Looking for a simple platform to begin investing? One of the best places to start on your investing journey is M1 Finance.

What is M1 Finance?

M1 Finance offers a free, easy-to-use investment platform where you can automatically invest into a diversified set of stocks and ETFs without paying trade commissions.

Since trading fees can range from $4.95 – $10+ per trade with other brokerage platforms, you can avoid these commissions and automatically boosts your returns. This allows you to keep more of your invested capital. Over time, you will save hundreds or thousands in unnecessary commissions.

Through the M1 Finance platform, you can select a combination of your favorite stocks and ETFs. With M1 Finance, you can take the easy route and choose expertly compiled funds that suit your risk tolerance or time horizon.

How Do You Get Started Investing With M1 Finance?

Once you get comfortable with the concept of investing and growing your hard-earned dollars through years of compounding, simply open an account and actually begin making contributions.

Unfortunately, too many younger individuals wait and defer investing. While you are never too old to start investing, compounding interest through the time value of money makes each dollar you put away at a younger age worth exponentially more.

For the novice investor, opening a brokerage account can be intimidating.

However, M1 Finance makes opening an account extremely simple. In fact, I opened my account and even individually selected my desired investments in under 10 minutes. While some brokerages and mutual funds require hefty initial investment contributions, M1 Finance only requires a minimum account balance of $100 to get started investing into stocks and ETFs.

This low barrier makes investing extremely accessible and affordable for novice investors who are looking to start their investing journey. However, if you are looking house a retirement account through the platform, you will need $500 as an initial investment.

Opening Your Account

If you are ready to open your account, download the M1 Finance mobile application onto your smartphone or go to m1finance.com.

Next, click “Get Started” and begin signing up for your free account.

After you enter your email and password, you can then begin the three step process of creating your “Pie” or portfolio, opening your account, and funding your account by linking to your banking account.

Creating Your Pie

Picking the companies you wish to hold an equity ownership has never been easier (or as interactive) than with M1 Finance.

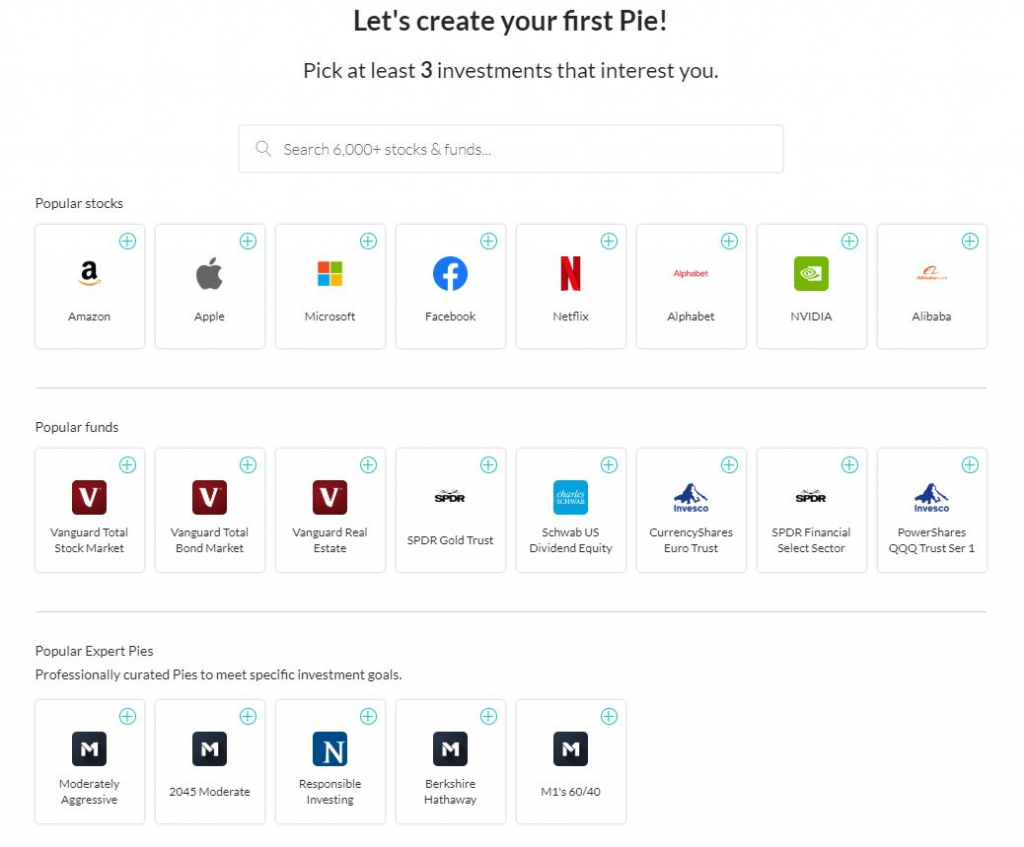

While you can certainly take the Peter Lynch approach and search for your favorite companies that you use on a daily basis, M1 Finance also offers a variety of popular stocks and funds to help you get started.

