If you’ve scoured Zillow recently, you’ve likely been in for sticker shock on how much homes are listed at these days.

Historically low mortgage rates and pandemic-induced supply constraints on the construction of new homes contributed to a nearly 20% surge in home prices in 2021. According to the National Association of Realtors, home prices increased another 16% in the start of 2022.

For many new home buyers, getting into their first home is becoming increasingly unaffordable. Median wages have lagged far behind home appreciation. Coupled with higher interest rates, many buyers are being stretched to their ends to afford their mortgage or are forced to continue renting until they have a more substantial down payment saved.

However, saving and investing extra money for a home down payment will eventually lead to the wonderful world of primary residence ownership.

Your first home may be a compromise…

Finding that delicate balance between what you can afford versus what you desire is a tough proposition.

However, determining what you can afford is the first step in setting your budget (and how much you need to save) for your first house.

For most people, what we want and expect in a primary residence is a stretch or completely out of reach given how fast home prices have appreciated. However, buying a house is not a permanent decision. Instead, it can be a medium-term (5-7 year) decision.

According to U.S. Census data, the average American will move nearly 12 times in their lifetime! Granted, there are a lot of renters. Therefore, not every move will require buying or selling a primary residence. However, most people can expected to purchase 3-4 houses over their lifetime.

This means your first house DOES NOT have to be your “forever home.” Instead, consider your first house as more of a forced savings account. Each month, you’re putting money away in the form of mortgage paydown. After several years, you should eventually have enough equity and savings to leapfrog into a nicer place.

Plus, in 5-10 years, your household income should increase as your career(s) are progressing. Along with any other savings, you can sell your appreciated home and roll that money into a down payment on a higher priced home.

First, what is a home down payment?

A down payment is generally a large sum of money that a borrow contributes towards the purchase of a home. This helps ensure that the borrower has enough “skin in the game” to not walk away from their mortgage obligation. It also helps the borrower by reducing the monthly payment and providing instant equity in their new asset.

The down payment is generally calculated as a percentage of the total purchase price and is dependent on the type of mortgage you are applying for. The required down payment could range from 0% (in the case of a Veteran Affairs loan) to the traditional 20% down in a conventional mortgage.

While coming up with 20% of a median home listed for over $400k will help avoid Private Mortgage Insurance (PMI) and potentially lower your interest rate, it can be a daunting task to save this much of a lump sum.

Saving for a Down Payment: How much to save?

Determining how much to save for a down payment may be a little tricky. The more you put down on your home purchase, the lower your monthly mortgage payment.

However, homes generally appreciate in value over time. Therefore, many new home buyers struggle to keep up with appreciating prices.

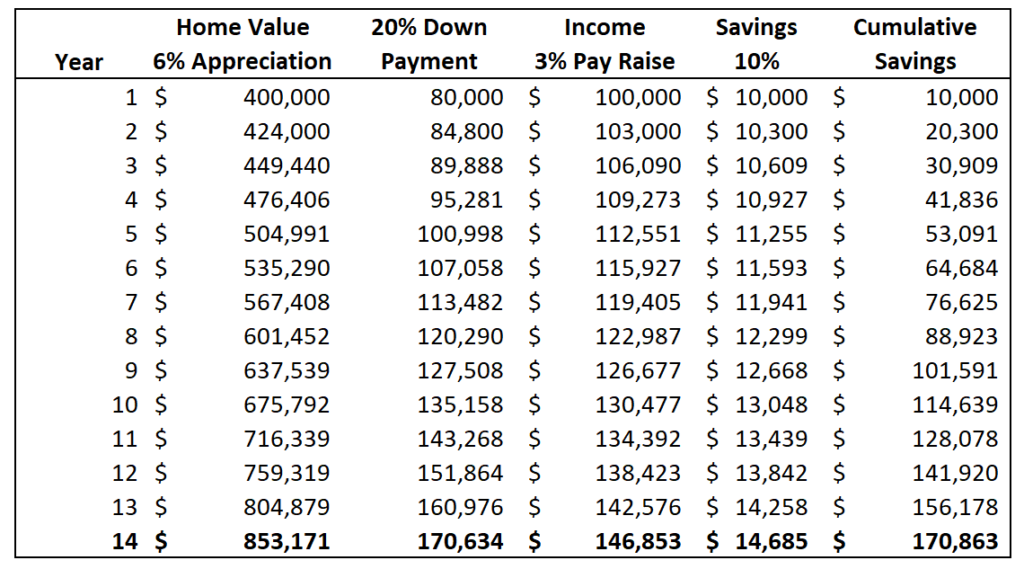

Think about it… Let’s say we have a family with a combined income of $100,000 who found some houses ~$400,000 that would be potential first home options. With all of their monthly spending obligations and savings goals, they’re only able to dedicate 10% (or $10,000) a year to their “new home fund.” In order to reach 20% (or $80,000), simple math says it would take 8 years.

But wait! As we’ve already discussed, homes generally increase in value every year. Accounting for historic home price and wage increases, it would actually take nearly 14 years to save 20% down!

This family would either have to save more money, put down less money, or compromise and buy a cheaper home.

Determining how much to put down on a home is a delicate balance between putting down as much as possible but as soon as possible on a home that you can reasonably afford today.

