I remember when I first graduated from college and started working my first job with a “Big 4” public accounting firm. The first time that paycheck hit my bank account, I felt like a rich man! On a single day, my bank account doubled!

Even today, there’s something rather exciting about payday…

If you are a new college grad, the thrill that comes with starting your first job and finally earning an “adult salary” can be an exciting time. It’s finally time for your 4+ year investment in education to pay off!

However, in this excitement, many new college grads make bad financial choices that will cost them dearly later on.

Sure, some lifestyle upgrades are in order. Gone are the days of eating ramen noodles!

According to surveys conducted by the National Association of Colleges and Employers (NACE), new college graduates earn around $50,000 per year. Considering you were probably living on fractions of this amount while in college, a $50k/year job can feel like you’ve hit the lottery!

Often, this newfound cash flow can find its way slipping through your fingers like quicksand. Before you look up at the end of the month, your bank balance is back to where you started.

Where did all that you worked for during the month even go?

These are the 9 Most Common Detrimental Financial Mistakes New College Graduates Make!

1. Not Budgeting and Tracking Your Financial Position

No surprise here!

One of the most common financial mistakes people make is not knowing where their money is going on a monthly basis. For most new college graduates, this should be the FIRST step you take – even before your first check clears.

According to Intuit, 65% of Americans have NO IDEA how much they even spent last month. No wonder so many Americans find themselves deeply in debt and reliant on credit cards to make ends meet!

Tracking your spending is a CRUCIAL step to achieve your financial goals – whether they be saving for retirement, a new home, or other big ticket purchase. Without keeping your spending under wraps right out of college, it becomes A LOT harder to develop good spending habits.

As you move up the ranks and earn more income, you’ll often find yourself a victim of “lifestyle inflation.” Instead of that incremental income being used for investments or long-term objectives, it can easily slip through the cracks and go to waste!

Budgeting Gives Permission to Spend

If you’re new to budgeting, you may associate the term with a negative and restrictive connotation.

However, budgeting is a PLAN.

Budgeting provides permission to spend on the things you value. It’s all about being INTENTIONAL with your finances.

There are a couple of ways to establish a budget. You can either take the “pay yourself first approach” or the “standard approach.”

Standard Approach

I call it the “standard approach” to budgeting because it is probably the most common method (because it’s easiest).

Simply, outline all of your income and identify all known expenses. For most people, their income is pretty straight forward. You can just see what’s deposited into your bank account or on your pay stub each month.

Often, figuring our your monthly expenses is the variable part. However, most of the money people spend will come in the form of housing, food, and transportation.

These are often fixed, required expenses made up of rent, utilities, groceries, and vehicle costs (gas, car note, insurance).

It may take 2-3 months to identify how much you normally spend in order to set a reasonable budget; however, you’ll never truly know unless you TRACK your spending (which is the most important first step of budgeting).

Once you know how much you typically spend, it will be much easier to set a reasonable budget for your spending needs.

Thankfully, there are many awesome apps that can automatically link to your credit cards or bank account and will categorize your spending and help you set a budget!

Two of my favorites that I personally use are Mint.com and Personal Capital! These can help you easily categorize your transactions and set a reasonable budget based on historic trends.

Paying Yourself First Approach

Personally, I subscribe to the “pay yourself first approach.”

This is because…

- My wife and I have consistent income from our salaried positions as a W-2 employees

- Our expenses (for the most part) are fairly stable

- We generally will have a little bit of excess savings at the end of the month

- Our emergency fund of 3-6 months of expenses is fully funded

The pay yourself first approach is usually best if you’re pretty confident you’ll have a reasonable amount of discretionary income and want to ensure it’s used for investments rather than blown on impulse purchases.

For those who want to pay yourself first, before the month begins, you must determine your take home income. This is how much will be deposited into your bank account.

Next, identify your savings goals. How much can you reasonably save given your fixed and variable expenses?

