Are you looking to diversify your investment portfolio into real estate but do not want the hassle factor of dealing with tenants? Maybe, you do not have the capital required to purchase an entire rental property or want to assume a ton of debt to purchase your first investment property.

If you are looking for exposure to the real estate market, one of the best ways to begin producing cash flow without the overhead and stresses of owning physical real estate is through a Real Estate Investment Trust (REIT).

While you can purchase a REIT on the open market through your brokerage account, another company that specializes in real estate investing is Fundrise.

What is Fundrise?

Fundrise is a crowdfunding platform that aggregates individual investors’ money to execute transactions to purchase, develop or renovate, rent or sell real estate properties. By combining investors’ equity with debt, Fundrise leverages the capital to expand their operations and generate a greater return on equity for investors. After the fund pays the necessary costs of doing business, the excess cash flow is distributed by dividend payments to the funds’ investors just like other REITs.

In essence, by investing capital with Fundrise, you have the ability to have an equity interest in the properties that the company acquires without having to perform due diligence on each transaction or fork over millions of dollars to purchase the physical real estate.

Based on the company’s transparent investment projects, most of their portfolio consists of residential real estate (apartments, housing developments) as well as commercial spaces.

What is a REIT?

Since Fundrise is organized as a REIT, you will find it helpful to have some background knowledge on what this structure is in order to make an informed investment decision.

Companies like Fundrise that finance, own or operate real estate properties are known as REITs. Through their operating activities, REITs purchase and bundle together various properties that are generally in a particular sector (such as healthcare/hospitals, shopping centers/other retail or residential) and distribute the cash flow generated to their investors.

Often, these companies are publicly-traded entities where the unit holders (shareholders) are entitled to the income generated in the form of dividend distributions. While the average dividend yield on the S&P 500 hovers near 2%, REITs often pay anywhere from 3% to in excess of an 8% dividend yield.

How can REITs sustain such a high yield?

Instead of paying federal income taxes at the corporate/trust level, as long as at least 90% of taxable income is paid out via dividends to the unit holders, federal taxes are not assessed at the corporation/trust level at the typically higher corporate tax rate. Instead, the income passes through to the shareholder’s tax rate.

However, while the tax rate on ordinary dividends is 15% for most investors, the dividends distributed by REITs are composed of 3 types of taxable income: ordinary income taxed at the individuals effective tax rate, a return of capital (which lowers the investors tax basis), and capital gains.

Investors should note that the majority of REIT dividend income will be treated as ordinary income. As always, seek the advice of a professional tax adviser to assess the tax implications on your personal situation.

Now that you have a general understanding of how REITs work, let’s discuss the portfolio options Fundrise offers so that we can compare to other similar investment choices.

Fundrise’s 3 Portfolio Options

Fundrise offers 3 different portfolio options tailored to potential investors’ needs. While some of these portfolios generate most of their returns through higher dividend distributions, another fund offers greater appreciation in the underlying assets and a lower dividend distribution.

Similarly, the portfolios vary their asset mix between equity and debt positions in order achieve greater stability or higher growth depending upon your personal appetite for risk.

Plan 1: Supplemental Income

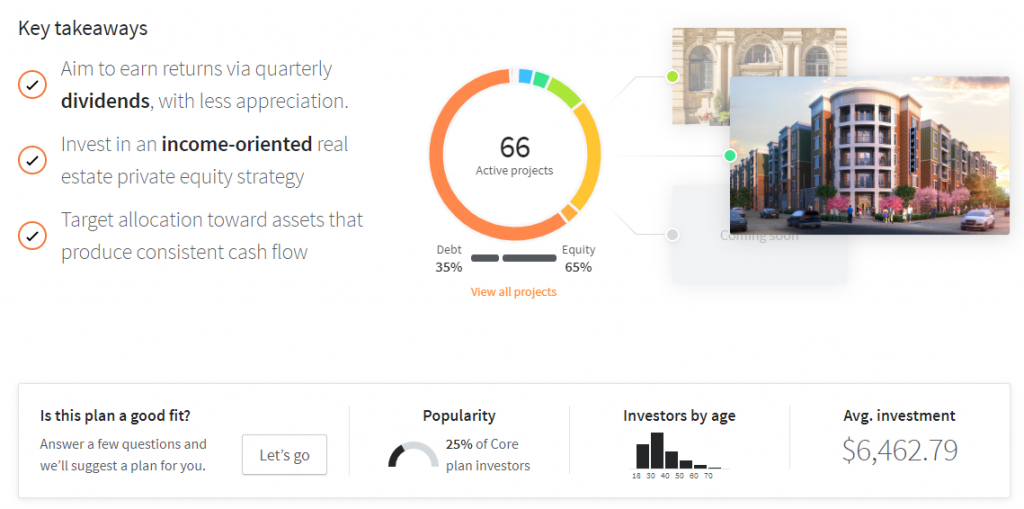

The Supplemental Income plan focuses on generating passive income through dividends.

