When we bought our first house in the fall of 2020, there was a lot of uncertainty in the housing market.

At the time, there was low inventory as people were hesitant to entertain prospective buyers due to health concerns. Plus, most of our area was still relatively “locked down.” With remote learning and most employers allowing “work from home,” the number of listings dwindled.

Fortunately, for my wife and me, we were able to find a new build in a community that fit our current needs.

However, we knew from the start this house would not be our forever home… With little inventory and a limited budget, we chose to compromise and buy a house that worked for “now” but not forever.

We viewed our first home as an alternative to renting…

As newlyweds with stable careers, we decided that we were ready to buy our first home.

While renting is often cheaper than owning in the short-run, I had spent the last 4 years renting as we saved for our first down payment. Now that we were married and committed to living in one place for the next several years, buying real estate made economic sense!

Although our initial down payment was only ~15% of the total purchase price, we locked in a historically low interest rate. With a sizable mortgage, we closed on a great, 3 bed / 2.5 bath within a 20 minute commute to work. We were officially homeowners!

First home – NOT forever home!

We knew going into the closing table that this would not be where we lived forever. It is a great start and nicer than anything I thought we would be able to purchase starting out.

However, there are certain aspects that we found to be necessary in our next house.

A little too close to the neighbors for comfort…

For starters, our current home does not have much privacy.

While the community is maintained by our HOA, the lot sizes and yards are very small. Most houses are within yards of the next home.

Eventually, we want an outdoor space with a decent size yard for our pup and future kids. This lack of privacy and outdoor space was offset by the great community – including walking trails, dog park, and pools! Even though these are shared spaces, we knew they would do for now.

The neighborhood is governed by an HOA controlled by the builder

Our homeowners’ association is great… sometimes.

HOAs are responsible for maintaining common areas, setting community standards and bylaws, and ensuring homeowners maintain the curb appeal of the neighborhood. In theory, this should keep the neighborhood pristine and individual homeowners for doing anything that could impact their neighbor’s property value.

In all practicalities, HOAs are often overburdensome and limit the freedom of what you can do to your house. Plus, some of the rules are vague and the fines they issue can be pesky. After all, who wants to get fined because their garbage can was still visible a day after trash pickup?

On the other hand, it’s nice for a property manager to be the “bad guy” when neighborly disputes arise. Plus, they take care of common areas such as pools and parks. This ensures prospective buyers will love the look and feel of the community.

My experience with our HOA is certainly a mixed bag. Are they worth the hefty price tag? For our current house, probably so. Being controlled by the builder, the HOA has an incentive to keep costs down. They are also incentivized to keep the neighborhood from feeling like a construction zone.

However, in our next house, we’ll certainly look to move into a neighborhood that does not have a mandatory HOA.

The surrounding neighborhood outside the gates? A little sketchy…

The immediate, surrounding area is still undergoing gentrification. Needless to say, this makes the property values less inflated. However, there is also a bit more petty crime in the area.

As new homes and businesses are sprouting up everywhere, our neighborhood is slowly transitioning to a cleaner, safer area. In essence, we wanted to buy in the path of progress. Our neighborhood is one of the last places that is affordable and close to the city center.

That said, we wouldn’t necessarily feel comfortable outside the confines of our gated and patrolled community at night. Eventually, we’d like to live in a walkable neighborhood. This means our next home will need to be in an established, family-friendly area.

Looking for great schools

The homes in the most highly-desired, public school districts were nearly double what we paid. In our area, the school district is the primary driver of property values. Sure, we could move out to suburbia, commute and hour or two downtown, and our future kids would be zoned to wonderful schools.

The issue is we would be much further from work, friends, and family. While the suburbs are great for a lot of people, we weren’t yet ready to leave the cultural center of our city. BUT, we couldn’t yet afford to live in the school zone we want our future children to attend.

Unfortunately, the schools we are zoned leave much to be desired.

Unless we wanted to spend $20k+ on private school tuition, we would have to move by the time we had school-age kiddos. However, since we do not have kids yet, this wasn’t a deal breaker.

However, our next home needs to be zoned to great schools.

Our plan to purchase our dream home

With equity in our current home, additional savings, and career promotions, we plan to eventually plant our long-term roots in a spacious home that is affordable and zoned to great schools.

There are 4 Key Components in our next house savings plan:

- Increase in equity of current home

- Increasing household income

- Lowering debt-to-income ratio

- Investing surplus for next house

1. Increasing equity in current home

Equity build up is one of the reasons that homeownership creates wealth over time.

Each month, a portion of our house payment goes to interest, property taxes, and insurance. However, ~30% of our monthly payment goes to principle payment.

The principle portion reduces and amount owed on the mortgage and increases the amount of ownership we have in the home. Each month, a little more of the mortgage payment goes to principle paydown and reduces the amount of interest owed.

When we turn around to sell our current home, the equity portion acts as a “savings account” that we can put on our next home.