How to pay yourself first…

Experts often suggest a minimum savings rate of 10%-15% for retirement. If you are a new college grad, see if you can aim to save 1/3 of your take home income (after taxes) or even more! After all, you’re probably still used to living fairly frugally, and you likely do not have kids yet. This is an opportune time to supercharge your savings rate!

You can keep expenses low by having roommates, limiting outings at expensive restaurants, or even picking up extra work to earn more cash. All of these tactics should aid in saving a bit more.

After paying yourself first, outline your fixed, required expenses. These would include rent, utilities, debt payments, and a reasonable food allowance. Then, budget in some “fun money” that can be totally at your discretion! The amount of discretionary spend will be totally dependent on how much you make and your fixed expenses (as well as your aspirational savings goals).

Monitoring your Net Worth

Your net worth calculation is a complimentary exercise to setting up your budget. Often, it can be just as important because it provides a broader indication of your financial health – beyond just how much you earned and spent in one particular month.

Tracking your net worth is like a report card that tells you where you stand!

The budget is a plan and “permission to spend.” It should help you identify extra cash flow each and every month as it eliminates wasteful spending!

With that extra cash flow identified in your budget, you can invest and grow your net worth!

Your net worth calculation is defined as ASSETS minus LIABILITIES.

What are assets? Assets are investments that hold their value and/or PAY YOU. These would include cash, stocks, bonds, real estate, or other investments that produce cash flow, pay dividends, or go UP in value.

Liabilities are expense items that YOU PAY. These would include debt obligations such as mortgages, credit card balances, car notes, or other required monthly payments.

At the end of every month, you want to use any excess cash flow to buy appreciating assets or pay down liabilities. In the end, this decision will compound and give you the most flexibility in your financial life!

Monitoring your net worth with Mint or Personal Capital can help you know where you stand and that your investments are paying off.

2. Spending on Things or Experiences You’ll Regret in 10 Years

There is nothing wrong with spending money. Some experiences bring value to our lives and make us well-rounded people. After all, our collection of life experiences with people we love is what makes life worth living!

However, many new college graduates have not yet defined what they value.

As a result, they waste a lot of time spending money on expenses and experiences that their future self will regret. Often, these experiences can be good (in moderation). However, in excess they can lead to regret.

Think about your own situation… Are there any nights out you wish you could have back?

Whether its trips abroad or nights out on the town, chances are you’ve spent money in a less optimal way.

There are some expenses that are worth the investment. I’m not saying new college grads should not spend money going out for drinks and dinner with friends.

However, there are a lot of recurring, monthly expenses that can be limited based on some intentionality.

Identify these costs in your budget

The benefit of budgeting your monthly expenses is that it helps you identify where your money is going.

You can then define a plan that tells your money where to go based on your values.

If you value time out with friends, identify a dollar amount you’re willing to “invest” in these relationships. Perhaps, those weekly dinner and drinks with friends is worth $200 per month. This means you are giving yourself permission to spend $50 per week in this category.

Is this realistic? Maybe, it’s not possible how you are handling now. But, is there another way to approach the situation? After all, the purpose is to spend TIME with friends and spending MONEY is the byproduct.

Maybe, you can accomplish the goal of investing in these relationships in a different way. You could eat dinner at home before meeting them out. This would cut out $15-$20 per night out. Perhaps, you could shift from eating at a restaurant to hosting a dinner party potluck where everyone brings their own food and drinks to a friend’s place. Instead of watching the football game at the bar, you host a watch party.

There are countless ways you can accomplish the same goals without spending money!

3. Buying a New Car

Unless you were fortunate enough to drive a new car in college, chances are you are in desperate need of some new wheels to get you to and from work.

However, buying a new car is often the first (and biggest) financial mistake new college graduates make in their first couple of years of work.

Now that you have a stable income, dealerships and banks are just begging you to finance a new car purchase. After all, with such low rates, don’t you deserve to “treat yourself?”

