Careers in corporate finance can be some of the most rewarding occupations in the business world.

The job of a financial analyst occupies the “sweet spot” between the monotonous world of an accountant and the extreme demands of private equity or venture capital. While not as lucrative as “high finance,” careers in the corporate world still pay very well – especially, considering the workload.

As you move up the career ladder in your corporate finance career, it is not uncommon to earn $150,000+ in total compensation. Combine this with a 40-50 hour week, and you may have found the sweet spot in work-life balance!

Here are 7 must-know tips to successfully navigating your career in corporate finance.

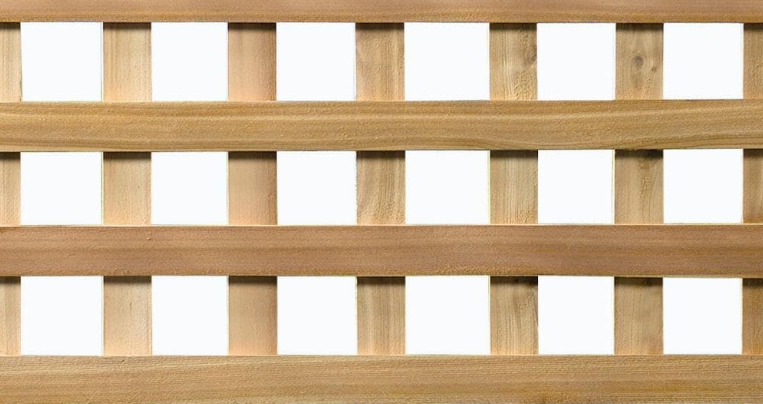

1. View your career as a lattice – NOT a ladder!

Have you ever heard the old adage of “climbing the corporate ladder?”

This is meant to visually embody what life is like in the corporate world.

Spend a few years at the bottom of the rung doing entry level work. Each day may be a grind as you perform the “grunt work” of pulling together schedules, compiling reports or presentations, and performing analysis to answer questions from management.

At this stage, many junior analysts are subject to burn-out from overwork and micro-management. If you’re at this level, you may be thinking, “How can I do this for the next 30+ years?!”

Let’s be honest… This work isn’t fun or glamorous and can leave you asking why you even went to college in the first place.

After a couple of years, you move up to the next level. Maybe you are given more complex or difficult work as a higher-ranked analyst. You are beginning to understand how your analysis relates to other parts of the business. Your insights become more valuable, and your contributions have a greater impact to achieving the company’s strategy.

A few years later, Congrats! You got promoted to senior analyst. Your managers and directors view you as a valuable contributor and you are able to “own” certain aspects of your department’s responsibilities. Perhaps, you are entrusted with the supervision and development of a more junior analyst.

With your new title and responsibility, you are beginning to see a much bigger paycheck. All that grunt work has finally started to payoff!

Let’s pause and talk about your first big promotion to Senior Analyst!

At larger companies, many employees find themselves on the rung of “senior analyst” for quite awhile – maybe the rest of their career.

Becoming stuck at a more mid-level role is not all that uncommon.

In fact, some employees are perfectly content at this level. They make great money without sacrificing too much family time. Often, they are making in the low to mid six figures with limited overtime. There’s less risk or disruption, and they are less likely to be pulled into weekend “fire drills.”

To move up to manager, they may need to supervise another employee. This would bring the added hassle of becoming a “people manager” and usher in a new scope of work.

Mid-level analysts may have found a certain routine in the work they perform and have mastered their current tasks. It might take significant effort to climb to the next rung in the ladder, and they would rather focus on their life outside of work. Maybe, they want time to focus on building their side hustle or investing time in other ventures!

For these reasons, many employees will never gain the skills or responsibilities to climb from the “analyst rung” to the “manager rung.”

Eventually, if you prove you know how to manage processes, workflow, and people, you may be entrusted to supervise more people and tasks as a manager or director of a group. At these levels, you are expected to understand the “bigger picture” and catch material issues with analysis based on your expert understanding.