You can find virtually every publicly-traded stock from Facebook to Boeing as an investment option. Simply select your favorites for a personalized, diversified portfolio.

Fractional Share Ownership

One huge benefit that M1 Finance offers which separates the platform from other brokerages is the ability to invest in fractional shares.

By contrast, if you open an account with Fidelity or another traditional discount broker, you need to cover the cost of at least one share of stock before making a purchase. Unfortunately, many of the most popular (and best performing) stocks such as Amazon or Google cost over one thousand dollars for just a single share. Very few individual investors have the capital to compile a diversified portfolio of their favorite stocks when single shares of some of the best companies costs four figures.

However, M1 Finance solves this problem by automatically buying in fractional increments of these single shares to keep your portfolio in balance.

Virtually Limitless Investment Choices

M1 Finance offers no shortage of investment choices. Whether you are in retirement and looking for stable, dividend-oriented stocks and funds or you are in your 20s and looking for explosive growth to build wealth for the long-term, you can find funds and stocks to meet your risk tolerance and investing goals on M1 Finance.

Seems like there’s too many choices? No worries, simply select as many or as few of the stocks and funds that you find appealing. Later on, you can adjust the investment allocation to make sure your favorites get their due respect.

Determining Your Risk Profile

When getting started, you should certainly do your own due diligence and seek professional advice. Generally, younger investors should focus on more growth-oriented stocks and funds. As you age, your risk tolerance changes. Older individuals who will need their capital sooner may wish to invest in more stable assets rather than high-flying growth stocks.

Remember, invested capital should be left alone for at least 5 years. Any money you need in less time is best kept in a high-yield savings account or money market fund. The longer you leave your investments alone, the less the likelihood of losing your principle. Longer time horizons have historically allowed for gains to overcome any market corrections. Additionally, more time will allow for greater overall appreciation in your investments.

Personally, I prefer to have at least one or two index funds to ensure I receive the proper amount of diversification. In my own portfolio, I selected the Vanguard Total Stock Market portfolio which holds all of the stocks in the market as well as the PowerShares QQQ Trust for heavier technology and growth exposure given my relatively young age and longer time horizon.

Additionally, I selected a wide variety of stocks ranging from Amazon to Bristol-Myers Squibb to round out my own portfolio.

Time to Adjust Your Portfolio Weighting

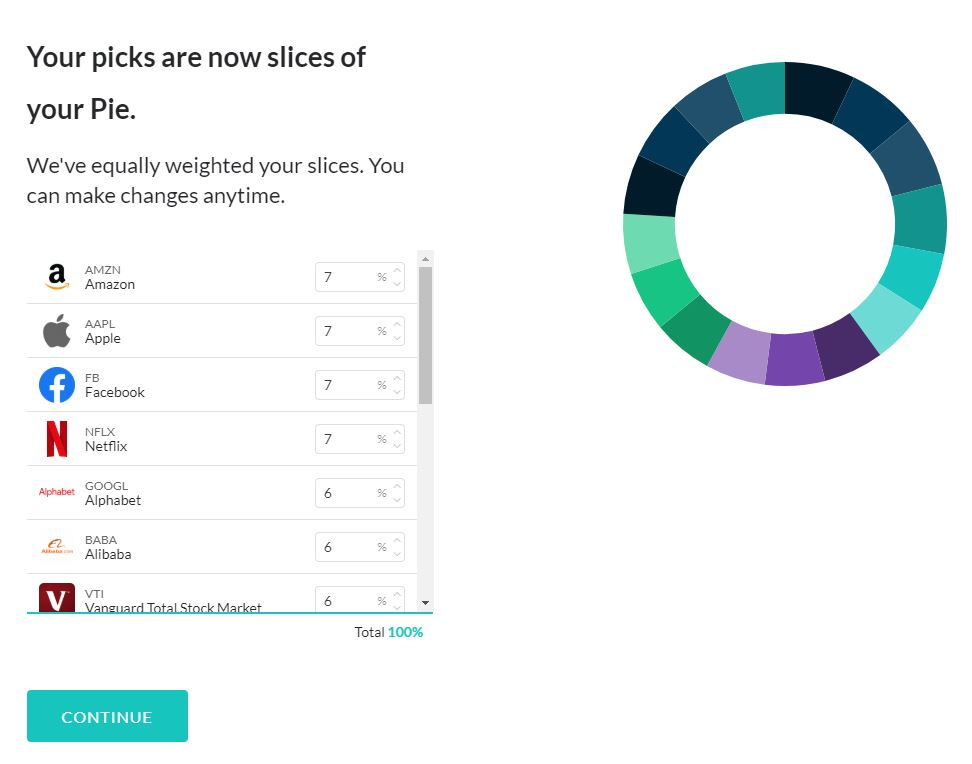

Now that you have picked your favorite stocks and funds, you have the opportunity to adjust the weighting of each investment in your portfolio.

