Combining finances with your significant other can be quite the challenge.

After all, money represents much more than green pieces of paper or a set of numbers in our bank accounts. The vast majority of us spend countless hours working a day job. Therefore, the purchases we make mean we trade our freedom for for money. Some of these expenses are necessary to enjoy life while others bring no added benefit.

Even if you love your job, navigating the integration of two financial lives into one can still be difficult. Especially, if each person in the relationship has different views of money. If one spouse frivolously spends while the other has a tendency to hoard, finding a happy medium can be quite difficult.

However, through careful planning and plenty of open communication, organizing your finances prior to marriage can go smoothly and help bring you closer with your significant other.

1. Evaluate Each Person’s Finances Separately

The first step in preparation for your new financial lives together is to each evaluate and organize your own finances SEPARATELY.

Why separately you ask? Combining your incomes or co-signing for loans can cause a huge financial mess if your relationship falters. Even if you’re engaged, over 20% of engaged couples end up not going through with the wedding plans.

This could leave you holding the bag for your ex-fiancee’s debt or fighting for your portion of the joint bank account. For this reason, keep your financial lives separate until you have the legal protection of marriage.

More than likely, one person in the relationship is more of the “numbers” person. If one future spouse tends to be uptight, hopefully, the other spouse is more of the free spirit to spruce things up. Because our financial behaviors and habits can be a sensitive subject, it is important to establish a “judgement-free” and understanding tone in all financial conversations – even if past mistakes have been made.

If one particular person is intimidated by personal finance, this could be the first opportunity to learn how to work together to come up with two separate financial plans.

Calculate Each Person’s Net Worth

Evaluating your net worth is the best place to start on the journey to understanding each other’s financial situation.

Just like corporations compile monthly balance sheets to understand changes in their assets and liabilities, a couple should prepare a personal “balance sheet” to help them understand their financial health.

Even if you have never had a course in accounting, you can still easily determine your net worth.

Your net worth is simply your ASSETS less your LIABILITIES.

To find your net worth, list all of your bank and investment accounts, home or vehicle value, jewelry, and other valuables and subtract any debt, loans, or mortgages.

Once you subtract all of your obligations from the fair value of all of your assets, you are left with your net worth. Hopefully, you have a positive net worth. However, many recent college graduates have substantial, negative net worths due to their student loans.

Openly laying out all of your assets and obligations to your significant other can be daunting. If you have a large amount of consumer debt or student loans, you may feel ashamed. After all, nobody wants to bring financial baggage into a relationship.

However, the first step to devising a plan together is to understand each of your financial situations. This allows you to begin taking the steps necessary to build wealth in the long-term.

Set Up Two Separate Monthly Budgets

In order to avoid a nasty situation in the event of a split prior marriage, couples should never combine their financial lives until they are legally married.

However, you can still begin slowly migrating your financial lives together through a monthly budget. Just be sure to keep your accounts and bills separately.

If each spouse does not already have their own monthly budget, start by compiling independent budgets. You can base each budget on your respective incomes and individual financial obligations.

Often, compiling a budget helps each person identify areas where they waste money. Cutting back your lifestyle prior to marriage can help you develop financial discipline. When you have another person who is impacted by your financial choices, you should ensure there is no wasteful spending.

If you do not want to manually track your budget via spreadsheets, consider using Mint or Personal Capital to compile your budget. These free applications automatically assign transactions you make into budgets that you can easily set.

In a hypothetical third budget, you can merge your incomes and expenses to see how much savings you will have each month once you tie the knot. Maybe, you will each identify areas you and/or your spouse are frivolously spending money.

Remember, once you are married, you will inevitably gain certain synergies by living together and eliminating expenses. For instance, you will not have multiple rent payments and will probably lower your combined food bill. Be sure to conservatively incorporate these savings in your “combined budget.”

2. Discuss Your Financial Situation with Your Partner

Because money issues are an often cited cause for divorce in America, discussing your financial situation with your significant other can help you align your goals and wants in life.

After all, where you choose to spend your money says a lot about what you truly value in life.

Discussing Your Net Worth

When discussing your financial situation with your future spouse, maintain a healthy tone and avoid judgmental language. The purpose of the conversation is to understand the starting point of your financial lives.

Money that has been spent is a sunk cost. Even if there is a history of negligent spending habits, healthy conversations focus on the future. As long as each person has learned a valuable lesson, you can overcome your financial mess.

Inevitably, there will be one person in the relationship that may have accumulated a larger nest egg. Even though one person may make the majority of the household income or may be bringing in the majority of the assets, the other person should still feel like they have equal say in the household finances.

Hopefully, you have dated your significant other long enough to understand if there are any potential money-related deal-breakers. Frivolous spending habits or differing views on finances could cause conflict in your marriage. This could pose an impasse in the relationship. Identifying potential issues sooner provides the opportunity to address concerns before marriage.

Use Your Net Worth to Identify Areas to Improve

Your net worth statements should facilitate conversations on what you value in life. These conversations may also bring to light areas you can both focus on improving together.

