It’s no secret that sending your child to college is an extremely costly endeavor.

With college student loan debt ballooning to over $1.5 TRILLION in 2019, we can evidently see that the average family simply can’t afford to cash flow college costs out of pocket. Maybe, they did not take the necessary steps to save and invest for future educational expenses. Instead, many college students fund their tuition and living costs by turning to student loans. Ironically, these loans meant to provide for a brighter future end up shackling them for the next decade.

Because of the increasing cost of university attendance, stagnant wage gains, and negative financial consequences of student loan debt, many Americans begin to feel that a college education is not worth the trouble.

Consider the Economics

While obtaining a college degree is no guarantee of prosperity, individuals with a college degree generally earn more money in their lifetime. For this reason, it’s wise to encourage the next generation to pursue further education in a marketable field of study. However, students should pursue higher education as economically as possible.

Even if you have the brains to attend an elite, private institution, the cost of attendance may simply be prohibitive for most students. Unless they receive an enormous amount of grants and scholarships or transfer from the community college system, attending these high cost institutions may not be worth the investment.

Alternatively, you could begin planning today for future education expenses. Even if your future college graduate has not yet been born, you can still take the steps to begin putting money back for college.

With proper diligence, you could even consider purchasing investment property in the college town your son or daughter lives. With a 529 Plan, you can partially pay the mortgage with appreciated gains from your portfolio. Because qualified 529 expenses include housing costs (up to specific limits based on the “cost of attendance”), owning the home your college student lives allows distributions to cover the mortgage as long as certain guidelines are met.

What’s So Great About a 529 Plan?

Just like other accounts such as a 401(k) or Individual Retirement Account (IRA) help you save for necessary expenses in retirement, a 529 Savings Plan allows you to save and invest in a tax-efficient manner for future educational costs.

While contributions to a 529 Plan are NOT tax-deductible on your federal income taxes, the capital gains and dividends that accumulate over the years will not be taxed withdrawn for qualified education expenses.

Qualified expenses range from tuition and fees to housing and even meal plan costs. However, unique cost of attendance estimates are published by each academic institution. Therefore, withdrawals from the 529 Plan cannot exceed the published cost of attendance of your particular institution. Further, taxes and a 10% penalty will be owed if money is withdrawn for non-qualified expenses.

Even if you “over save” for your child’s college costs, 529 Plan rules permit you to withdraw the amount of scholarships and grants your college student receives. Thankfully, you will not incur the 10% penalty. Instead, you just pay taxes on the appreciation.

Alternatively, you could transfer the remaining balance to another child or family member to pay for their education expenses without the taxes or penalty.

Let’s Look at an Example

As an example, if you save and invest in a 529 Plan that grows to $100,000 and your child receives a full ride scholarship covering $80,000 towards the cost of attendance, you can withdraw up to $80,000 without owing the 10% penalty. Instead, you will only owe ordinary income taxes on the capital gains withdrawn. The remaining balance can then be transferred to another child or relative.

Alternatively, you could just transfer the full $80,000 to another child or relative without incurring any taxes if used for qualified expenses. If you have another student in the family, this may be the most tax-efficient method.

My College Savings Situation, Goals, and Plan

Currently, I do not have any children. In fact, I’m not even married yet (engaged with an upcoming wedding – woohoo!).

I’m not financially independent (yet), work a 8-5 job I’m not crazy about, and don’t make six figures. However, I was blessed to have parents that valued my college education which allowed me to graduate without any student loans in a marketable field of study (accounting).

My goal is to provide the same opportunity to my future children and even grandchildren.

I know that college is crazy expensive and the inflation rate of attendance (~5% for public, in-state universities) greatly outpaces the general economic inflation that hovers around 2%. Often, the excess inflation in college leaves many families who only receive cost of living adjustments in their salaries unable to afford to pay for the escalating cost in higher education.

However, by opening and investing in a low-cost index fund within a 529 Savings Plan, your savings can beat college inflation.

Getting Started with a 529 Plan

The CPA in me constantly thinks of ways to efficiently save and invest. Ultimately, compounding interest will make my financial life easier in the future – even if sacrifices are required today. Coupled with investing tax-efficient accounts, you can grow your investments even faster.

By starting to invest earlier, you can put away less each month and allow the market to work its magic over the next couple of decades. This is precisely why I have already started investing a small amount each month for my future children’s college costs.

In order to combat the outrageous cost of higher education that I will inevitably endure, I opened a 529 Savings Plan through Fidelity.

Fidelity 529 Plan and Investment Choices

While you can certainly open a 529 Plan through your individual state and different service providers, I elected to open mine through Fidelity since my other brokerage and retirement accounts were already there, and I’m familiar with the platform.

While you can choose from a limited selection of pre-set portfolios and target date funds, I took the simple (and best historical performing) method of investing in a Total Stock Market Index Fund.

As shown below, the average annualized return over the last decade is over 14% which is 4% higher than the average annual return of the S&P 500 since 1926.

Even though VTSAX has returned ~14% over the last decade, the starting point includes the 2008-2009 economic recession. Therefore, the average returns are from a pretty low basis which may skew future expected performance. For this reason, I have adjusted my expected return in my own 529 Plan to ~12% (including dividends) annually. Taking the conservative approach means I need to put more away each month. However, I can always reign in any contributions

Now that we have determined an approximate rate of return, we can now take a 3-step process to determine how much to save each month to fully fund any future college costs.

