hours in ethics must be completed to reinforce the importance of ethical decision-making in the profession.

Depending upon which state board issues your license, you must comply with their CPE requirements to remain in good standing.

Considering you’ll already be working 50+ hours a week as a CPA (see Disadvantage #3), getting the necessary CPE often comes at the expense of your personal time.

Plus, the CPE generally isn’t free. Unless your employer reimburses the expense, you could be out of pocket hundreds of dollars (or more).

Continuing Professional Education Courses

CPE courses are designed to enhance both technical skills and non-technical areas. Once a CPA completes the course material (which can range from 1 hour to 10+ hours), they must also pass a test on the material to receive credit (for online CPE).

Technical lessons may include courses on updates on tax law, using Microsoft Excel for financial modeling or capital budgeting, and auditing material.

Non-technical lessons are designed to enhance “soft skills.” A CPA can get CPE credit when they complete NASBA-approved courses that enhance non-technical aspects that CPAs encounter. Examples include courses on stress management, ethics, or client relationship courses.

A CPA can obtain CPE from a variety of sources. Many public accounting firms provide ample online webinars to keep their staff updated on the latest accounting pronouncements. Often, these webinars qualify for CPE.

If you enjoy attending conferences or seminars, the AICPA or other professional organizations offer a variety of conferences where top experts provide the latest insights in the accounting profession. As a CPA, attending these events provides a chance to receive CPE, network, and enhance your knowledge.

However, often the most convenient option is an online, self-study subscription. There are several providers like the AICPA and CPEThink that offer unlimited, NASBA-approved courses that qualify for CPE.

While these courses enhance and maintain your knowledge base, some may find the fairly stringent CPE requirement as a disadvantage.

3. CPAs generally work long hours

If you think the hard work is over by graduating college and passing the CPA Exam, you’re in for a rude awakening. Until you’ve “done the time” and “earned your stripes,” prepare to spend countless hours working the corporate grind.

During certain times of the years, accountants are likely to work 70+ hours per week.

Depending upon the CPA’s specialty, this could be around tax time (January – April) as they help clients prepare their tax returns. Similarly, many auditors face an immense workload around corporate filing season (generally, January – March). The workload for accountants employed in industry also ramps up during quarter and annual filing deadlines.

According to the AICPA, nearly 90% of CPAs work more than 50 hours per week during “busy season.” Nearly 30% of CPAs indicate they work more than 70 hours weeks.

Even when work “slows down,” many CPAs still find themselves working a ton of overtime (often, unpaid). In fact, nearly 60% work at least 50 hours per week throughout the entire year.

Often, many CPAs must work weekends, holidays, or through important family events so that their work can be completed on time.

For most CPAs, the tight deadlines and excessive workload causes immense stress.

Therefore, if work/life balance is your top priority, you’ll need to make a concerted effort to find an employer or role that fits your needs.

However, a big disadvantage of being a CPA or working in accounting is that a 40-hour workweek is not standard (or all too common).

4. CPAs encounter a lot of stress in their work

As you would expect as a side effect from the excessive hours, many CPAs experience the disadvantage of stress due to work.

Is the work itself stressful? Not necessarily. After all, we’re not talking about life and death here.

However, accountants work under tight deadlines dictated by governing entities. These requirements are out of their control.

Annual and Quarterly Reporting

A large number of CPAs and accountants are employed by public corporations to compile annual and quarterly financial statements. Another army of CPAs is tasked with auditing or reviewing these financial statements and disclosures.

Come filing season, CPAs who work in financial reporting often work under tight deadlines to complete their work within the allotted amount of time.