Here’s a quick example:

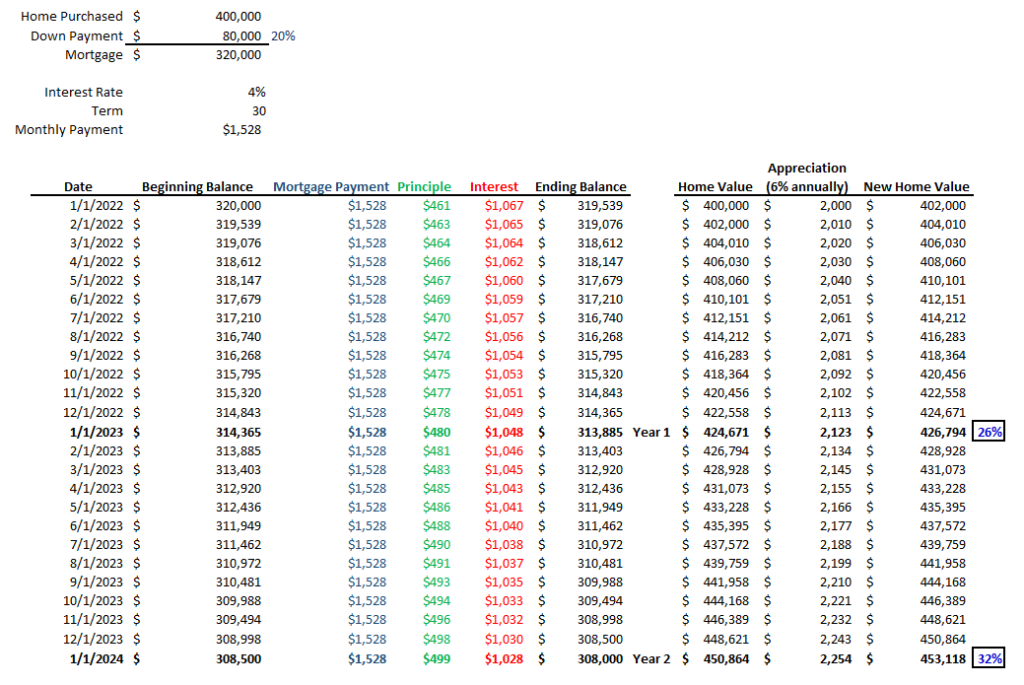

Let’s say you bought a $400,000 house with a 20% down payment.

The monthly payment over a 30-year, term at 4% would be $1,528. In the first monthly payment, $461 would be loan pay down. This means the vast majority of the payment will go to interest.

However, each month, the interest is calculated on the reduced mortgage balance. Therefore, the amount going to principle increases a few bucks each month.

On day 1, the equity position is only 20% (i.e. the down payment). However, assuming the house is still worth $400k at the end of year 2, your ownership position is now 23%.

Essentially, the interest is a sunk cost (like renting) and the principle is money you will have restricted access to (when you sell the home).

The principle portion is like putting money away in a forced savings account.

But wait… there’s another benefit!

Let’s be real. A 3% savings over two year isn’t going to be life changing or help you reach any meaningful financial goals like buying that dream home.

The best part of home ownership comes with locking in a fixed payment on an APPRECIATING asset. Let’s assume given the current environment, the home increases 6% per year.

At the end of year 2, you would have an equity stake of 32%. This is because the home increased in value to $453,000 while the mortgage decreased to $308,000. That’s $145,000 in equity/net worth creation!

Even though you have only contributed $80,000 in cash for the down payment and $38,000 in mortgage payments, the house has increased in value the rest – or $27,000.

Aside from selling costs, this equity can be rolled into the next home.

Bottom line on current home equity

Based on our timeline to purchase our next home, local housing appreciation, and mortgage amortization schedule, I estimate that we will have ~$180,000 in equity we will be able to use as a down payment on our next home in 3-4 years.

This will be comprised of ~$80,000 in principle pay down and $100,000 in property appreciation. Also, these numbers are after 9% selling costs (6% realtor fees, 1%-2% closing costs, 1%-2% repairs/concessions).

Based on our budget for the next home, the proceeds from our current house after selling costs should cover the 20% down payment.

2. Increasing our household income

The next component of our home savings plan is to increase our income.

While saving for the initial 20% down payment is more automatic (principle pay down) and out of our control (market appreciation), our incomes are a bit more controllable.

Each year, our employers provide cost of living adjustments. While my spouse’s income is capped as a teacher, my income potential has a higher ceiling. Plus, I am still fairly early in my career. With only five years of work experience in accounting and now finance, I have much more upside as I take on increasing responsibilities.

Conservatively, I estimate that I will be promoted around the same time we look to purchase our next home. This should result in a 25%-35% increase in income (including cost of living raises over the next 3-4 years).

This will certainly help alleviate some of the financial stress of a new, pricier home. In fact, I estimate that our total housing cost will increase by ~$1,500-$2,000 per month. This is because of 1) the bigger mortgage 2) higher rates and 3) higher property taxes due to owning a more expensive home.

The goal is to have the increase in my salary offset the increase housing cost and my spouse’s salary increases go to savings.

