An emergency fund represents cash reserves that help you cover inevitable but unanticipated expenses when “life happens.”

Perhaps, your company decides to downsize and you lose your job. Maybe, you or your spouse fall ill and needs extended medical attention.

Unfortunately, most Americans live paycheck to paycheck. In fact, nearly 26% of Americans do not have any sort of emergency savings. Even worse, 60% of Americans could not cover a $1,000 unexpected expense.

Establishing enough cash reserves to cover one-off, unexpected expenses is extremely important. Holding cash in reserve helps you avoid turning to high-interest credit cards or other financing schemes to pay your bills.

Further, having a rainy day fund will help you sleep better at night. Instead of drastically cutting back on your lifestyle, you can still maintain some sense of normalcy in the event of an emergency,

Establishing My Emergency Fund

Honestly, the bulk of my non-restricted cash is invested in the market. While my investments will earn substantially more invested over the long run, I realized I was too “cash light” after making a few large purchases.

With markets experiencing volatility in 2019 due to the “trade war,” the possibility of a looming recession, and upcoming 2020 Presidential election, I needed a stable source in the event of job-loss or other “life crisis.”

After saving for months, I finally accumulated enough cash for a 3-month emergency fund.

Determining My Emergency Fund Size

Generally, the financial planning community recommends 3 to 6 months of living expenses in cash reserves. For most families, this provides enough to cover the vast majority of financial surprises that come your way.

In the event you are unable to work for an extended period of time, you can withdraw from your emergency fund account until you are back on your feet. In fact, according to the Bureau of Labor Statistics, the average duration of unemployment in 2019 was ~22 weeks. While this represents nearly 6 months, even a 3 month emergency fund would go along way in subsidizing your expenses. More than likely, you could find temporary work or drastically cut back on expenses until you land in a full-time position.

Therefore, your emergency fund size depends upon an array of factors. Base your cash cushion on your individual needs and what helps you sleep better at night.

Let’s Look at Some Examples

As an example, if you have a volatile income based on commissions or work for a company on the brink of bankruptcy, leaning towards holding 6 months of expenses could be more prudent. Similarly, if you have recurring health issues or have significant debt obligations, keeping excess cash could help you sleep better at night.

However, if you have a high savings rate and low overhead costs, you could probably keep around 3 months of expenses in cash. Maybe, you have large income, managed to accumulate a substantial nest egg, or have little debt. In this instance, you may not need quite as large of cash in reserves. Instead, you could afford the added risk of investing any excess cash above your 3-month emergency fund.

This would allow you to hold the minimum recommended amount in cash reserves while also building investments in unrestricted accounts.

What Qualifies as Expenses?

More than likely you spend a bit more than just your required living expenses every month.

While you could take your average monthly expenses over the last year to base your emergency fund, more than likely this figure would include expenses that you would not have in the event of a financial emergency.

For instance, in the event of a job loss, you probably would not go on vacation, play golf twice a week, or frequent the nail salon. Instead, you would cut back on lifestyle expenses and spend more time cooking at home.

Rather than including lifestyle expenses, focus on adding ONLY your necessary living expenses. This would include obligations such as your rent or mortgage, car payments, and other required debt service. Similarly, you will want to include any other recurring monthly expenses such as utilities, gas, and insurance.

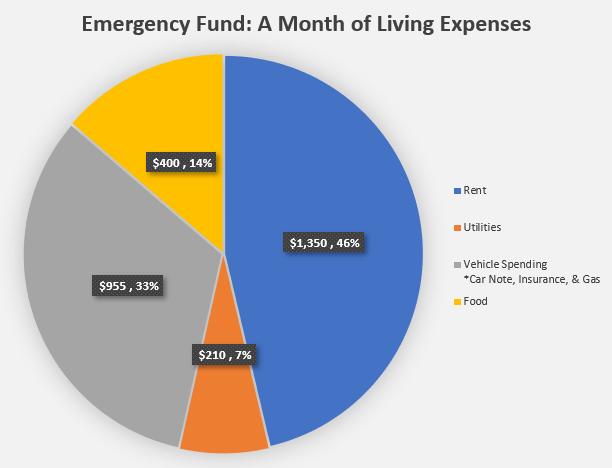

My Emergency Fund

As a practical example, this is how I determined my emergency fund.