How to save for the down payment

Generally speaking, first time homebuyers will likely have a shorter timeline to buy compared to someone thinking about upgrading their existing primary residence.

Short-term money is best kept liquid. Even though cash will decline in value due to inflation in real estate prices, it is the safest way to preserve the down payment money that will be needed in 3 years or less.

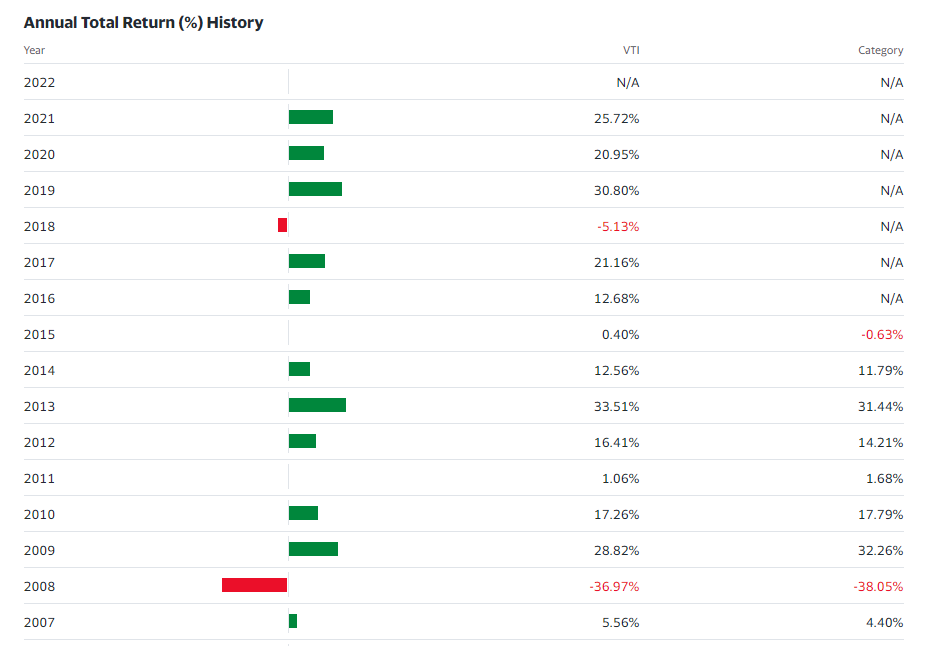

For those with longer timelines (3-5 years), it may be worthwhile considering a balanced approached between cash and index funds (like the S&P 500). Because markets are sometimes volatile, investments involve risk of loss over shorter term periods. However, in the long-run, the market has historically returned an average ~10% per year.

This means your investments could be up 20% in a given year or down 10%. If the market is down the year you desire to buy a house, you could be out of luck and need to sell when stocks are low.

For this reason, it’s better to have more of your down payment in cash when you get inside of that 3 year window.

For the first time homebuyers…

I view our current home as an alternative to renting. Although the cost of ownership involves paying interest, property taxes, and insurance costs, mortgages essentially “lock in” your housing payment. This will help avoid rental payments and avoid paying more for rent each year. Plus, you get to enjoy your homes appreciation!

Personally, I knew we were ready to buy our first home when we could put down enough to keep the mortgage payment to <25% of our monthly income.

This meant we had to get our financial house in order BEFORE getting pre-approved to buy.

This is what we did to prepare to buy our first home:

- Paid down consumer debt to improve our credit scores

- Eliminated other monthly obligations

- Saved enough cash to keep our total payment (including escrow) <25% of our gross household income.

Why was this helpful?

By paying off credit card balances, our mortgage lender was able to get us pre-approved for the amount we wanted at the best possible rate.

Paying down credit card and eliminating monthly obligations lowered our Debt-to-Income ratio (DTI). Your DTI is one of the key pieces that dictates how much of a mortgage a borrower can get approved for.

Plus, paying down debt improved our combined credit score, allowing for us to lock in the historically low rates (which reduced our interest expense).

Lastly, we saved enough cash to put down ~15% even though this requires us to pay PMI each month. However, even with PMI and escrow (property taxes & insurance), our monthly payment was still affordable. Putting down less money would have increased the monthly payment and would have caused some months to be too “tight.”

Even though we only put down 15% less than two years ago, the market appreciation we’ve seen has us around the 80% loan-to-value. In order to remove our monthly PMI payment, I will simply need to pay for an appraisal. If the loan value is less than 80% of the appraised/market value, the lender will remove the PMI.

Although we’ve been paying ~$100/month in PMI, I’m thankful we purchased when we did. With the increase in property values, we would have paid nearly $50,000 more for the same house! Therefore, the PMI was more than worth the cost to us.

Are you ready to buy your first house?

Buying a home is at least a 5 year commitment. This allows for the property’s appreciation to offset the selling costs which are often 7%-9% of the selling price.

If you are committed to staying in the home for a minimum of 5 years, have eliminated your high-interest consumer debt, and have a debt-to-income ratio that allows for you to meet your other financial goals, it may be worth sitting down with a real estate and lender.

While neither one of these team members are financial advisors, an agent and lender that you know and trust can help you identify properties that won’t be a burden.