Avoid the career ladder trap by considering lateral moves before continuing your climb upwards!

Each career opportunity you have may not be a direct move upwards. Perhaps, there are simply no openings or more qualified individuals ahead of you.

Maybe, there’s a gap in your skillset that you need to fix before landing that big promotion. Viewing your career as a lattice instead of a ladder can be a key way to reach your full potential. In other words, be willing to make a lateral move if you have reached the top in your current space!

For instance, you could be a senior analyst. You have proven you can manage your processes and produce a timely and accurate work product. However, most of your work is focused on historical financials. You are an expert at reconciling the data to ensure accuracy and providing meaningful analysis and explanations for what happened during the quarter and year-to-date.

However, you lack the experience of producing a forecast model. Managers at your company focus on bridging the gap between what has happened and what is expected to happen to help management make strategic decisions to improve operations.

To gain forecasting experience, you may need to switch groups for a time at your current level. This means you will have new or added responsibilities, requiring more work – without the increase in pay! After a year or two of producing forecast models, you may have the complete skillset to own the whole P&L – from actuals to forecast.

Hopefully, after rounding out your experience with a lateral move, you can now “cash in” and apply for that open manager position.

Often, careers are NOT linear

After all, there are only so many open positions and a surplus of demand for quality roles.

As a result, you may find yourself applying for the same role you currently fill at a different company. You might make more money, but you might not. In fact, you may find yourself as a high-ranked executive at a small company, but only qualify for middle-management positions at a Fortune 500 company.

However, this linear move could be an investment in the skills you need to one day reach the top – even if it’s not a move upward!

2. Work Smarter AND Harder

Earlier, we discussed that one of the draws for Corporate Finance is the fact that the hours are much less demanding than other finance careers.

One of the ways you can set yourself apart and accelerate your career is by working harder than your colleagues.

Arrive a little bit earlier. Stay a little bit later. Lastly, be more efficient and get more done when you are at work! In the corporate world, efficiency and effectiveness can be quite a novel trait!

As a salaried employee, you are learning more and creating more value for your employer. If you work in a healthy environment, you will inevitably be rewarded financially in the long-term. If you find your work is not being valued, simply find a place where you will be more valued!

Applying the same mindset as you would have in other traditional finance will certainly set you apart from the typical corporate finance professional. After all, the average corporate finance professional is drawn to the profession because they are content working their 8-5. Many leave investment banking and private equity because the hours are too demanding.

But, if you can find the sweet spot between outworking your co-workers without burning yourself out, you can clearly set yourself up for success in the corporate world.

Automate, Automate, Automate

The best way to gain a leg up on your work colleagues is to automate as much work as possible.

Often, many deliverables are needed monthly or quarterly. Sometimes, these tasks are very routine and monotonous. However, if you can find ways to produce the routine tasks more quickly, you will have more time to provide meaningful analysis. Providing data analytics and insights is key to becoming a more valued employee.

How can you automate your work product?

If you work exclusively in Excel, take a few courses to master formulas and short-cuts. Understand which formulas can help you automatically link data between spreadsheets.

Consider learning VBA. Dabble in Python or other coding languages. Learning to code is an investment that could be the difference maker that sets you up for a successful career at your company.

If your company uses Oracle or SAP, become a wizard at these data management systems. After all, the book of records holds all of source data your organization needs to make strategic decisions. However, learning how to navigate these systems can be difficult.

Visually represent the data

A picture is worth 1,000 words, right? Sometimes, the best way to present data in a concise manner is by producing charts and graphs. By setting up automated inputs, you can quickly refresh your charts and graphs to show trends. This can help you spot key areas to hone in on and gather more information to relay to your boss.

There are plenty of online resources to learn how to graph and demonstrate financial data in a visually appealing manner. Learning to convert complex data into a simple visual can do wonders for your career!

Collaborate, Collaborate, and Collaborate!

Often, the best way to efficiently complete an ad hoc analysis request is to collaborating with your peers.