Will you both be working to repay student loans or other debt? What is the timeline for buying a house? How much do you need to invest each month to reach your retirement goals?

Laying out all of your assets and liabilities can help you develop a game plan and “hit the ground running” once you get back from the honeymoon.

Talk About the Budget

The overall purpose in setting a budget is to give yourself the permission to spend money without guilt.

Once you have combined your finances and budget in marriage, discuss “why” certain monthly expenses are important to you.

For instance, maybe you allocate 15% of your income into retirement accounts. If your spouse does not share your love for saving and investing, consider showing them how small contributions today will grow into large amounts in the future. You could either spend the dollar today or multiples of that dollar in the future. Plus, by diligently saving, you won’t be a burden to your children or grandchildren. Instead, you can provide opportunities to ensure they are taken care of. If your spouse is not well-versed in financial markets, this can be a learning opportunity to discuss how investing can provide for independence in your later years.

Perhaps, you have an expensive gym membership or costly hobby. To the other spouse, this expense may not seem justified. However, you can use your budget to explain why you receive value beyond just the workouts and classes. You may enjoy the social aspects of taking classes. The monthly expense could allow you to meet new people and develop quality friendships with others who share your healthy lifestyle or interests.

The key to discussing the budget is to understand why each spouse values certain line items. This allows you to gain comfort with these expenses in marriage.

Compiling a budget gives you an opportunity to discuss your dreams and wants in life.

Maybe, your dream is to send your children or grandchildren to college. Perhaps, your life goal is early retirement and travel. Putting together a budget can help you accomplish these goals.

Discussing your budget gives you an opportunity to find common ground and divert a larger percentage of your monthly income to common goals. After all, sacrificing is hard. However, when you have a greater goal and purpose in mind, you can more easily stay on track to achieve the lifestyle you both desire.

3. List Your Pre-Marriage Goals

You do not have to wait for marriage before aligning your long-term life goals with your future spouse.

Often, there are healthy habits and aspirations you can implement BEFORE you are married. These habits will drastically improve your overall quality of life today.

Implementing a Healthy Lifestyle

Maybe, you have always wanted to live a healthier lifestyle. Why wait any longer? Your upcoming wedding could provide motivation to make a positive change.

You could set a measurable goal to lose 10 pounds by exercising 45 minutes, 5 days per week prior to your wedding day. Each week, track your progress through a food and exercise diary until you reach your goal or the lifestyle becomes a habit.

Not only will you gain the aesthetic benefits of being in shape, your health will also improve and you will have more energy to use elsewhere.

Achieve a Short-Term Financial Goal

Alternatively, you may have made certain financial messes during your single years.

Perhaps, you have a large balance on a credit card that is financially debilitating. Your goal could be to repay the balance prior to your wedding day. Paying off the balance may require significant sacrifice in other areas of your budget or even a side hustle to earn extra income. However, it’s better than the embarrassment of asking your new spouse for help making your payment.

Getting your finances in order prior to marriage can help set your household up for future success.

Evaluate Your Career Goals

Do you feel stuck in a job or career you hate? If you are part of the 51% of Americans who are disengaged at work, your upcoming marriage could be motivation to consider making a switch into something you enjoy more.

While you are single and only responsible for yourself, you may wish to consider making a career change. If you find yourself working a job that requires consistent overtime or travel, the lack of work-life balance could pose an issue in your relationship – especially, when starting a family.

This change in your personal life could provide a catalyst for making a career change that is more conducive with your long-term goals.

Set a Personal Development Goal

If the thought of marriage and an eventual family scares you, explore furthering your education through personal development.

There are thousands of books and other educational materials expressly written to help you further your knowledge. These resources can help you maintain a healthy marriage, resolve conflict, and rear successful children.

If your goal is to have a fruitful marriage, consider reading a few books on marriage. Maybe, join a weekly couples class at your church or invest in pre-marriage counseling. In fact, couples who receive premarital counseling prior to marriage have a 30% higher success rate. This could help you learn the best ways to love your future spouse better.

By setting achievable and measurable goals you want to accomplish prior to marriage, you can improve your life today and set your lifelong journey together on a firm foundation.

4. Schedule Weekly or Monthly Recurring Meetings to Discuss Your Progress

One of the biggest benefits (and curses) of marriage is always having an accountability partner.

After you have each determined your individual pre-marriage goals, set aside time each week (or month) to discuss the status of each of your goals.

Are you making progress towards your fitness and financial goals? Have you identified helpful educational material, and if so, what have you learned? If you are looking to change jobs or careers, have you met with any prospective employers or recruiters?

Along with your budget discussion, feedback sessions with your partner can provide valuable insight. Who else has as intimate knowledge into your hopes and dreams? Plus, they have a vested interest in shaping your ideal life together.

Use this time each week as an opportunity to make updates to your goals, share encouragement, or push each other closer to achieving your pre-marriage goals.