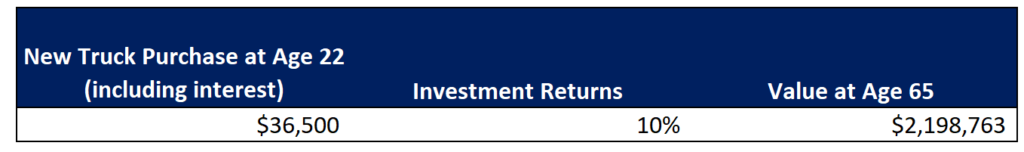

Buying a new car right out of college can be so tempting. I even fell for it! However, over the course of my life, that $35,000 truck will end up costing me nearly $2.2 million!

Sure, you may be in need of a new vehicle.

However, minimizing the expense and diverting all available funds to focus on jump starting your personal balance sheet (i.e. Net Worth) the first few years of employment can produce immense, compounded wealth!

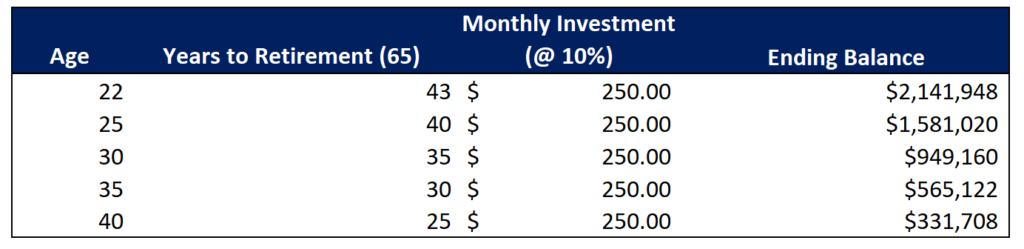

Right out of college, your greatest asset is TIME. Even with a small income, the time you have can generate substantial wealth. Simply investing $250 per month starting at age 22 can result in a multi-million dollar portfolio in retirement! Waiting just 8 years until age 30, can cut the total balance in HALF!

For this reason, time is the greatest ally to recent college grads and it’s imperative to avoid choices the first few years that inhibits your ability to save and invest such as buying a new car.

What if you really NEED a new car?

Obviously, there are certain situations that require you to get a “new” car. However, your new wheels don’t have to be brand new – just new to you!

First determine how much you can afford. Generally, a good rule of thumb is no more than HALF your ANNUAL income. So, if you are making $50,000 annually, try and keep your purchase to $25,000 or less.

I would rarely suggest financing a vehicle right out of college, so you may end up purchasing a car that is much less than the 50% rule of thumb. After all, the less you spend, the more you can invest.

Honestly, if you are right out of school, there is no shame in driving a $10,000-$15,000 vehicle that you own outright! Once you’ve established yourself, you can always begin saving up and upgrading your ride in a few years!

Sometimes, delayed gratification is the best solution.

After you’ve researched and determined a vehicle purchase price, begin saving. In your monthly budget, begin setting aside a dollar amount each month until you reach your goal and take the plunge in buying your “new” vehicle!

This will ensure your vehicle purchase decision will not cost your future self.

4. Renting an Expensive Apartment Instead of Living with Roommates…

Housing is generally the largest line item in the average American’s budget. The typical American spends 1/3 of their gross income on housing.

Cutting housing cost is often the easiest place to start in supercharging your savings. When you’re young (and likely unmarried without children), why not take advantage!

Cutting your housing cost in half or 1/3 by living with a roommate or two can add thousands of dollars to your bank account! Think about it, depending on your location, you could easily spend $1,000-$2,000/month living alone. With roommates, you could cut this cost in half, saving you $6,000-$12,000+ depending on your situation.

Not to mention, you’ll likely save money by splitting utilities as well.

The lifestyle choice of roommates…

Trust me, I know what it’s like living with roommates. It’s great having some of your best friends there all of the time. However, it’s impossible to have your own space and keep the place clean.

Coming home to dirty dishes in the sink after work from a less than hygienic roommate is NOT ideal.

However, minimizing your housing cost by living with roommates can cut down on the largest line item in your monthly budget and supercharge your savings.

AND… living with roommates in your early-to-mid 20s is one of the few life stages where living roommates is normalized. Often, it’s a great extension of college life where you may have been surrounded by some of your best friends 24/7.