According to the plan’s Key Takeaways, the overall goals are to return capital to shareholders through quarterly dividends with less of a focus on appreciation. To accomplish this goal, the portfolio is heavily weighted to debt investments.

According to the plan’s return profile, the projected annual return is between 8.3 – 9.6% with dividends comprising 6.4 – 7.1% of total returns.

Who is the Supplemental Income Portfolio Geared Towards?

For many investors in retirement or for individuals who are looking to supplement their income through consistent dividend payments, this portfolio offers a way to generate income above and beyond what most bonds and REITs offer. However, investors should note that there may be increased risk compared to owning and investing in bonds.

If you are seeking multiple sources of income, this plan provides consistent quarterly cash dividends as well as periodic cash distributions when certain properties in the portfolio are sold.

If you are less concerned with building overall wealth through appreciation and plan to use any excess income to fund your lifestyle, the Supplemental Income Portfolio provides an element of stability through the dividend payments that are made possible by a heavier concentration in debt investments.

Plan 2: Balanced Investing

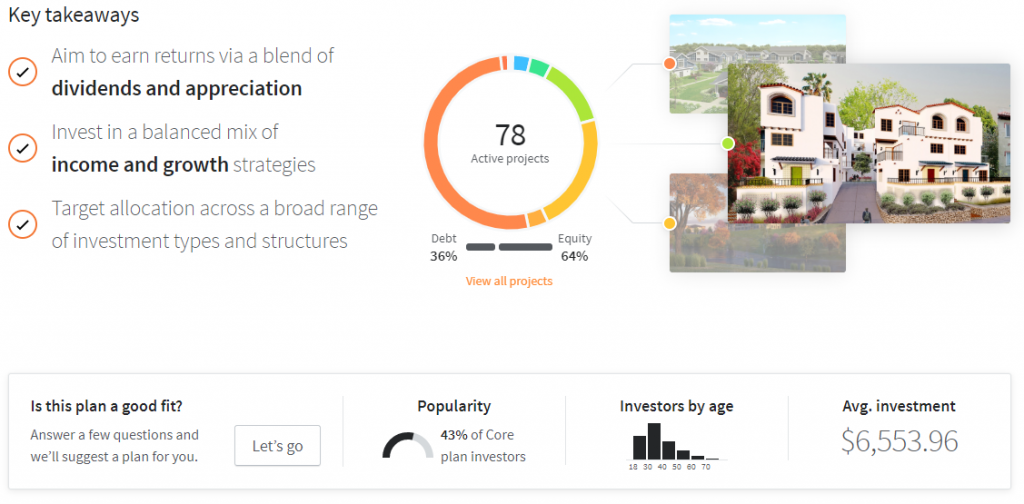

Between a more growth-oriented and income-focused option is the Balanced Investing fund. Over 75 projects make up this fund which focuses on a mixture of dividends as well as capital appreciation of the assets.

In addition to debt assets which primarily comprises the Supplemental Plan, the Balanced Plan is also made up of equity real estate assets.

The fund strategy for this plan is two-fold:

The plan operators wish to acquire assets in locations that have the opportunity for growth and appreciation based on the neighborhood as well as cultural and demographic shifts. Fund managers then implement strategies to improve the property value through renovations, re-zoning, or further development to increase the overall value of the property.

According to the Balanced Investing plan’s return profile, the projected annual return is between 8.8 – 10.1% with dividends comprising 4.2 – 4.7% of total returns.

As you can clearly see, the overall projected returns is slightly higher than the Supplemental Income plan. Additionally, the percentage of the total return that stems from dividend distributions is lower which allows for the company to reinvest the capital into revenue-generating projects.

Who is the Balanced Investing Portfolio Geared Towards?

If you are willing to assume a little more risk for greater returns, the Balanced Investing approach provides greater exposure to growth in your total capital balance.

While the dividend yield is ~2%-3% lower than the Supplemental Income plan, plan administrators expect overall returns to be ~1% higher with the Balanced Investing portfolio as compared to the relatively more “stable” Supplemental Income plan. If you still desire an income producing portfolio that is higher than the overall S&P 500, but also want to experience greater appreciation, the Balanced Investing portfolio may be right for you.