5. Set Short-Term, Measurable, and Attainable Goals for Your First Year of Marriage

Let’s be honest, the first year of marriage can be extremely tough.

If you think you know your significant other now, just wait until you spend most of your waking time together. As most of us know, the person who we love the most can easily and simultaneously be our greatest source of anger. This is certainly a contributing factor in why 20% of marriages end in the first 5 years.

However, while the first several years of marriage will certainly be a test of will, setting mutual goals for the first year of marriage can teach couples how to work together for a successful marriage.

More than likely your pre-marriage goals are more “self-focused.” While your significant other can be there to cheer you on and your pre-marriage goals will impact your life together in the future, you should also set short-term goals you want to accomplish your first year of marriage.

What’s Your Vision for a Healthy Marriage?

We have all seen those couples who consistently fight. Nobody wants a volatile relationship consistently on the cusp of divorce.

Your first year of marriage can provide the bedrock foundation of how you “deal” with each other. Conflict is inevitable. Seek to learn what tends to trigger sticking points in your relationship. Preemptively develop plans for how to resolve this conflict before it happens.

In your first year of marriage, you should implement a system for how to communicate and discuss issues and feelings, learn from any mistakes, and resolve to grow from any conflict.

Virtually no relationship can come remotely close to matching the romanticized version of marriage we all see in movies or read in books. However, setting a mutual vision in your first year can help set the course for a positive, fulfilling marriage.

Setting Common Financial Goals for Year 1

Setting common financial goals for the first year of marriage can help you align your finances and achieve your vision as a couple.

Depending upon your age and financial position entering marriage, your first year could either deepen your financial struggles provide a catalyst to set you up for prosperity and wealth.

Putting Together a Plan to Repay Debt

As anyone with loan payments knows, debt can really put a damper on your monthly cash flow.

While some debt such as a mortgage can be “productive” and allow you to purchase an asset or increase your earnings potential, maintaining a large amount of consumer debt will keep you from reaching your financial goals.

Because of the crippling effect of unproductive, high-interest debt such as credit cards and some car loans, your goal should be to eliminate these consumer loans in your first year of marriage.

You will probably also want to pay down any student loan balances as fast as possible. Eliminating the negative cash flow from recurring debt obligations can free up thousands of dollars to invest for retirement. As a couple, you could use these payments towards a home or other dreams you have.

Not Yours or Mine, but OURS

One of the hardest parts of integrating your finances in the first year of marriage is the mentality change from ME to US. After all, most of us can be rather selfish and protective when it comes to OUR money.

While you both may work, earn different incomes, or have varying amounts of debt obligations, most healthy relationships view finances from a cohesive perspective.

When you are married, your financial choices affect your partner. Therefore, you cannot earn or spend money without some sort of impact on the person you love the most. Because of the financial benefits and consequences coupled with the emotional aspects, your mindset must shift from being individually-focused to unit-focused.

Perhaps, one person has significant student loan debt that they could not quite eliminate prior to marriage. Potentially, this could make the other spouse feel animosity and resentment. Instead of harboring negative feelings, both spouses should view the debt as “ours” and put together a plan to repay the balance.

The key for a healthy financial relationship is to maintain a judgement-free, understanding tone, while making selfless financial decisions.

Saving for Your First Home

For many young people, buying a home represents the epitome of “adulting.”

Depending on a wide array of factors, buying a home may be the right choice. However, if your earnings are extremely volatile, you do not have a set career path, have a ton of debt, or do not think you will live in the home 5+ years, renting may offer a more financially prudent choice.

Maybe, both of you are in a position and stage of life to save for your first home purchase. Together, you can decide how much home you can reasonably afford. This allows you to set a savings goal each month to attain the necessary down payment.

Do NOT Let Your Home Be a Source of Financial Stress

The biggest investment (and expense) most people make centers around their home purchase.

While the bank will probably approve you for a loan that is twice as much as you can reasonably afford, you should try and limit your monthly housing expense to 25%-33% of your take home pay. This allows ample room in your budget to save for retirement, kids college expenses, and even your next vehicle purchase. Plus, you will have extra spending money for vacations and other fun activities. This keeps your home from detracting from your ideal life.

In addition to a down payment, you will want to have your emergency fund (3-6 months of expenses). If you are a renter, you do not have to worry if the roof leaks or if your air-conditioning unit stops working. However, when you own the home, you will be responsible for the vast majority of the maintenance and repair expenses.

A solid emergency fund will keep you from turning to debt in the event a costly repair is needed.

Aligning Your Desires in a Home

After you are in agreement on a budget and savings plan together, discuss what you both want in a home. One spouse may have certain aesthetic desires while the other spouse may have different tastes.

Finding common ground can be difficult. However, you should always remember this is not your “forever” home. Instead, your first home should be an investment that helps you build equity. This will propel you into your next residence as your life evolves and family grows.

As long as you have an emergency fund in place, buy in an appreciating location, have a 20% down payment, keep your payment well below 33% of your take home pay (preferably, on a 15 or 20 year mortgage), and are willing to live in the home at minimum 5 years, you will probably come out ahead on buying your starter home.