There are rarely any new questions that come up for established companies. So, someone in your company has more than likely tried to tackle the analysis before or has more in-depth knowledge of the topic. Why not ask around and begin polling your fellow colleagues to see what previous work you can uncover? Partnering with your peers across the organization can help you come up with a more confident and accurate answer, and it will give you project leadership experience!

3. Become an Industry Expert

Establishing yourself as an industry insider may take years or even decades. Truthfully, most employees never become “experts” in their particular field. After all, they are content performing their tasks, drawing their paycheck, and pursuing other non-career aspirations. And that’s ok! Everyone’s career aspirations are different.

But, if you’re reading this article, that’s not you!

Understanding how your industry has matured over time and how economic cycles impact your industry can be incredibly valuable to your employer.

How do interest rates impact your industry? What levers can be pulled in the event of an economic recession. How does a slowdown in China impact demand? Does volatility in commodity pricing hamper or benefit operating margins? What regulation and pending legislation could impact your company’s strategy?

You may never be on CNBC giving your take on where your industry is headed. However, you can still be a resident expert on your team and within your department.

At the bare minimum, knowing the key performance drivers and correlation to economic factors can set you apart as a “go to” financial analyst!

Learn from the tenured voices at your company

If you’re at a mature, Fortune 500 company, chances are there are many leaders who have devoted most of their career to climbing the corporate ladder.

One of the best ways to expedite your learning is to develop a relationship with a leader that is willing to transition some of that institutional knowledge to a young(er), driven person that they wish to see succeed.

Because the demand on senior leaders’ time is so valuable, you may not have many shots to make a good impression. For this reason, it’s important to have done as much due diligence on your own. This will allow you to pose well-informed questions that demonstrate your curiosity.

Relationships often take time, but after you have had a few “water cooler” chats or impromptu conversations at happy hour, it may be worthwhile to see if they have time for coffee or if you could simply stop by their office for 30 minutes to learn more about their career or what drives success at your company. During these conversations, you can understand more about the industry and what indicators they follow to stay “in the know.”

Then, IMPLEMENT what you learn. If they say they get most of their news from the Wall Street Journal or a particular industry publication, begin reading those same articles. After a few weeks, send them a “thank you” for directing you to that industry source. Send them a relevant article and a brief write-up of why you thought it was an interesting read.

Overall, the goal is to show initiative and intellectual curiosity.

4. Go Where You Are Valued Most

Internally, most departments and groups within companies are given limited resources within their budgets.

However, some key or high-profile departments may have a little more wiggle-room to offer incentives that attract and retain the best employees. This could be because they are a niche group that looks for a particular, in-demand background or skillset.

For instance, your organization may classify accounting in the “finance organization.” Although, accounting can be lucrative, most finance-oriented jobs pay more and require a different skillset. These skills come at a higher cost and your employer knows it!

Even within pure corporate finance, there are different groups that likely develop and pay talent differently. A reporting analyst probably makes less than a corporate development analyst that runs due diligence on acquisitions.

Identify which groups are responsible for the work you want to do. Hopefully, after gaining the necessary skills, you can command a higher salary that is in line with other members of your team.

Consider pursuing outside opportunities

For most employees, entertaining outside opportunities is a bit scary.

You’ve spent years developing relationships that often turn into friendships at your workplace. However, sometimes the best way to stretch yourself and get to that next level is to jump ship to a different industry or company.

Unfortunately, many companies begin taking tenured employees for granted. Instead of developing them, they become stale commodities. Many in corporate finance are perfectly content and actually prefer to fly under the radar. However, if you want a more inspired career in corporate finance, you may need to take a little more of a proactive approach.

After all, most companies give meager cost of living adjustments that may not even keep up with inflation. If you’re being promoted every 2-3 years, this may not be a big deal since your promotion may make up for the mediocre cost of living raise. However, if you’ve been stuck in the same role for 4-5 years, you may be leaving money and opportunity on the table.

This could leave you well below your true potential and achieving a stellar career in corporate finance.

Express your concerns with your manager. Understand if there are improvements in your work that need to be made. Make a concerted effort to show improvement and request feedback periodically to understand your progress.