My Monthly Expenses:

Rent: $1,350

Utilities: $210

Car Loan: $720

Car Insurance: $105

Gas: $130

Food: $400 (groceries only)

Total: $2,915 per month

3-Month Emergency Fund: $8,745

6-Month Emergency Fund: $17,500

Average: ~$13,120

Based on my monthly expenses, I determined that an emergency fund of approximately $10,000 should be appropriate. While this is only about 3.5 months of expenses, I have a fairly substantial sum in unrestricted brokerage accounts. Even though this account fluctuates with the market, I could easily tap these funds if necessary.

Further, I have managed to build a decent nest egg in my Health Savings Account. If needed, my portfolio would easily cover my deductible for emergencies due to illness.

Not only do I have ample, liquid cash reserves, my career as a salaried CPA provides stability. As I am still early in my career, I could easily find other roles requiring 3-4 years experience in the event of a job loss.

Therefore, I can lean towards the lower-end of the 3 to 6 month range and invest the difference.

However, if I relied heavily on commissions or worked in a volatile industry, I would feel more comfortable having $13,000-$15,000 (or more) in my emergency fund.

5 Requirements for the Emergency Fund

Where do we even start when establishing a rainy day fund?

An emergency fund is nothing more than a separate savings account. Instead of stuffing cash under your cushions, opening a separate account not used to pay bills provides an extra layer of protection. Hopefully, an “out of sight, out of mind” account will keep you from impulse buying that truck or handbag you always wanted.

When opening a separate emergency savings account, you should look for specific characteristics:

- Extremely Liquid and Accessible

- No Transfer Restrictions

- No Fees

- Easy-to-Use and Access Online Platform

- The Maximum Possible Interest Rate to Protect Savings from Inflation

Liquid and Accessible

The number one characteristic in an emergency fund is liquidity.

In the event of an emergency, you should have nearly immediate access to your money to pay bills. In the event of an illness, job loss, or other major expense, you do not want to wait 2-3 days for a wire to clear or account restriction to be lifted.

Keep a Small Portion of Cash on Hand

Obviously, the most liquid form of an emergency fund is cash on hand.

With securely stored cash at home, you have immediate access to a small portion of savings. In the unlikely event you cannot get to the bank or access your money online, this cash should help tie you over.

If you’ve lived through natural disasters such as wide-spread flooding, devastating tornadoes and hurricanes, wildfires, or significant earthquakes, you may have first-hand experience of lengthy outages and bank closures due to unfortunate circumstances.

Sure, you can keep a few hundred (or thousand) dollars stored in a safe at home for these unlikely situations. However, avoid keeping the bulk of your money in a single, physical location – especially, your home.

What if your emergency situation stems from a house fire? What if your home gets robbed?

Keeping substantial physical cash on hand provides great liquidity and accessibility. However, keeping too much money “under the mattress” substantially increases risk.

To avoid this risk, store the bulk of your emergency fund with a FDIC-insured financial institution. Even if your financial institution fails, your money is still safe.

Play Defense, Not Offense

If you rarely have emergencies, you may be tempted to “reach for yield” with your rainy day fund.

After all, we all want our money to work for us. With low interest rates, earning a measly percentage on our emergency fund feels like highway robbery.

However, avoid locking all of your emergency fund in Certificates of Deposit (CDs), illiquid investments, or other accounts that limit accessibility.

While you will not earn much interest on your emergency fund, the purpose of an emergency fund is insurance and protection. This allows you to invest more of your money and keeps you from tapping these wealth-building accounts when “life happens.”

Certificates of Deposit

Many traditional banks encourage consumers to purchase CDs. In general, banks take in your deposits and lend to borrowers at a higher rate. Much of their profits are due to the spread on the interest rates between borrowers and savers. With a product like a CD, the bank knows a certain percentage of their holdings are “locked in” for a set period of time at a given interest rate.

Because of strict liquidity rules in place to prevent another financial crisis, financial institutions must maintain a certain level of capital reserves to for stability. With a CD, they don’t have to worry about you walking in the next day and withdrawing all of the money they just lent to someone as a personal loan. Even if you do need your money, they can accommodate – for a fee.

While you will earn a limited amount of interest, fees to break the term of your CD make these “investments” less than ideal.