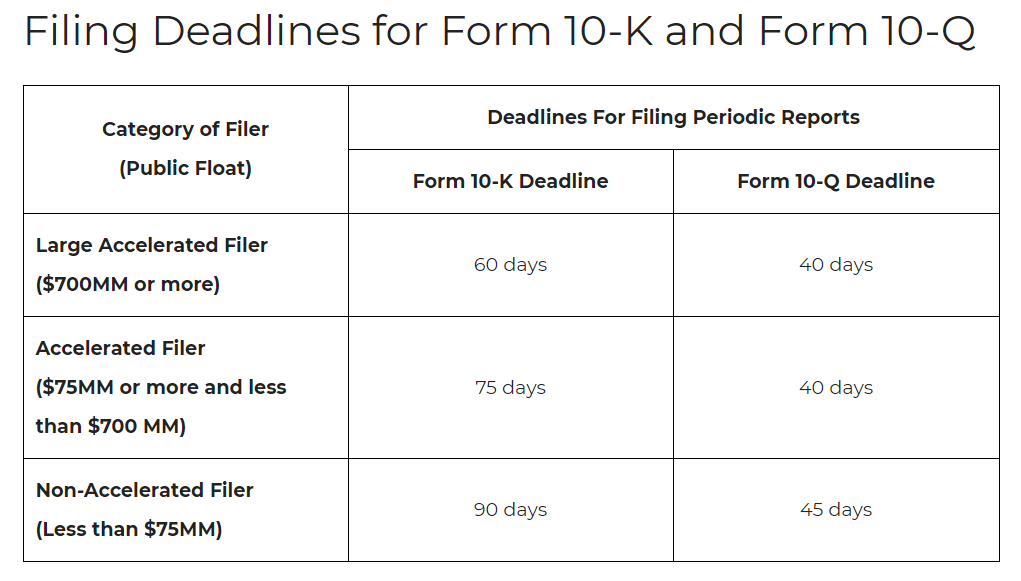

The Securities Exchange Committee (SEC) requires that annual reports be filed between 60 – 90 days from year-end depending upon the category of filer. For quarterly reporting, companies must file their 10-Qs between 40 and 45 days depending on their filing status as shown below.

Because of the strict deadlines, Internal Accounting departments must work overtime to “close the books” and ensure all entries have been properly recorded as quickly as possible. Once closed, External Reporting can begin compiling the financial statements and disclosures.

Because of the complexity of accounting principles and systems, internal control policies must be carefully followed and completed along the way. “SOX support” requires fairly tedious documentation of review and retention of evidence for external auditors.

The result? Extra work on top of the actual job of recording entries and compiling the financials.

Clearly, the regulated nature of the accounting profession is a disadvantage of becoming a CPA.

Tax Season

Just like CPAs that work in financial reporting, CPAs that specialize in taxation experience similar stresses due to tight deadlines.

For CPAs that perform tax services for individuals, February through April 15th is generally jam-packed full of overtime work. During tax season, CPAs must field client questions, research the tax code and IRS regulations, complete client tax returns, and file the returns on behalf of their clients.

Often, these CPAs file hundreds or even thousands of returns (depending upon the size of the firm). Each of these returns must be carefully reviewed to ensure the proper amount of deductions were applied. After all, the goal for most filers is to calculate the minimum amount of tax that is legally owed.

Corporate tax accountants experience similar deadlines. While extensions can be filed for both individual returns and corporate returns, the initial corporate due date is generally April 15. Often, CPAs that specialize in corporate tax work extra hours to ensure the corporate tax properly reflects the taxes owed.

For financial reporting, tax CPAs record tax expense and ensure current and deferred tax assets or liabilities are properly reflected on the balance sheet.

Just like Corporate Accounting, this work must be done under pretty strict deadlines which can lead to stressful situations.

While CPAs don’t deal in life and death situations, the tight deadlines and regulatory environment can result in the disadvantage of intense stress.

5. Boring or uninspired work or environment

Let’s face it – accounting isn’t “sexy.” However, it pays the bills and can allow you to build wealth over time in a stable career.

While the general population recognizes the stability of the work environment, higher-than-average pay, and respect due to the profession, no child grows up saying, “I want to be an accountant.”

Even in the accounting world, very few CPAs wake up on Monday morning excited to perform 50 hours of accounting that week.

In fact, 67% of accountants surveyed indicated they are bored with their work. Are there aspects of our work that makes the daily grind not a complete drag? Yes, of course.

Many CPAs enjoy the complexity. Most of us enjoy the daily challenges that cause us to use our critical thinking skills and grow as business professionals. At times, our work is like a giant puzzle. Eventually, everything comes together right at the very end!

However, you’d be hard-pressed to find a CPA or accountant that says the work is “fun.”

What makes the work boring?

Remember, what one person finds boring, you may find enjoyable.