Too often, newlywed couples put their entire life’s savings and monthly cash flow into their first, “dream home.” Many young couples are forced to work overtime or rely on pay increases to “grow” into their first house. While owning a home is a part of the “American Dream,” home-ownership can certainly turn into a nightmare if not done prudently.

While owning a home is certainly an admirable goal, it should not be your only financial goal. While you are young, you should consistently invest as much as possible to achieve other goals such as retirement. After all, your overall returns will be substantially higher invested in the market versus a primary residence. Especially, if your employer provides a match within your retirement account.

By planning for your starter home purchase in the first year of marriage, you can be financially able to take the plunge of buying your first house.

Retirement Savings

One of the best ways to save for the future is through tax-advantaged retirement accounts such as a 401(k), 403(b), or IRA.

Once you have paid off high-interest debt, start investing by plowing 10%-15% of your gross income into retirement savings. For most couples, a Roth 401(k) or Roth IRA will be a more lucrative long-term option.

While your contributions are after-tax, you will not owe taxes on the growth when you begin making withdrawals. Since you will probably have a lengthy investment horizon, the vast majority of the balance will end up being growth.

However, if you do choose the Traditional option, you will receive a tax deduction from your adjusted gross income in the year the contributions are made. The earnings and dividends will grow tax-deferred. Ultimately, you will owe ordinary income taxes on the distributions when withdrawals are made at age 59 1/2.

Instead of relying on Social Security, you can truly secure your financial future by investing 10%-15% of your gross salary throughout your working lives.

Saving for Your Children’s College

It’s no secret – the cost of college has gotten way out of hand.

With total student loan debt exceeding $1.6 trillion, it’s no wonder most young people are encumbered by student loans. Even if you took out student loans to pay for college, you can give your children the opportunity to attend college without debt by investing in a 529 Savings Plan.

Much like a Roth IRA, a 529 Plan allows contributions to be made with after-tax dollars. You can invest the balance and when withdrawn for eligible college expenses. These eligible expenses include tuition, books, room, board and even food. Your student will pay no taxes or penalties on the appreciated gains when used for these qualified expenses.

As an added benefit, you can even open up the 529 Plan account prior to your child being born. Instead of waiting until your first child’s birth, simply open the account under your Social Security Number and begin investing your after-tax contributions.

Once your child is born, 529 Plan rules allow for the transfer between qualified family members.

Set Other Savings Goals

If you both begin taking the steps necessary to save and invest for other savings goals early in marriage, you will have the added benefit of a longer time invested in the market.

For any expense more than 5 years out, consider opening an account specifically for your saving goals. You can begin investing for future expenses whether it be your next car purchase or a vacation home.

Setting Up Investment Sinking Funds

Opening up an ordinary brokerage account and investing for unavoidable future expenses can help you subsidize the cost and fight inflation through dividends and capital appreciation.

For instance, you will inevitably upgrade your vehicle. Instead of taking out a car loan when your current vehicle quits working, begin investing a “car payment” to yourself each month – even if your vehicle is fairly new.

As an example, if you invest a $500 “car payment” per month in an S&P 500 index fund that has historically generated 10% per year, you will have nearly $39,000 to purchase your next vehicle in 5 years.

While the majority (77%) of the balance is comprised of your contributions, nearly $9,000 (23%) will come courtesy of dividends and capital gains. While you will owe taxes on the capital gains and dividends, the tax rate is much more favorable and you will still come out way ahead (as compared to taking on consumer debt).

Depending upon the final cost of your purchase, you can back into how much you need to invest each month at the historic market return to achieve your final goal.

Determine Non-Financial Relationship Goals

Obviously, your relationship should not solely revolve around finances.

While money is simply a tool to provide a high quality of life, there are much more important things to focus on your first year of marriage. By sitting down with your partner, you should come up with resolutions to do healthy activities together that help your relationship blossom into something even more special.

Keep the Romance Burning

To keep your relationship fresh and growing, consider setting the goal of having a “date night” every week.

Even if you do not feel like going out, planning activities can keep you from staring into your phone or television screens on Friday night. Schedule double dates with other couples to avoid the trap of becoming that reclusive couple who never does anything fun outside of “Netflix and chill.”

By taking lessons or classes together, joining clubs, associations, or church groups, you can build a community of encouraging friends that are in a similar stage of life. These peers can help you mold and reinforce positive behaviors in your relationship.

Volunteer Together

Nothing feels quite as good to the soul as giving back to the community.

Another way to grow closer with your spouse is to get involved in community or civic activities together. Volunteer for a cause you are both passionate about.

Volunteering at a not-for-profit organization a few times per month can help you stay grounded and grow closer together as you serve your local community.

Exercise or Find a Mutual Hobby

If you both enjoy physical fitness, make it a point to go on a run once or twice per week together. Maybe, even consider joining the same gym or taking classes together at the local YMCA.