The working world can be rather lonely, and it’s nice to come home to roommate friends!

Take advantage of one of the last opportunities to live under the same roof with friends your age and SAVE SAVE SAVE!

5. Letting High-interest Credit Card Debt Hang Around Like a Pet

Credit cards can be a two-edged sword…

On one hand, the sign up bonuses and points can be redeemed for travel, cash back, or other rewards. On the other hand, it’s easier to spend more than you otherwise would have. Neglecting to pay the cards in full can result in exorbitant interest rates that will greatly impede your ability to build wealth!

Often, this leads to accumulating credit card debt and paying hundreds of dollars in interest. In fact, over 40% of households fall prey to these high-interest loans. Collectively, Americans owe credit card companies over $444 BILLION at an average of nearly $7,000 per household. This results in BILLIONS of dollars in interest American consumers pay to credit card companies annually.

Avoid becoming indebted to MASTERcard…

If you’re right out of college, chances are you’ll be incurring a lot expenses all at once as you get settled into your first job. This will frequently mean you’ll have to pay relocation costs, buy furniture or other household items, or incur social expenses BEFORE you even get your first check.

It can be tempting to put these start-up costs on a credit card and just pay it off later.

If you’ve got the cash savings available, putting a reasonable amount on a credit card won’t be the end of the world. However, avoid the temptation to “buy now and pay later” if you will not be able to pay your bill IN FULL EVERY MONTH.

Attack Credit Card Debt IMMEDIATELY

If you already have credit card debt, avoid incurring any lifestyle expenses until you have paid your balance in full.

You see, credit card companies charge insanely high rates, ranging from 15% to 20%+! At these high rates, you’ll be hard-pressed to find a better, guaranteed ROI than paying off debt. Perhaps, getting an employer 401(k) match would be the exception.

However, setting a budget, identifying ways to cut costs or earn more income, and attacking any credit card balances in a surefire way to begin the process of getting your finances on track.

6. Not Identifying New Sources of Income

Often, new college grads are content with just working their new job.

After all, college is mostly theoretical while the workplace applies principles learned in a practical setting. It takes an investment of time to get up to speed to your employer’s expectations!

However, relying too much on your first job and putting ALL of your eggs in one source of wealth can be a costly mistake.

Plus, the eventual goal SHOULD BE going from trading TIME for MONEY to generating PASSIVE INCOME and financial freedom.

Always give your employer 100%

Now, I’m not saying to only give partial effort at your day job. You should absolutely take pride in your work and never short-change your boss at your day job.

Working hard and giving 110% for 40+ hours a week will certainly make you stand out and open the doors for promotion.

However, looking for ways to diversify your income source beyond your base W-2 income can be extremely beneficial!

There are countless reasons developing side income should be a goal right out of college. However, here are just a few!

- It helps you develop complimentary skills

- Creative side projects allow you to “scratch an intellectual itch” in something you may be interested in pursuing full-time one day

- Earning a different source of income allows you to diversify your pay check

- You can build a scalable business

- Eventually, you could gain financial freedom! (or at least the ability to be your own boss)

Developing a side hustle to the point where it starts paying off can take quite awhile. Putting together a passion project often eats up a TON of free time too.

For these reasons, starting right out of college before you have family commitments can be the best time to invest the time in developing a passion project that is scalable!

Often, developing additional income can take years! Why not start now?

What are some examples or identifying new sources of income?

You don’t have to necessarily start your own YouTube channel, blog, or business to earn additional sources of income.

Start looking for additional income at your current job!

Obviously, the easiest place to start in generating more income is at your current day job.

Is there an opportunity for overtime which will help you earn substantially more than your base hourly rate?

While finding extra work for your current employer is not necessarily a “side hustle,” it can provide the seed money that can be invested in your own business! Often, this will be the highest ROI in terms of trading time for money.

Perhaps, after a few months of demonstrating your work ethic in your current role, you can find another role within the company that is more lucrative!