At the end of the day, the goal is to keep the ratio of housing payment / gross monthly income to <25%. This would allow us to maintain our savings goals and keep us from being “house poor.” To achieve this goal, we need to increase our income 25%-30% in 3-4 years.

3. Lowering our debt-to-income ratio

The debt-to-income ratio (DTI) is calculated by dividing monthly debt payments by monthly gross income.

The ratio is a percentage that lenders use to determine if you can afford to repay a loan. There are two calculations lenders use: a front-end ratio and back-end ratio.

Front-end ratio which is also called the housing ratio. This is the percentage of your monthly gross income would go toward your housing expenses. This includes the mortgage payment, property taxes, homeowners insurance and HOA dues.

Back-end ratio is the part of your income needed to cover all of your monthly debt obligations. This is inclusive of your housing costs, credit cards, car loans, child support, student loans and any other debt on your credit report.

Your credit score partially determines what ratio a lender is comfortable accepting. However, an ideal front-end ratio is ~28% or less. This means 28% or less of your total gross income will go to housing costs.

How we plan to manage our DTI

This should not be an issue as we are aiming to keep our housing costs to 25% or less.

An ideal back-end ratio is 36% or less.

Currently, the only debt we have (other than our mortgage) is my spouse’s student loans and car payment.

However, my spouse’s parents agreed to pay for her college. Even though we do not pay the bill, it shows up on her credit report. Therefore, it’s included in our combined back-end ratio and limits the amount we could borrow.

Based on current income and payment projections, the car loan should be paid off well before we look to buy our next home. So, this monthly obligation will free up 3%-4% in our back-end ratio borrowing capacity.

The student loans are a bit tricky because they are being paid by my in-laws. Even though I would love for them to clear the remaining $25,000 in student loan debt, it’s kind of tough to ask someone else to expedite the loan paydown.

However, I’m hoping this will be completely paid off by the time we purchase our next home. If not, it may make sense for us to chip in and eliminate the debt.

4. Investing any monthly surplus for our next house

The last aspect of our approach to save for our next house is saving and investing any extra each month in good stocks and index funds.

After taxes, 401(k) and HSA contributions, and other payroll deductions, we can usually save ~$2,000 per month. Once we pay off my wife’s car, we should have an extra $500 to invest as well.

A portion of these savings goes to my employer employee stock purchase plan (ESPP). This allows me to purchase my employer stock every 6 months at a guaranteed 15% discount. Generally, once the stock is purchased and deposited into my brokerage account, I sell and move the money into more growth-oriented stocks/funds within my “New House” brokerage account.

The sale of employer stock within the ESPP results in taxes on the gains. However, I believe that I can invest in stocks/funds that have the potential to appreciate faster than my employer stock. This should more than offset the taxes. Plus, it is good to diversify my wealth away from my employer.

Risk v. Reward

All investment requires risk. There is no guarantee the investments will increase in value. In fact, stocks often decline in value over the short-term. However, stocks generally appreciate over longer periods of time as economic progress continues forward.

Assuming a completely flat market over the next 3-4 years (highly unlikely), our extra monthly savings would result in an additional $90,000 we could use as a down payment, renovation budget, or assist with the monthly cash flow.

As I am writing this article, the market is in bear market territory in early 2022. This means, the broader indices are down more than 20%. Historically, this is usually a great time to buy. Even though it’s painful to lose money, I believe that dollar-cost-averaging into great stocks and funds will produce returns of ~10%, annually. From a bear market bottom, the appreciation could be even more.

Our potential investment strategies

Currently, my house portfolio is invested aggressively in great companies that have taken a beating in the technology sell-off. This is because I believe that these beaten down growth companies have the best opportunities for rebound and produce outsized total returns.

As we get closer to looking for our next home, I will gradually move our invested funds to cash or less volatile investments in preparation for buying the next house.

The good thing is that we should have the down payment in the form of equity from our current house.

Therefore, how much stock to sell will be a calculation between opportunity cost between potential market returns and the interest rate on our mortgage. It will also be driven by how much work needs to be done on our next home. If it’s move in ready, we may be able to cash flow any new expenses and let the investments continue compounding. This would obviously be the ideal scenario.

If interest rates continue to climb, it may make sense to put down more money to lower the monthly payment. This would also result in a “guaranteed” return equal to the mortgage rate.

The last option would be to move the investments into more stable, dividend-oriented investments. Based on the portfolio size, this could result in an extra $500/month in dividends (on average) that could be used to pay bills without touching the investment principle.

What we do with the money will largely be dependent on…

1) the cost of the house we buy

2) how much work it needs

3) how the market has performed and

4) the interest rate on the mortgage

Conclusion on our Investment Approach for our Next House

As you have read, there are 4 key components that make up our approach to buying our next home.

- Increase in equity of current home

- Increasing household income

- Lowering debt-to-income ratio

- Investing surplus for next house

We’re relying on automatic principle pay down and housing appreciation to come up with the down payment. With pay raises and promotions, we should be able to cover the bulk of the incremental cost of a higher housing payment. Paying down current obligations should provide breathing room in our DTI ratio. Lastly, investing surplus cash each month will allow for greater flexibility on what we can afford to buy.