If running a marathon has always been a bucket-list item, sign up and train for the marathon together. Overcoming obstacles and completing a tough challenge will certainly help you grow closer together.

Working out or physical fitness may not be your thing. Simply find another hobby you both enjoy. Consider taking classes or attending lectures on a subject you both enjoy.

Perhaps, you can join a music or art appreciation society. Learn to laugh together by taking an improv comedy class or overcome a fear such as public speaking by attending a local Toastmasters club.

While it is important to maintain hobbies you enjoyed in your “single days,” forming new hobbies you can enjoy together in your first year of marriage can help expand your individual tastes.

6. Together, Come Up with a Strategy to Accomplish Your Shorter Term Financial Goals

The biggest thing the first year of marriage is do not become overwhelmed by trying to completely change course and drag a reluctant spouse along.

Instead, take incremental steps on a path to achieving short-term goals. These goals should be both attainable and achievable and mutually agreed-upon. Even if a financial goal seems easily attainable, “checking-off” simple tasks can be positive reinforcement. These wins motivate you to continue your financial journey together.

Set a Strategy to Combine Your Finances

As an example, in your first month of marriage, have a plan to combine your financial lives.

Aside from determining an agreed-upon budget once you are married, the first step of combining your financial lives involves opening a new bank account or merging your cash into common operating and savings accounts.

What Accounts Should You Share?

Ideally, you should have a minimum of two accounts. One account should be used to pay bills. This is an operating account that you can use to automate your bills. Another account can house your emergency fund. Hopefully, you will rarely use this account. Therefore, you can leave this money in a high-yield savings account. While the interest won’t be comparable to stock market returns, the interest should keep up with inflation. Plus, you will not lose your principle like you could in the stock market due to short-term volatility.

Ideally, both spouses should do research and arrive at a conclusion on which financial institution is best. After doing your research on the fees, level of service, trust, and interest rates offered, you can identify the best institutions to house your checking and savings account. Generally, online banks or credit unions provide the best high-yield savings account rates.

Other Financial Matters

Another key areas is updating beneficiary information on any life insurance or retirement plans. If you have been working for a few years, you probably listed another family member as the beneficiary. Now that you are married, you should ensure your new spouse is taken care of in the event of tragedy. This can at least give you solace that your loved one is well taken care of.

If you have a mortgage or co-signed debt, consider term life insurance to ensure your spouse receives enough of a benefit to pay off the house and clear any remaining debt. This well help them avoid the need to sell the house in the event he or she loses your income.

Strategically Repay as Much Debt as Possible

By now, you realize that repaying as much debt as possible provides a fairly consistent theme.

If you do not have any debt, consider yourself lucky (or very responsible). After all, the vast majority of Millennials maintain some sort of debt. Most of us have some sort of student loans, credit cards, or vehicle loans. As we discussed, not all debt cripples your financial future. However, debt that fuels irresponsible spending or allows you to purchase big ticket items (i.e. a vehicle you cannot afford) without paying cash will cause you to fall behind.

If you are getting married in your 20s or 30s, you still have plenty of time to clean up your mess. Before you begin contributing to your retirement accounts, consider repaying all high-interest debt (i.e. interest rates of 6%-8%+). While markets have historically generated annualized returns of 10%, repaying debt with an interest rate of 6% is a GUARANTEED rate of return. In this low interest rate environment, you will not find in another guaranteed investment earning near 6%. Further, this will relieve stress and free up extra money to invest.

In your first year of marriage, you may want to take a few different approaches depending upon your philosophy:

1. The Debt Snowball

Financial guru Dave Ramsey coined the Debt Snowball in his book the Total Money Makeover.

In his course Financial Peace University’s “Baby Step 2,” Ramsey recommends listing your combined debt balance largest to smallest regardless of the interest rate. His prescription recommends applying every penny of extra income and savings beyond a $1,000 started emergency fund and minimum payments to the smallest debt. When the smallest debt balance has been eliminated, use the extra cash flow on the next smallest debt while continuing to maintain minimum payments on any other debts.

The Benefits of the Debt Snowball

The Debt Snowball Plan’s secret weapon comes in the form of psychology and human behavior.

While a strict mathematical equation dictates you should eliminate the balance with the highest interest rate, Ramsey explains that eliminating small, “ankle-biter” debts gives his audience a much needed psychological win. This helps fuel and motivate people to stay on the plan and continue sacrificing their lifestyle while they repay their obligations.

Further, he explains that this momentum tactic greatly outweighs any savings on interest since most people can repay their high-interest consumer loans within a few years.

2. The Debt Avalanche

Another method to the Debt Snowball Plan is the Debt Avalanche Method.

As expected the Debt Avalanche Method advocates for listing debts from highest interest rate to lowest interest rate and attacking the debt based on the higher interest rates. Overall, if you put the same amount of dollars to work in this plan as you do the Debt Snowball Plan, you will save a few hundred (or thousands) on interest payments. Obviously, this depends on your debt balance, interest rate, and payoff period.