If your career has stagnated because of economic constraints, limited market growth at your company, or a lack of open positions, you may need to reach out to a recruiter or begin tapping your network to see what other opportunities for growth are available.

5. Build a Strong Internal Network at Your Company

Strong relationships are key to a successful career in corporate finance.

Even though you may not be actively selling a product or service to clients on a daily basis, each day you interact with your colleagues, you are applying for your next job whether you know it or not.

In large corporate finance organizations, there is a constant need for talent. As companies grow, complexity is introduced, and more analysis must be performed to track performance and provide key insights to management. Naturally, this requires more employees to perform the work.

Some contributors leave to pursue opportunities elsewhere. Others retire. Some employees go on leave for parental leave or sabbaticals. All of these reasons could open up the door for YOU to shine in your next role.

And the proven way to advance and take advantage of these opportunities in the workplace is to have a stellar reputation as an intelligent, curious, and hard-working employee!

Build a strong relationship with your current manager

The first place to start in cultivating a strong network at your company is with your current boss. A good manager not only coordinates and guides your work, but they also act as a career mentor focused on your development. At great companies, they should be your advocate, putting you in a position to excel.

Building a strong, professional relationship with your manager can be a delicate balance. On one hand, you want to be open, honest, and “real” with them. On the other hand, you do not want to confide in them in an unprofessional way that could come back and bite you in the future.

For instance, complaining about leadership or gossiping about a fellow employee could be a career-limiting move. Even if your boss participates, it’s never a good idea to behave unprofessionally if you want to reach your full potential. If your boss views you as a positive, contributing employee, chances are you will be set apart from employees known for their negative attitudes in the workplace.

Ask for continual, periodic feedback. This can help you gauge where you stand and identify areas to develop. Plus, it ensures you and your manager are in sync! After all, everyone in corporate finance works differently, and with hybrid or remote work, this could certainly impact “face time” which is vital to building relationships.

Some employees prefer to get to the office early and leave early. Other employees prefer to arrive later and leave well after 5PM. Understanding your manager’s expectations can go a long way in ensuring you are available if a task arises. You want them to be able to count on you to deliver! Setting clear expectations is key to ensuring a great working relationship with your manager.

Management and leadership styles often differ. You may be used to a manager that is very hands-off. They may only touch base with you a couple times a day. However, other managers may be more involved in your work. Understanding your manager’s style can go a long way in ensuring you exceed their expectations.

Cultivate a positive image among your peers

Office politics can be tricky. Let’s be honest, most of us wish internal politics did not exist, and we were judged on the merits on our work. However, this simply is not the case.

Humans are social creatures, craving hierarchy and leadership. We are constantly playing the comparison game and rendering “judgement” on our peers and leaders. Hopefully, it is not to the point of toxicity; however, office politics are virtually impossible to avoid.

In order to have a successful career, you’ll more than likely need to understand how to play the game.

Management promotes people they like who have proven themselves as competent.

Being known as a likeable, dependable, and hard-working employee is a key to developing a distinguished relationship among your peers. Some may view you as a threat to their job or own aspirations. You can navigate these dynamics by being pleasant to work with and lifting your co-workers up and celebrating their accomplishments.

Always be quick to give your peers credit and never throw anyone under the bus. You want to be known as someone your peers can trust to have their back and ready to help if they need help.

This can help to foster a healthy work environment where everyone succeeds in their own career aspirations while helping the organization achieve its mission.

6. Seize opportunities outside of your comfort zone

If you’ve followed the first five suggestions to a successful career in corporate finance, chances are you have been given a few opportunities to shine.

Your preparation and expertise has made you stand out and you consistently deliver valuable insights and have a great reputation at your company! When problems arise, you are one of the first people management tasks with answering those tough questions.

Because of your contributions, your manager and director think you would be a great fit for an open role. Your only concern is that you know you are an all-star in your current role. Is this new opportunity worth the risk?