For most savers, the right high-yield savings account provides slightly lower interest rates. However, with a savings account, you’ll have access to your money without the worry of fees or restrictions.

CD Laddering Strategy

However, if you have managed to find a series of higher yielding CDs (~2.5%+), you could implement a CD laddering strategy. By staggering your investment in CDs with different maturity dates, you will have a continual “ladder” of CDs accessible at different times. At the same time, you’ll benefit from a slightly higher interest rate.

Let’s say you had a portion (~$12,000) of your emergency fund to dedicate to this strategy. You could invest $1,000 in 12 different CDs that mature each month of the year. Every month, you’ll have a fresh $1,000 available for emergencies. If the money isn’t needed, simply invest in another 12-month CD. After all, the next CD will be maturing simultaneously. Therefore, you will continually have access to $1,000-$2,000 in the event of an emergency. In addition, you should receive a modestly higher interest rate.

When CD Laddering May Be Appropriate

However, laddering the maturity on your CDs only makes sense under a few scenarios:

- You must prefer to keep a larger emergency fund (i.e. 6+ months of expenses).

- You simultaneously keep a minimum of ~2-3 months of expenses readily accessible in a high-yield savings account.

- The interest rate on the CD is higher than the high-yield savings account

For this strategy to make sense, only a portion of your total emergency fund should be used. If 90% of your emergency fund is tied up in CDs with maturities ranging from 1-12 months, you have a significant risk of not being able to cover an emergency greater than the amount of the single CD maturing.

In the scenario above, what if you had a $5,000 medical emergency? Only $1,000-$2,000 would be available from your CDs at any given time. To access another $3,000, you would incur fees and penalties.

Instead, this strategy only makes sense if you have other money accessible. For this reason, you should maintain at minimum 2-3 months of expenses in accessible accounts. Only implement this strategy with excess beyond this threshold.

Further, you will want to ensure the interest rate on the CDs is higher than what you could get from a high-yield savings account. After all, with the right high-yield savings account, you will have immediate access to 100% of your funds. If you are earning the same interest rate, it does not make sense to go through the hassle of reinvesting in a new CD and locking up your money for 12 months.

Roth Accounts

As highlighted above, you will want to avoid storing your emergency fund in illiquid or volatile investments.

Some after-tax accounts such as Roth IRAs allow for contributions to be withdrawn tax and penalty free. You may be tempted to keep a portion of your emergency fund in a Roth IRA.

In theory, this would allow you to invest your emergency fund while maintaining access to your contributions. However, investing involves risk. Unlike a FDIC-insured account, there’s always the possibility of losing your principle.

Instead, your emergency fund should be a source of stability during times of turmoil.

As an example, if we experience an economic recession, there is a greater likelihood of job loss. Companies cut back on their workforce and hiring due to decreased demand. Simultaneously, markets tend to experience a sharp decline.

If you lost your job and the bulk of your emergency savings during an economic downturn, your financial well-being could be jeopardized.

However, if you had a large emergency fund not subject to market fluctuations, you would have a secure source of cash reserves. This would tie you over until you find your next job. Depending upon the size of your nest egg, this excess fund could even provide an opportunity to invest during a market correction (once you land your next gig).

No Transfer Restrictions

Similarly, ensuring there are no transfer restrictions that limits accessibility is important.

Depending on the financial institution, some banks impose limits on the number of transfers that can be made from certain higher yielding accounts. If you will only make a few withdrawals per month in the event of an emergency, this restriction should not pose a major issue.

However, if you plan to link your automated payments to your high-yield savings account during a financial emergency, you could be hit with fees or restrictions.

To understand why transfer restrictions exist, we need to understand how banks can offer higher interest rates for these savers.

Why Some Institutions Impose Transfer Restrictions

In some checking or savings accounts, you may receive very nominal interest on your savings. For the most part, banks pay the small amount of interest rate from the spread they make on your deposit. After all, banks take in deposits and make loans at higher rates. In order to entice savers to store money with their institution so that they can originate loans, banks compete for depositors via interest rate and service (and a lot of marketing).

With high-yield savings accounts, banks must invest the depositor’s savings to generate a greater short-term yield. However, investing involves risk of loss. Therefore, normal equity and private debt investments pose risk and returns cannot be guaranteed.