That being said, accounting is fairly tedious. One small calculation or input error can flow through and impact multiple accounts. If Internal Reporting doesn’t fully understand the transaction or isn’t told complete or accurate information, the entries may not be properly reflected on the books.

Not only does the tedious nature make accounting boring to some, there are several other characteristics of accounting that may induce boredom.

- No longer learning

- The work is no longer challenging

- The workload is either too little or too intense

Lack of learning opportunities or development

The corporate environment is generally not conducive to continual learning and development. Just like factories may require employees to specialize in certain stages of the fabrication process, many CPAs or accountants specialize in certain areas that become routine.

For example, many corporate accountants perform the same tasks month-after-month or quarter-after-quarter. Accountants may book the same entries to cash and accounts receivable each month. Internal Reporting may compile and generate the same schedules for management at the same time each month. Fixed asset accountants may prepare the same depreciation forecast every month. Preparing tax returns eventually becomes repetitive.

Inevitably, the work can be done in their sleep and these CPAs may begin to feel “stuck.”

Specializing in certain areas and performing the same or similar tasks improves efficiency. However, doing the same task over and over inevitably leads to disengagement. This can be a major cause of boredom.

Lack of workload optimization

As discussed, most CPAs do not work a normal 40-hour workweek.

Instead, it’s not unusual for CPAs to work 50, 60, or even 70+ hours per week during certain periods. While the excess workload induces stress, the overwork can also ironically lead to boredom.

After all, spending that much time under fluorescent lights and surrounded by the same people can be mentally draining. Inevitably, most people will lose their focus and become bored with their work. More than likely, they will spend time daydreaming, surfing the internet, or just longing to be elsewhere.

As a coping mechanism for feeling overwhelmed, many workers may even delay starting projects that must be completed under a tight deadline just because it feels insurmountable. As a result, more hours must be worked and the quality may suffer.

Even if you actually enjoy the work, doing ANYTHING for 50+ hours can eventually become boring.

The office environment isn’t for everyone

Do you sitting at a desk all day under fluorescent lights? How about hours of internal meetings that don’t seem to have a purpose? Not only do you sit in traffic on your commute, you’ll be sitting 95% of the day and staring into a computer screen.

While some offices are energetic and youthful (complete with ping-pong tables and soda fountains), most office environments that CPAs work are pretty stale.

Some companies have implemented flexibility programs to improve work-life balance. These programs may allow for “work from home” days. Sometimes, changing up the work environment helps combat some of the negative aspects of working in the office every day.

However, for most people who work in an office environment, it feels like you are in prison for 9-10 hours per day. Can you leave for fresh air unsupervised? Yes, but don’t be too long lest you worry you’ll be missed.

Overall, the office environment is mundane. Just like the work becomes routinal, working in the same space and surrounded by the same people can lead to boredom.

In conclusion…

Obtaining the CPA license is an admirable goal if you want to progress in the accounting profession.

Not only is the accounting profession respected, you’ll work in a stable, lucrative field.

As a CPA myself, I certainly believe in the career prospects and growth potential that having the designation provides.

However, there are also disadvantages to being a CPA which may not make the career right for everyone.

Obtaining the necessary education requirement to sit for the Uniform CPA Exam is expensive. Further, there’s no guarantee you can pass the exam even after paying for the degrees and exam fees. If you do become a CPA, you are required to obtain continuing professional education (CPE) to maintain your license. On top of your workload, this can be an added time and monetary expense.

If you’re like the average accountant, you’ll probably work long hours – especially, during “busy season.” The excessive work hours could cause stress and lead to boredom.

Before deciding if accounting is right for you, consider applying for a few internships. By working in public accounting and in industry, you can get a better picture of what the work actually entails. This can leave you better informed to make the best long-term career decision.

For further readings, consider these insightful articles answering FAQs on becoming a CPA:

Is Being a CPA Stressful?

3 Proven Strategies for How to Transition from Accounting to Finance

Can You Get Rich in Accounting as a CPA?

Is Becoming a Certified Public Accountant (CPA) Worth It in 2020?

Working at a Big 4 Firm: A Comprehensive Guide

5 Reasons Accountants (CPAs) Should Know Financial Modeling