The new opportunity may be outside of what you thought of as the “next step.” Perhaps, the role is in a new group or venture that has struggled to gain ground. Maybe, it’s outside of your core competency and requires you learning new skills like people management. There could be an element of travel or require uprooting your family to a new locale.

Whatever the potential risk, you cannot be afraid to say “yes” if the opportunity accelerates your career and aligns with your longer-term goals.

Granted, not every opportunity may be a perfect fit – even if it’s a “promotion.” If you want to work in finance and the opportunity to take a director role in technical accounting opens up, it probably does not make sense to pursue this opportunity if it does not achieve your goals in finance.

Carefully assess each opportunity and if it provides a path to your long-term goal.

Walk a proven path to success

More than likely, someone at your company has been on a similar path as you. Talking with more senior leaders who have been where you are can go a long way in quelling your concerns about the uncertainty of taking new responsibilities.

Often, companies have specific roles that are meant as “transitionary” or “development” roles. The jobs are specifically designed as learning opportunities to higher leadership positions. By discussing your concerns with those who are a few steps ahead of you on the path can be helpful in making pivotal career decisions.

For instance, your company may have a track record of using the VP of Treasury as a grooming ground for CFO. Maybe, a Director of Planning is where you gain skills to be the Head of Finance.

Identify what roles produce the next generation of leaders at your company. This can help guide your career trajectory and identify which relationships can be a worthwhile investment!

Get comfortable with your new responsibilities!

Taking the plunge into something new can be a combination of emotions.

Leaving the “known” for the “unknown” can certainly feel like a risk. What if I mess up and ruin my reputation? What if I do not like the work? Could the hours getting up to speed take away from my personal time with family?

Often, new opportunities introduce more questions and an element of risk.

Through preparation, you can get comfortable with anything new that may be outside of your comfort zone.

While it may feel like “sink or swim,” most companies have structure in place so that nobody is left feeling stranded. Heck, even the CEO has a board of trusted advisors and leadership team meant to help steer the ship and provide counsel!

Understand the expectations and scope of work

More than likely, you are not stepping into a newly created role.

Even if the individual in the role previously had a certain list of responsibilities, much of that was likely defined by their strengths and company needs at the time.

Likewise, you were selected because of your proven track record of strengths, so do not lose sight of that trying to fill someone else’s shoes!

You likely got a taste of the needs during the interview process or prior to accepting the promotion. This gives you an opportunity to call on past experience or a timeframe to prepare before things really get going.

Preparation is key to success in your next role.

7. Leave a legacy of giving back

Along your career path, you will have the opportunity to impact many people.

The work you do will eventually become outdated. In the long run, your company may not even exist due to bankruptcy or merger.

However, the people you work with on a daily basis and the relationships you develop can last a lifetime.

A major impact of a successful career in corporate finance is contributing to a charitable culture and leading by example.

Develop charitable habits

You do not have to be in executive leadership or make seven figures to give back.

Developing charitable traits can start today – whether it’s your first day on the job or 5,000th.

Giving back time

Time is our most valuable, non-renewable resource. It’s precious and limited.

Most of use work in order to have a successful personal life and yet we spend more of our time at work or thinking about our careers.

A valuable way to invest time as you progress is through mentorship opportunities.

Whether it’s your direct reports or the new people at your company, understand that investing your time in those who are behind you on the career path can be extremely rewarding.

We all have a desire to find meaning. We all want our contributions to matter. One way to ensure what you do matters is by investing in those who will eventually take your spot.

This can ensure their success and the success of the company that has supported your lifestyle along the way.

Corporate finance can be a lucrative, rewarding path…

In summary, there is no one size fits all path to success in corporate finance. Your path is unique, based on a combination of your intrinsic goals and the opportunities created in conjunction with the needs of your employer.

Your career path may not be a straight line from analyst to CFO. You will often need to be flexible, taking lateral moves to build your talent stack. As you spend more time becoming an industry expert, you may need to examine opportunities outside of your current workplace.

However, always remember that relationships are key to both a successful career and finding fulfillment in the workplace.

Look for opportunities to invest in relationships and others, and you too can find a successful, rewarding career in corporate finance.