Instead, the bank invests in government bonds to achieve “risk-free returns.” Because U.S. government debt (i.e. Treasury Bills) are backed by the federal government, there is no risk of default for investors. Theoretically, the government could either raise taxes or print more money to pay their obligation. Although, each would pose specific and unique issues.

Either way, investing in federally-backed debt with depositors’ money provides financial institutions with higher, risk-free yields that are greater than they would get in a normal checking or savings account. Further, these accounts are FDIC-insured up to certain limits (generally, $250,000 just like your checking account).

For financial institutions, there are costs associated with buying and selling these bonds. Perhaps, they’ll have to pay brokerage commissions to buy and sell the bonds. Maybe, there’s a delay between when the order is received and with the cash settles and can be withdrawn.

Any of these reasons could be a reason banks impose transfer restrictions on your account. However, you can find plenty of financial institutions that offer great rates and accessibility to your emergency fund.

No Fees

Paying fees on your own money is inexcusable.

Unfortunately, many financial institutions charge fees to open accounts or when balances dip below certain levels. Some require annual maintenance fees just to store your money.

If you are just starting to build your emergency fund, account fees could be a headwind that slows down your progress.

Why Do Some Charge Fees?

Sometimes, account fees are an integral part of the service a bank offers.

After all, most brand name banks have a hefty amount of overhead. Perhaps, they have physical branch locations, a large employee base to pay, or a mammoth marketing budget to attract more customers. Further, many banks have a duty to generate a return for their shareholders.

In order to profit from your savings, these banks charge account fees or maintain restrictions for increased profitability. While this may be good for their bottom line, fees are not good for you the consumer.

Avoiding Fees

With the advent and progression of online banking, consumers not only have 24/7 access to their accounts but costs have been drastically reduced.

Many online-only banks are able to achieve increased profitability by decreasing costs while simultaneously providing better service and interest rates. Because they do not have physical branches or a large employee base, they no longer require the fees big banks need to operate.

For this reason, credit unions and online banks can be a great, no-fee place to store your emergency fund.

Instead of paying account fees, always opt for institutions that do not impose unnecessary fees. Thanks to the competitive landscape and transparency required, you can eliminate any institutions that charge fees for their services.

User-friendly Platform

Simplicity is always preferable.

After all, the financial services industry is notorious for packaging and selling high-fee, low-performing products in a complicated concoction to hide the true cost to the consumer.

Instead, I look for a straight-forward platform that is easy-to-use. A financial institution that is consumer-focused wants to provide the best user-experience possible.

Thanks to technology, over 80% of Americans have access to a smartphone. This connectivity provides another level of convenience to our financial lives. With the download of an app, we can easily transfer money, pay bills, and monitor spending.

Even when you are not experiencing an emergency, your institution’s platform can be a valuable resource for monitoring your financial well-being. Perhaps, you will have access to financial experts. Depending on where you hold your emergency fund, you may have access to research or other financial planning resources to help you achieve your goals.

When establishing your emergency fund, accessibility is key. With a user-friendly platform and technology, you will be able to quickly transfer needed money during an emergency situation.

High Interest Rates

For most consumers, their goal is to shop around and minimize the interest rate.

However, since you will be earning interest instead of paying interest, the goal is to MAXIMIZE the rate without risking any of your emergency fund balance.

Why is Your Rate Important?

The interest earned keeps you from losing value to inflation.