Find part-time “hobby” work

What could be more fun that earning money doing something you enjoy?

Do you love fitness and working out? Why not become a personal trainer or yoga instructor? Chances are, you’ll get free access to a gym or studio – which can cut your expenses as well!

If you love attending concerts or sporting events, see what as needed work is available at your local events or sports venue! Perhaps, you could work security, collect tickets, or sell concessions while watching the game or concert.

Play an instrument or are competitive at a given sport? Teach beginner lessons to the kids of family friends who have been recently introduced to your lifelong passions!

Maybe you are a teacher or work in education. Chances are, there are several families who would be willing to pay $30-$50 per hour for your tutoring services. Often, it’s a win-win for the family (who may be paying for childcare anyway) and the teacher!

There are countless ways to earn side income while doing enjoyable, hobby work!

Start your own side hustle or business

Adding to your W-2 with side income is virtually limitless!

You can start a blog or YouTube channel. Gain followers on an Instagram, TikTok, or social media account and monetize with affiliate marketing. You could buy and resale items through Ebay or fullfillment by Amazon.

Perhaps, you could take a more traditional approach by starting your own business providing landscaping services or any other business!

You could even take a more traditional approach and just pile as much money as possible into dividend-paying stocks, index funds, or real estate! It may take 10+ years to build healthy, monthly cash flow. However, you could develop SUBSTANTIAL passive income along the way with relatively little time or effort (just intentionality).

There are countless ways to develop alternative streams of income.

You’ll first need to figure out what your goals, passions, are how much TIME your are willing to invest in earning side income!

7. Not taking advantage of employer benefits

Okay ladies and gents, this one is a no brainer…

One of the most egregious financial mistakes new college graduates make is not taking FULL ADVANTAGE of their workplace benefits.

It’s a hard market to attract talent in corporate America. However, many companies offer generous incentives in order to attract and retain employees.

However, that doesn’t mean those benefits and programs are automatic! Often times, you’ve got to give a little to get a lot!

After all, from the employer’s perspective, they want to make sure you have a vested interest as well.

Get any and all employer matches!

Who doesn’t love free money?!

That’s exactly what employer matching is… Whether the match is in your 401(k), Health Savings Account (HSA), or any other benefit program, the dollars matched on your contributions are the equivalent of tax-free income!

Plus, it’s a guaranteed 100% (or whatever the match is) return on investment.

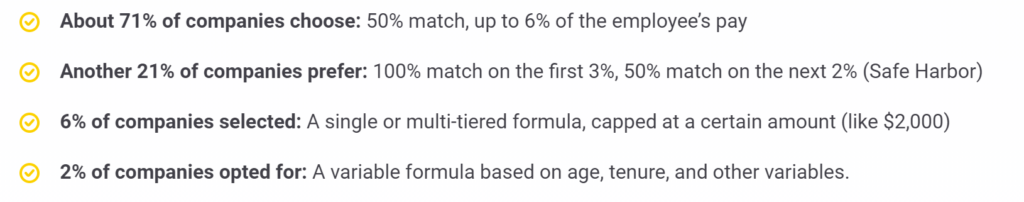

Many (but not all) larger companies offer some sort of retirement plan. If you are offered an employer-sponsored plan, check and see if they offer a matching program which can vary.

Take advantage of other benefits

Aside from taking advantage of free money, see what other plans are offered.

Some employers provide employees the opportunity to be part owners in the company. Often, this comes in the form of stock grants or the ability to purchase shares at a discount.

From the employer’s perspective, it’s great a great way to motivate the workforce to have a vested interest in the company’s success. The employees can benefit from their collective work as the company produces income and the shares appreciate in value.

If your employer provides an Employee Stock Purchase Plan (ESPP), this can be a great way to benefit when the company does well. Plus, many companies will allow the stock to be purchased at a discount (say 15% from market price).

This can be a lucrative way to build wealth right out of college!

8. Buying a House Too Soon

Starting at an early age, we’re conditioned that buying a home is necessary to live the “American Dream.”

However, buying a house right out of college and before you are financially ready can turn into a nightmare!