As you can see, each of your picks will start out having a fairly equal weighting in your portfolio. Based on your own research, adjust the percentage make up in your portfolio determined by your conviction of how well the company is likely to perform in the future.

Generally, you should not allow one of your individual holdings to exceed 10% of your portfolio (unless this holding is an index fund which is already an inherently diversified investment). After all, if one of your stocks comprises an outsized amount, the single stock could have an big impact on your portfolio. If the company declines on bad news or goes bankrupt, you could lose a substantial amount of your invested assets in one fail swoop. Therefore, diversify your investments. This allows you to spread risk across a greater base and provide stability to your portfolio while still capturing any upside.

After you have selected your portfolio, M1 Finance provides a feature that shows you how your mock portfolio performed over the last 5 years. With this information, you could “back test” your portfolio strategy to see how it performed relative to the S&P 500.

As you continue to make contributions and each of your investments rise and fall with the overall stock market, M1 Finance automatically re-balances your portfolio to ensure your asset allocation strategy is maintained.

Setting up Your M1 Finance Profile Information

Now that the fun part you came to do is over, it is time for the dreaded paperwork. Fortunately, you can easily open and set up your profile.

Simply fill out your contact and personal information, answer a few questions about your financial situation, risk tolerance, and investment experience, and you can be well on your way to putting money to work in your portfolio.

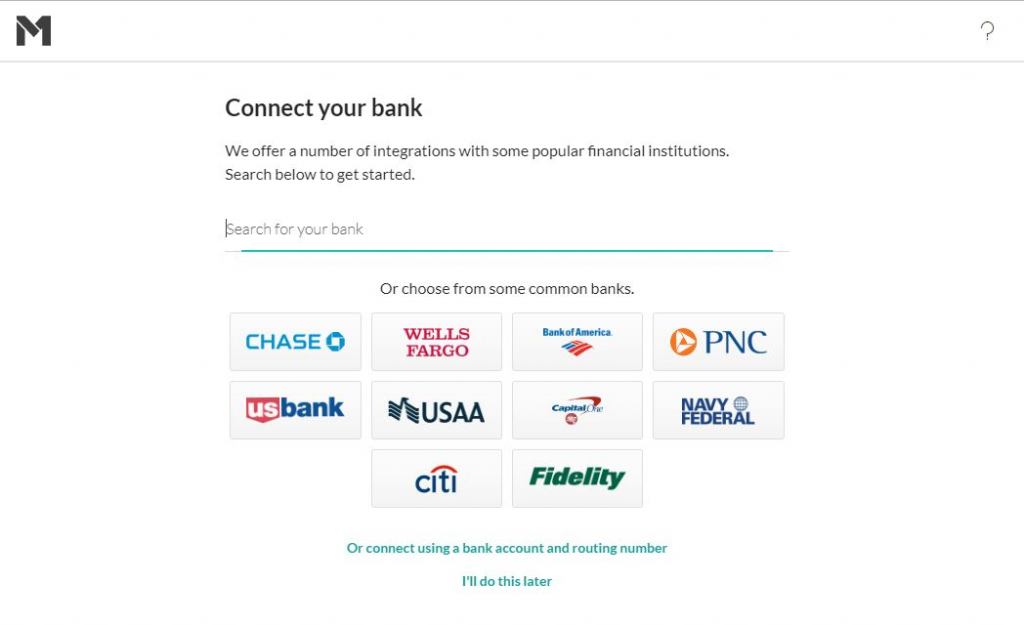

After you have filled out the necessary information and confirmed your email, you can fund your account by linking to your financial institution.

After you have found your banking institution, contribute the amount you would like to invest. Remember, to get started you will need minimum contributions of $100 for normal investing and $500 for IRAs.

Start Your Investing Today!

Now that you have funded your account, you can begin free automated investing in your favorite stocks and funds through M1 Finance.

You have the ability to set up automatic funding or even single deposits. By automatically funding your account on specific days each month, you will receive the benefit of dollar-cost-averaging. This helps you avoid market timing. After all, few investors can really predict where the market is going. Therefore, scheduling regular investment contributions at pre-determined intervals (like with each paycheck) can help you stay on track and committed during times of volatility. Since the market has risen an average of 10% historically, any dips could represent the market “on sale” and an opportune time to buy.

If you prefer, you can also adjust the amount of cash you wish to hold. If you think you have the special capabilities of identifying the most opportune times to invest or just like having a sizable cash position, M1 Finance allows you to keep a cash cushion. Simply, choose a pre-selected amount of cash to hold. With each additional contribution, only the excess above your cash threshold will be divided up among your investment choices.

Remember, investing involves the risk of loss. Only invest money that you can comfortable risk losing or keep invested over the long-term. After all, the stock market has proven time after time to be a great, passive wealth generator over the long-term.

For those ready to begin or expand their foray into the investing world, M1 Finance offers a free, easy-to-use platform that may be suited for your investment dollars. Consider giving M1 Finance a try! As a free platform, you have nothing to lose.