However, Dave Ramsey would probably contend you would not be able to find the extra income to put toward your debt or you may become burned out if your largest debt is coincidentally the highest interest rate.

Both plans provide a reasonable strategy to attack debt. At the end of the day, you will need to decide which plan best suites your financial situation in the first year of marriage.

Begin Implement Saving and Investing Strategies Based on Your Combined Vision

In the business world, companies employ an army of accountants and finance professionals in their Financial Planning & Analysis groups. These individuals are tasked with setting, maintaining, and updating the firm’s annual budget to help their company achieve maximum returns.

Similarly, you can view your new household as a business (or at least implement a few of these best practices).

In the short-term, what are a few (5-10) mutually agreed-upon financial goals you both share that can be accomplished by your first anniversary?

Do you want to payoff any credit card balances? Would you like to save for your first-year anniversary trip? Maybe, you want to buy a house after renting your first year of marriage. How much more do you need for the down payment?

More than likely, you will likely have multiple achievable short-term goals.

After combining your finances and determining a monthly budget, you should have a reasonable estimate of how much disposable income you could theoretically save every month or spend on your desired lifestyle.

Automate Your Savings

For the best results, you should set up automatic payments into different accounts earmarked for specific goals. Set aside a certain amount to live on and pay daily expenses while simultaneously diverting funds into other savings accounts for upcoming expenses.

Given the shorter term nature, you probably should stick to high-yield savings accounts where your principle is insured by the FDIC. You will only earn a small amount of interest. However, these high-yield accounts insulate your balance from inflation.

If you want to save for longer-term goals (5+ years), you could implement a dual strategy. Invest a portion in the stock market and divert a portion to a high-yield savings account.

After automating your savings, monitor your progress each month during your budget meeting and make any necessary changes.

7. Dream “Big” Together

All too often, we get caught up in the routine, daily grind of our 9-5 job.

Somewhere along our commute to work each day, we find ourselves wondering if a better life exists. As an example, many of us find ourselves dreaming of what we would do if we hit the lottery or inherited immense wealth from a rich uncle.

Instead, most of us end up chasing a paycheck to pay bills or climbing the corporate ladder. While working hard is admirable and provides a sense of purpose, our daily routine should not cause us to forget about our WHY for working.

Are you meant to achieve more in life?

Dreaming in High Definition

What if you could both quit your jobs in 10 years and travel the world for several months? If financially able, would you buy that beach or mountain house in a locale you always dreamed of living? What if you were able to give $1 million to your favorite charity?

Maybe, you just want to stay at home with your children or start your own business.

No matter your dreams or desires, you can achieve all or a portion of your dream in life together. After all, life is too short to work a job you hate or struggle through life. On your deathbed, you will certainly not regret giving your dream job or life your best shot – even if you fail miserably. However, the “what ifs” may always haunt you for not trying.

Why is Dreaming Together So Important?

Chasing our dreams helps provide a sense of purpose and accomplishment. Not only does dreaming help us escape from issues today, dreaming together gives us hope.

By dreaming with your partner, the two of you can gain momentum and live your best life. However, by not setting big picture goals, you may find yourself sacrificing your most desired life. This could cause feelings of resentment about your partner or even children.

More than likely, your mutual dreams are complicated. Without working together, you can be virtually assured that your dreams will not come to fruition. However, when you both align your long-term vision, you both can understand the “WHY” and keep motivating each other through the finish line.

How Do Dreams Change in Marriage?

We certainly have different dreams when we are young. As we age and life evolves, our wants and desires change.

Even before marriage, you should discuss your idealized life with your future spouse. Find common ground and advocate for your dreams and begin putting into motion a plan to accomplish your combined goals.

Your big-picture goals WILL come at a cost. Perhaps, you will need to take on a side hustle to help pile extra money away for that beachfront cottage. You will probably need to implement financial discipline and sacrifice other areas of your life and budget for an extended period of time to travel the world. If you desire financial independence and a portfolio that allows you to quit your job, you will need to live well below your means for multiple years.

However, with intense focus and discipline you CAN accomplish many of your big picture dreams. With your partner, together you both should discern which dreams are mutual, achievable, and most important to provide the best quality of life for your family.

While discussing your dreams together is healthy, you must also implement a plan to accomplish your dreams together.

8. Implement a Plan to Accomplish Your Mutual Goals

Achieving the idealized portrait of married life may not be easy. After discussing your lifelong dreams, you should set both a timeline and plan to achieve your goals.

What aspirations are you working towards in life?

The vast majority of your financial and personal decisions should be leading you down the path to achieving your dreams. Any deviation from the plan that inhibits or slows down your long-term goals should be carefully scrutinized together.

Life Tends to Get in the Way of Our Aspirations

As an example, together you may have diligently saved $50,000 to put down on your dream vacation home for your family to enjoy. Inevitably, the engine on your 10-year old car stops working. You may impulsively and emotionally begin shopping the new car lot. You both may have plans for your family to grow. This means you NEED an SUV for your wife to take the future kids around town. After all, you both work hard and DESERVE a nice car.