Owning a home is both an asset and liability

For the average American, they look at their home as an “asset.” But, remember that assets PAY YOU. Last I checked, my own house is a never-ending money pit that rarely writes me checks!

Benefits of Home Ownership

All joking aside, there are several benefits of home ownership (that most of us are keenly aware).

Firstly, we all need a place to live, so the cost of living can rarely be avoided. Buying a house allows us to lock in our monthly payment over a long period of time (i.e. generally, over a 15 to 30 year mortgage). On the other hand, rent generally goes up each an every year. Sometimes, well above inflation or your annual raise depending on your market!

Secondly, a portion of your payment each month pays down the principle balance on your loan. This debt paydown is converted to EQUITY in real estate. Each month, you own a little bit more of your property.

Another benefit of residential real estate is appreciation. The amount of appreciation in your property depends on the demand for housing in your particular area. However, the average annual appreciation is generally 3%-5%. On a $100,000 home, this can equate to $3,000 – $5,000 in appreciation each year! This aspect of home ownership is often the most heavily cited reason the average American household thinks of their home as their greatest investment.

While it’s certainly true that equity appreciation increase your net worth, unless you plan to downsize and use that cash to invest or spend elsewhere, home equity is generally considered “trapped” or unproductive wealth.

Home ownership is largely an “intrinsic” investment rather than purely financial

What most Americans end up doing is selling their current home and rolling the savings (in the form of equity) into a down payment that allows them to buy an even bigger or better home! Often, this is purely a lifestyle enhancement. This can be both and bad (depending on your personal aspirations and dreams).

In the end, a personal residence rarely produces POSITIVE cash flow like other investments. Owning a home is certainly a wonderful decision in the LONG-TERM. It stabilizes your housing costs. It provides the “pride of ownership.”

However, there are downsides new college grads should consider as well…

Downsides of Home Ownership

For new college grads, buying a house the first year or two of their career may not be the most prudent decision.

Buying a house tethers you to a particular area. Once you own your own residence, you’ve pretty much committed to living in a particular city – unless you are willing to lose money on your residence. After all, it generally takes a few years to recover transaction costs of buying and selling a personal residence which can range from 6-10%!

Right out of college, you may not be able to afford a house in a particular neighborhood that you WANT to live in for the next 5-7 years. You may be forced to live further out from where you work or from the “buzz” of the city where your peers may live.

Secondly, buying a home limits your flexibility. Remember that stability home ownership brings? Well, that stability may not be great for a new college grad who may benefit from FLEXIBILITY of renting.

What if a year or two into your first job, you end up hating that work you are doing but you still have to pay that mortgage? What if you want to pursue graduate school or change careers? Perhaps, you are excelling and your boss wants to give you an extremely lucrative promotion. However, it will require you to relocate to a different city or state.

You may not have the flexibility to pursue opportunities because you have the obligations of home ownership.

Home ownership has many hidden costs.

Unlike renting where your “all in” housing costs are generally locked in, as a homeowner, you will likely incur many other monthly costs. Aside from the mortgage payment, you’ll have higher insurance costs. You’ll have property taxes which can cost a few thousand dollars per year. As a renter, you need not worry about roof leaks, hot water heater issues, or the A/C unit going out.

In fact, a good rule of thumb for the average maintenance costs on a home is 1%. If you own a $100,000 house, you should expect to pay 1% (or $1,000) per year in maintenance costs. Granted, a water leak or A/C going out could cost well in excess, but you get the point! Home ownership can be expensive.

When you own your own residence, you don’t have the luxury of phoning the landlord to cover any of these costs!

As a new college grad, you may not have an adequate emergency fund (especially, after the down payment) to cover the incremental costs of owning your primary residence.

Buying a home is an aspirational goal you will likely pursue

If you want to buy a home, you absolutely should!

Owning a home is a wonderful thing that is worth the hidden costs and “investment.” However, never rush to buy a home until you are ready. Make sure you are in a stable position with your career, happy with where you live and are willing to live in that location 5-7 years, and have adequate reserves to cover any unforeseen expenses!