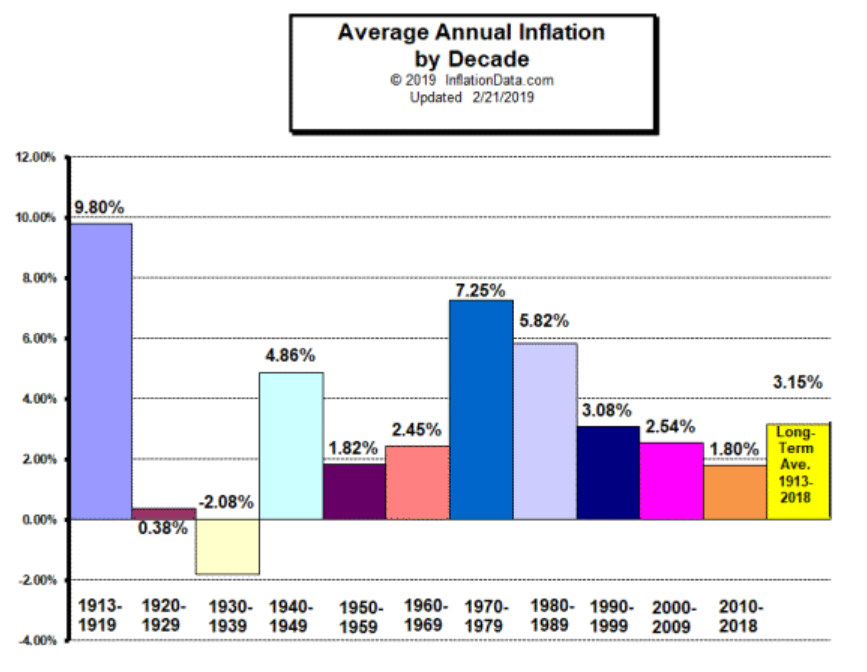

After all, the real cost of goods and services generally rises every year. As an example, since the financial crisis, the Consumer Price Index (CPI) has ranged from flat to 3.2%. If you did not earn an interest rate to match inflation, you would have to continually add 2%-3% to your emergency fund each year to cover the same costs in the event of an emergency.

Have you ever heard your parents or grandparents talk about how much they made first year out of school? More than likely, you were astonished on how they could have survived. Have you ever seen a $.05 Coca-Cola advertisement?

These are just a few examples of how inflation influences the price of goods and services.

Generally, inflation ebbs and flows based on a wide variety of economic factors. Interest rates, economic policies, and the overall supply and demand for goods and services impacts inflation in the economy.

As shown by the chart below, inflation varies by decade. However, the overall average from 1918-2018 is ~3.15%.

The bottom line is inflation causes the price of everything to go up each year. In fact, at inflation of 3.15%, the costs of goods or services will double in ~23 years.

If you leave your money sitting in a bank account, it will stay “safe.” However, the real value of your cash will decrease every year. Eventually, your value will be cut in half due to inflation in 23 years.

However, you can combat inflation by earning interest on your money.

Savings Rates and Inflation

The interest rates offered by financial institutions are generally tied to the Federal Reserve’s benchmark interest rate.

As the Fed raises and lowers the benchmark borrowing rate, banks adjust the amount they pay to savers or charge borrowers. One of the biggest drivers of the Fed’s target interest rate centers around the Consumer Price Index (CPI) compiled by the Bureau of Labor Statistics (BLS).

In essence, the CPI provides a barometer for inflation. It measures the change in the cost of a variety of goods ranging from eggs to gasoline. Taken as a whole, the BLS determines how much the cost of living has increased or decreased over a period of time.

In turn, the Fed seeks to combat inflation and maintain stability. If the Fed expects or sees inflation in the economy, they vote to raise interest rates. This helps savers earn more on their deposits (or investments) and maintain their standard of living. Further, higher rates increase the cost of borrowing which “throttles back” economic expansion as the cost of debt increases.

The Bottom Line on Interest Rate

In essence, look for the highest interest rate in a FDIC-insured savings account possible for your emergency fund.

While you will not earn returns similar to investments, at minimum, your account should maintain its spending power and combat inflation.

Work to Establish an Emergency Fund Today

Establishing a rainy day reserve of 3-6 months of expenses is a good start to getting your financial house in order.

Remember, an emergency fund is a defensive strategy and NOT an offensive scheme. Much like insurance protects your downside, establishing cash reserves keeps you from turning to debt in the event of job loss, a health crisis, or expensive car or home repair.

While you should obtain the highest risk-free yield possible, your balance should not be subject to the volatility of the stock market. Further, you’ll want to limit any accessibility restrictions and fees. In today’s competitive environment, plenty of financial institutions provide higher yields, better service, and no fees or transfer restrictions.

When you establish an emergency fund, you will sleep better at night knowing you have take the steps to control some of the financial unknowns that may be lurking in the future. With extra cash reserves, you are free to pursue a little more risk in your investment portfolio or every day life.

Perhaps, you’ve always wanted to turn your side hustle into a full-time job. Maybe, you see an opportunity to pursue a different career path. With ample emergency savings, you’ve given your family the cushion to take the leap and pursue your dreams while self-insuring for whatever life throws your way.