Instead of distributing more excess cash to shareholders and focusing on more debt instruments, this fund provides more weighting to equity ownership in the physical real estate.

Plan 3: Long-term Growth

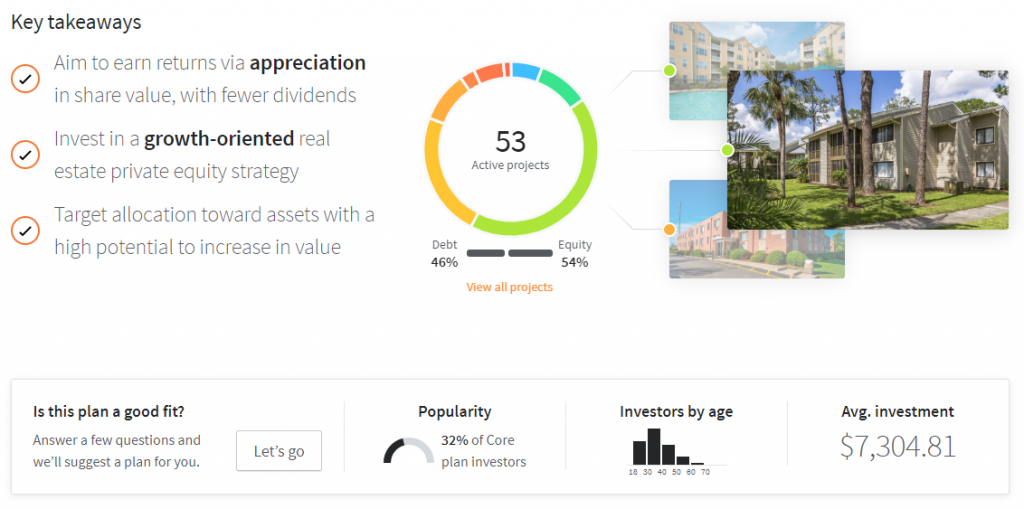

The third option is for investors who are more concerned with longer-term growth in their invested assets through capital appreciation rather than a more dividend-focused strategy.

According to the Growth Plan’s return profile, the projected annual return is between 9.1 – 10.5% with dividends comprising 2.8 – 3.1% of total returns. In order to achieve greater returns longer-term, this particular fund focuses on a smaller number of properties that are strategically located in areas with a potential for greater appreciation. After acquiring the property, improvements, renovations or further development is performed to increase the equity value in the property before selling and realizing the gain.

Who is the Long-Term Growth Portfolio Geared Towards?

While the total returns from the Long-term Growth Plan are modestly higher, most of the returns are due to capital appreciation rather than dividends. Even though this portfolio spins off a higher dividend yield than the average stock or S&P 500 overall, the quarterly payments are lower than the other two portfolios.

Therefore, if you do not need the quarterly dividend payments as income (which would trigger tax implications), this plan allows the company to reinvest the majority of their cash flow back into the business and increase your overall equity in the company.

Additionally, if you have the necessary longer term time horizon that is required for managers to perform diligence and scout out the most opportune projects, implement rehab on the properties, and implement the necessary strategies to yield greater appreciation, this portfolio may provide greater long-term appreciation.

How Has Fundrise Performed Historically?

As the old adage goes, “past performance may not be indicative of future results.” While we will not know for sure how an investment in Fundrise will perform in the future, we can use past performance as an indicator for what to expect in the future.

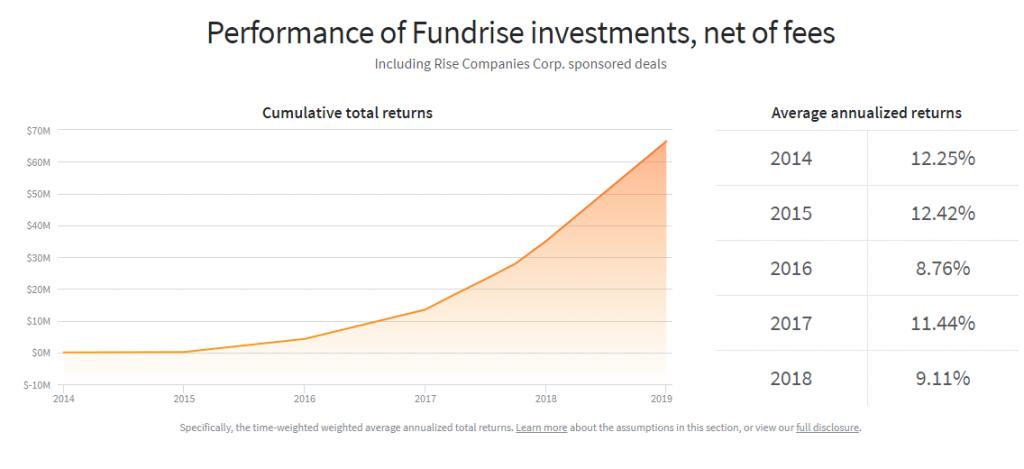

Historically, an investment in Fundrise has yielded fairly consistent annual returns averaging ~10%-11% net of fees as demonstrated by Fundrise’s chart below.