Does using your dream vacation home savings on a new car help you accomplish your goal faster? Obviously, not.

Feeling entitled to nice homes, cars, vacations, and materialistic items often causes us to sacrifice our worthwhile aspirations. Even though driving a nice car may make you happy the first month or two, the newness will fade. Similarly, spending too much money on materialistic items may bring pleasure in the moment. However, buying consumer goods will not help you achieve a transformational lifestyle change.

To combat lifestyle inflation and “keeping up with the Joneses,” you will need a counter-culture mindset shift.

Guiding Steps to Achieve Your Dream Life

In order to avoid the pitfalls and distractions that come your way, set measurable goals and diligently track your progress. This helps hold yourself accountable and identify when you are not on track.

Where do you want to be in 10 years? Set milestones along the way to help break a complex aspiration into achievable steps.

Is Your Job or Current Career Holding You Back from Achieving Your Dreams?

Let’s say you and your new bride dream of achieving financial independence in 10 years. After all, leaving your 9-5 jobs where you are tied to a chair and cubicle sounds tempting. Maybe, this would allow you to pursue opening your own business or service.

How much would you need saved and invested to replace your income or cover your expenses?

Replacing Your Income Passively

As a general rule of thumb, you will need 25 times your annual expenses invested. In practice, this means you can withdraw around 4% of your portfolio each year without ever touching the principle balance. In essence, you will never need to work again since your investment portfolio replaces your salary.

For example, let’s say your family currently spends $50,000 per year to survive. To spend this amount annually (including inflation), you will around $1,250,000 invested earning 6%-8% per year. As the S&P 500 has historically returned ~10% annually, achieving this rate is certainly doable. More than likely, a portion of your portfolio will be invested more conservatively when you both quit your jobs. Therefore, your average returns will probably fall into the 6%-8% range.

Calculating How Much to Invest

After determining how much you need in 10 years, you must determine how much to invest each month.

Based on the time value of money and the historic market returns, you will need to invest ~$4,900 per month to accumulate a portfolio that replaces your income in 10 years. If you save 50% of your household income, this means you probably will need to earn around $120,000 after taxes.

If you and your new wife are not knocking down $150,000, do not lose hope. You can still achieve your goals, but the route may not be as straight forward.

You will either need to earn more income, reduce your expenses, earn greater returns, or delay your retirement. All of of these are potential levers you can pull to help you achieve this dream.

Earning More Money

Earning extra cash is the obvious first place to start.

You can earn more income by switching to a new company, taking an extra job, or starting a side business. Potentially, this side income could turn into a full-time business and provide income during “early retirement.” This could reduce the amount you need invested and allow you to quit even earlier.

Reducing Expenses

Depending upon your lifestyle, cutting expenses could be an easy way to generate greater surplus to invest.

During your monthly budget meetings, ask if certain expenses are taking you on the path to achieving your dream. If not, cut them out. The sacrifice is temporary.

If you have a home mortgage payment, consider paying off the balance as soon as you can. More than likely, this is the largest line item in your monthly budget. If you did not have a housing payment, your annual expenses would probably drop from $50,000 (in our example) to $30,000 – $40,000. This would drastically reduce the amount you would need invested.

Earning Greater Returns on Your Investment

On average, the S&P 500 has generated 10% annually.

However, plenty of mutual funds and other indices have beaten the market. Consider adding growth-oriented mutual and index funds to compliment a Total Stock Market Index Fund.

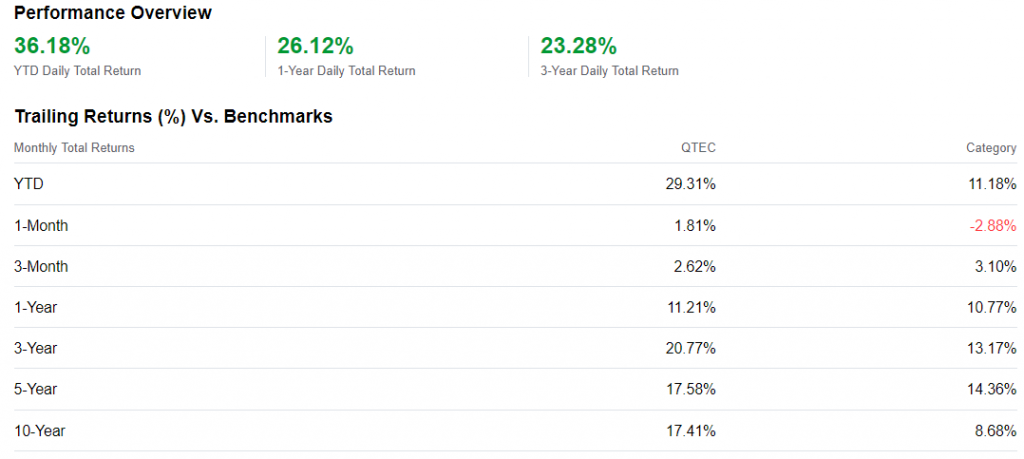

Many of these growth-stock funds have annualized 12%-16% over the last decade. As an example, the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) is an investment I personally own. Over the last decade, it has averaged nearly 17.5%.