Often this takes several years to buy a home from a position of strength. This will make your experience as a home owner much more pleasant!

9. Neglecting to Network

Okay, so you may not be thinking this qualifies as a “detrimental financial mistake.”

However, networking can be one of the most crucial ways to improve your financial position.

Think about it… How did you land your first job out of college? Likely, there was some form of networking required. You met some company executives at a career fair. They saw potential in you, extended an interview, and you crushed it. Eventually, they chose you out of the hundreds of applicants, and they offered you the gig!

Even before the interview, you worked on your networking skills in college that got you there. Perhaps, you developed a relationship with a favorite professor, and they wrote a letter of recommendation for you. Maybe, you developed a friendship with a peer that connected you with your first job.

Just because you landed your first job out of college does not mean you should stop networking…

Even if you landed your dream job, networking should never end.

Developing a professional relationship with your peers, co-workers, and executives at your company (and other companies) can propel you further in your career.

If you show promise and a strong work ethic, chances are that experienced workers in your profession will be more than willing to invest in your career. If they have a good relationship with you because of your networking efforts, this can put you at the top of the list for the best projects or next promotion.

After all, people want to work with people they like. This means, they’ll do what it takes to retain you (assuming you’ve networked)!

How do you network in your first job?

Networking starts with the people you work with directly.

Often, this will be the most “natural” place to start networking. Working with your team or boss on a daily basis will eventually turn into a professional relationship as you work together and get to know each other.

However, it takes ITENTIONALITY to get the most out of a professional, working relationship with your coworkers.

You can be intentional in a variety of ways. Ask your boss (or other folks in your company) out for coffee or lunch. Learn about them as people and professionals. See what problems in their department that they have that YOU may be able to solve. OFFER VALUE.

You can show initiative by researching your industry, company, and competitors and asking your co-workers detailed, genuine questions that demonstrates that you are thoughtful and willing to work! After all, most people become content to work their 9-5 with minimal effort. Right out of college YOU BRING ENERGY to an otherwise dull workplace. This can be a breath of fresh air for your co-workers and can lead to exciting opportunities and advancement (and more money!).

Network outside of your workplace

Your network should extend beyond your workplace.

Perhaps, there are professional associations within your industry that can boost your resume or enhance your knowledge of your industry. Attending monthly or quarterly meetings can allow you to meet others outside of your company. Eventually, this could lead to your next job!

Your network could also extend beyond your industry and reach into area of personal interests. Volunteering at a local charity that is meaningful allows you to give back and network with others who are inclined to help with that charity as well.

Networking with recruiters or headhunters may feel like a betrayal to your current employer. However, entertaining other roles and talking with a headhunter quarterly (or annually) can help you keep a pulse on the job market. It will also ensure you are properly compensated.

Many placement professionals will help guide you along your career journey. If you want to make a shift within your current profession, they can help you identify weaknesses in your current work experiences that other candidates have. After all, few people have “unique” skillsets. Instead, it’s a blend of experience and how you demonstrate this experience that catches a potential employer’s attention!

Networking should not stop until you retire!

Your network should be another tool in your professional arsenal. Granted, as you mature in your career, your network may shift from being self-serving to giving back.

Starting out, your network can help you progress in your own career. As you become a hiring manager with your employer, you can tap your network to find qualified talent.

Networking should never stop! Those who network well can help them (and their employer) meet their full potential.

9 Detrimental Financial Mistakes New College Grads Make Summary

Over the course of your life, you won’t be perfect with money. Nobody is perfect!

Instead, new college grads should be intentional with their money. Set a financial plan through budgeting. Track and monitor your budget and net worth. Avoid big ticket, impulse purchases in depreciating assets like vehicles, and never keep a balance on your credit card! Limit your housing costs by living with roommates, and avoid purchasing a home before you are ready. Take advantage of time in the market and get those extra employer dollars! Generate extra income through side hustles, overtime, and/or investments.

Following these steps and avoiding big financial mistakes can help you lead the life of your dreams!