Generally, these returns are consistent with the long-term track record of the overall stock market represented by the S&P 500. Based on these returns, an investor can expect their original investment will double about every 7 years due to the power of compounding. Overtime, these returns can correlate to a healthy portfolio that continually spins off dividends that you can either use to reinvest or supplement your income.

While these returns are consistent with the long-term stock market average, we must also assess how they compare to the S&P 500 as well as other similar REITs over the same time.

After all, since we all have a finite amount of money that can be invested, we must ensure our invested capital is invested at the highest and best use that will help us to maximize our returns.

Fundrise Returns: How do they compare to other benchmarks?

As we previously discussed, the overall returns from Fundrise align with the long-term performance track record of the S&P 500 dating back to the early 1900s. While this offers investors a historic, long-term perspective, we must also assess how the returns compare over the same period to the S&P 500, other alternative investments in real estate, and other potential investments.

As summarized below, you can clearly see that average total returns from Fundrise have outperformed the overall market as well as other REITs from 2014 – 2018:

| 2014 | 2015 | 2016 | 2017 | 2018 | Average | |

| Fundrise | 12.25% | 12.42% | 8.76% | 11.44% | 9.11% | 10.80% |

| Vanguard Real Estate ETF (VNQ) | 30.29% | 2.37% | 8.53% | 4.95% | -5.95% | 8.04% |

| iShares U.S. Real Estate (IYR) | 26.62% | 1.62% | 7.00% | 9.37% | -4.29% | 8.06% |

| Vanguard S&P 500 Index (VFINX) | 13.51% | 1.25% | 11.82% | 21.67% | -4.52% | 8.75% |

| First Trust NASDAQ – 100 Index (QTEC) | 24.82% | -1.38% | 25.29% | 37.85% | -4.72% | 16.37% |

While the returns seem fairly comparable and only a few percentage points apart, these differences can culminate into thousands of dollars in the long run.

For example, Fundrise has only beaten the next best performing REIT (IYR) and S&P 500 by an average of 2.73% and 2.05%, respectively. If you had invested in the iShares U.S. Real Estate Index (IYR) instead of Fundrise, you would have $2,916 less over the 5-year span. Similarly, had you invested your money in an S&P 500 index fund, you would have $2,254 less over the same time period. Clearly, earning an extra 2% matters immensely.

Fundrise versus Growth Investments

Honestly, comparing Fundrise to growth-oriented funds such as the First Trust NASDAQ – 100 Index (QTEC) which holds stock in companies such as Amazon, Netflix, Google, Microsoft, Apple, and Facebook isn’t even fair. The investment characteristics and risk profile between REITs and technology-based ETFs are drastically different which leads to the wide variation in performance.

After all, REITs are designed to produce steady, consistent cash flow while technology companies tend to be much more volatile. However, over the long-term, investors can expect to achieve higher overall returns from growth investments. For this reason, I chose to include QTEC to demonstrate why it’s important for most investors to consider adding an element of growth-oriented stocks to their portfolio and not rely solely on cash flow producing assets.

Fundrise: Is an Investment in Fundrise Worth the Hype?

While the company is still fairly young and continually adding to their assets under management, investors looking to add exposure to real estate through REITs may want to consider investing some of their discretionary cash with Fundrise.

However, you must remember that investing in real estate is meant to be long-term in nature. Additionally, your investment in Fundrise is simply not as liquid as investing in a publicly-traded REIT, and it may take time to redeem your shares. Since the company requires a minimum deposit of $500 to get started, you must also be willing to part ways with a decent amount of cash for most new investors.

Should Fundrise be the first investment novice investors make? Probably not. However, if you have already gained exposure to the stock market and have accumulated a sizable amount of diversification through an S&P 500 index fund, various mutual funds and ETFs, investing a portion of your portfolio in a platform such as Fundrise that has historically outperformed other REITs may be a prudent asset allocation choice for those looking for greater real estate exposure.