If you took a little more risk by investing in a growth-oriented mutual fund that returned 14%, you would only need to invest $3,900 per month (versus $4,900).

Coupled with reducing your expenses and earning more, you may be able to achieve investing this much per month.

Alternatively, you could seek outsized returns in other asset classes such as real estate.

By meticulously scouring investment properties that rent for ~1.5%-2% of the fair value, produce cash on cash returns of ~10%-12%, and are located in appreciating areas, you can probably beat stock market returns. Many real estate investors look to earn 15%-20% total returns (including appreciation and tax benefits) on their properties. Further, real estate produces passive, monthly cash flow that you can spend when you quit your day job.

Always remember that returns involve risk. You can never guarantee the market will appreciate, so do not invest money you need in the short-term (<5 years).

Expanding Your Time Horizon

Perhaps, the “easiest” method would be to delay your dream lifestyle – whether purchasing a vacation home or retiring early.

However, since we all have a finite amount of time, this could come at great cost. Delaying your timeline may not be pleasant. However, it could be necessary.

If the other levers have not quite gotten you to a point where you are comfortable, you could always allow for a little more time to save. Plus, the market will probably continue helping to push you along.

As an example, if you delayed retiring for just 5 years, you would only need to invest ~$2,400 per month (versus $4,900). The extra time invested would allow the market to compound both the original and new contributions.

If you pulled the other levers and took a more aggressive approach (earning 14% annually), you would only need to invest $1,650 per month for 15 years. While this is still a hefty sum, expanding your time horizon to 15 years may provide a more realistic time horizon to achieve your dreams.

What if You Love Your Job and Career and Quitting Is NOT Your Dream?

If you love your job and your current career is a part of your dream, congratulations!

You may find fulfillment and purpose in your occupation. Even if you “hit the lottery,” you would continue to working at your current job. You can still take a similar approach to investing to achieve other lifestyle desires.

Build Wealth to Prepare for Evolving Dreams

If you have other dreams, you can still set measurable steps to achieve your plans together in marriage. After all, you may be content currently, but your dreams and desires will certainly change as life evolves. A once endeared career could take a negative turn with a new boss or unforeseen layoff. Feelings about the time you spend at work could certainly change as children are born and priorities shift.

You can still prepare and insulate yourself through achieving financial independence and wealth. Even if you do not spend the extra money on yourself, you can be extremely generous to friends, family, and society.

Alternatively, you could set a plan to save an invest for that vacation home, boat, or bucket-list vacation around the world. Maybe, your one dream in life is to pay for your children to attend college and set them up for success. Why not take it a step further and invest for their children and their children’s children?

You only get one shot at life, so make the most out of it. By dreaming big together, you can achieve your aspirations in life and leave behind a legacy for future generations to emulate.

9. Continually Monitor or Update Your Financial Goals as Dreams Change

Just like you should continually monitor the short-term financial aspects of your lives, together, you should monitor and update any long-term shifts as life changes.

Events will occur and life will happen that causes your dreams to change. Because of life’s curveballs, you may find yourself feeling stuck or headed the wrong direction.

Monitor Your Joint Long-Term Goals on a Monthly Basis

More than likely, your long-term dreams and goals have an impact on your monthly budget.

Whether you are saving for retirement, your dream home, or a buck-list backpacking trip through Europe, our dreams in life often take substantial money (or time) to pursue.

For most of us, we do not want to spend hours each week tracking and updating spreadsheets to see how we are tracking on our journey.

After you have calculated an estimated cost of your dream and set up a separate savings account, you should work backwards to determine how much you should have saved given your timeline. You can adjust any contributions or investment allocations to keep yourself on track.

What if Your Dreams Change?

Inevitably, your dreams together will probably change a bit.

Whether your long-term dreams change due to unexpected life events or children, there is no harm in adjusting your long-term wants.

Perhaps, you originally wanted to use your beach house fund as a down payment on a condo in Florida. When you finally accumulated the nest egg, you decided you would rather keep the amount invested and use the earnings to pay for a rental a couple of weeks per year.

Maybe, your original lifelong goal was to “retire” at age 45, but you landed your dream job or started a successful business.

Our dreams change as our circumstances in life continually unfold. As long as you are in agreement with your spouse, there is no harm in shifting your “dream fund” savings to accomplish a new aspirational goal.

Combining Your Financial Lives and Future

Combining your financial lives and aligning your short and long-term dreams with your spouse may not come naturally.

However, open and honest communication is necessary to ensure you transition into marriage smoothly. Even though there will be bumps along the way, by setting a clear strategy and tangible goals, you can ensure you both work together to live your “dream lives” together.