Step 1: Determining My Investing Timeline

Now that I have determined my purpose for investing (getting a jump start on my future child’s college costs), the next step is to figure out when my future child will actually go to college.

I know it sounds a little crazy (or pre-planned) to think about when my unborn child will go off to college. However, the purpose is to just get a general expectation of how long any contributions will be invested in order to determine approximately how much to contribute monthly.

Whether your child has reached their teenage years or just a glimmer in your eye, you will need to determine your investment horizon in order to determine how much you should save each month.

Since I am engaged and will be getting married in 2020, I would not expect any children before 2024. From that point, I will have 18 years to save for college (or ~22 years from today).

Step 2: Determine the Total Cost Expected to be Incurred

If you thought estimating the investment timeline was a pretty wild variable, attempting to estimate the actual costs of college in 2041 may be even harder.

After all, we do not know what the political landscape (i.e. free public college?) or even educational environment will look like in 2041. Will we even be working and need higher education or will most jobs be automated? While this scenario is certainly unlikely, we must consider the steep progression we have seen over the previous two decades. Just think about the drastic changes in how we live over the last few decades due to the internet and technology. Knowing what the job market will look like in 2041 is all but impossible.

If your future college student is 5-10 years away from their college years, chances are we probably won’t see drastic change in how we educate the workforce. Perhaps, certain industries such as technology will provide the most lucrative and sought-after occupations. Maybe, healthcare will still represent a stable career. Either way, we probably won’t see a monumental shift in the workplace. However, we probably will continue to see the increase cost above and beyond general economic inflation.

Therefore, planning for the expense of higher education is still financially prudent.

Determining the Cost of College Today

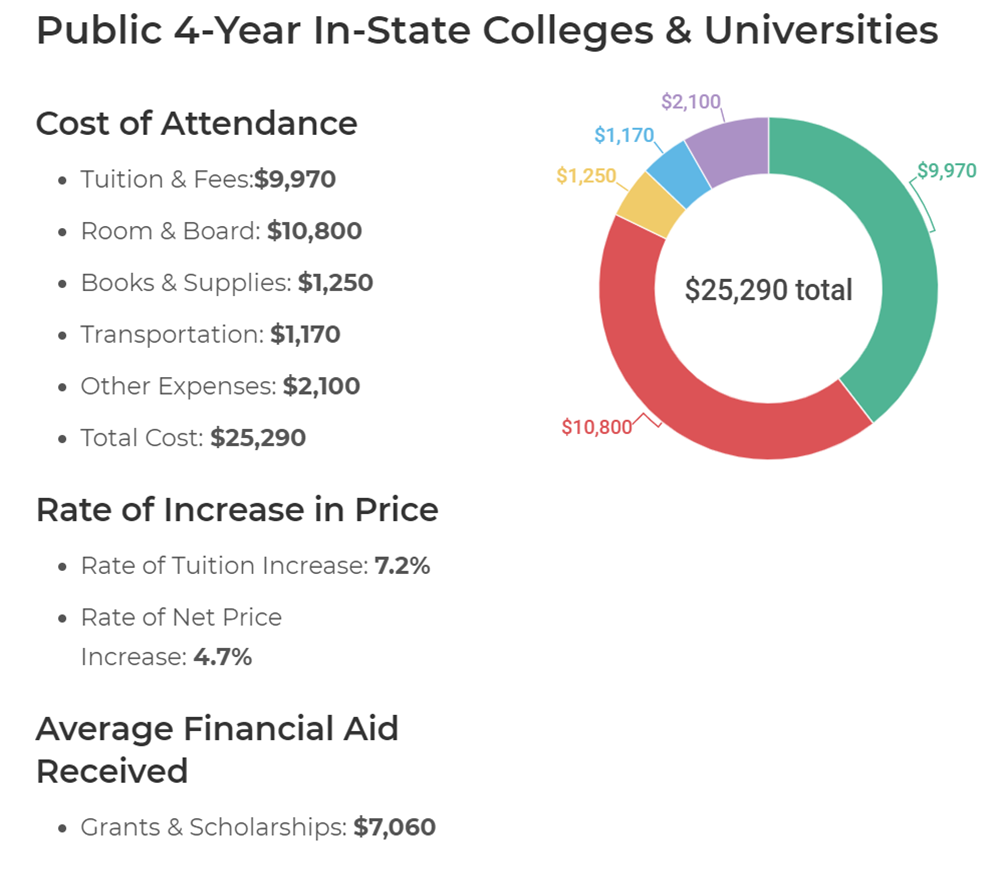

The first place to start is the current cost of higher education as shown in the below breakout.

Based on the above breakout, the average total cost of a bachelor’s degree from an public, in-state institution before any financial aid is ~$100,000 in 2018.

While the average student receives grants and scholarships that cover approximately 28% of the cost of attendance, there are no guarantees your student will receive grants and scholarships (even if likely). Therefore, it is more conservative to plan to assume you will bare the full cost of attendance.

Further, 529 Plan rules permit the withdrawal of the amount of grants and scholarships awarded without penalty. You could view any free financial aid as a “bonus” to invest elsewhere.

Applying an Inflation Factor

As we all know, the cost of college rises over time. In order to estimate how much a bachelor’s degree will cost in 2041, we must apply an inflation factor. Historically, the average annual increase in public, in-state higher education approximated 4.7%.

At this rate, the total cost of college will be approximately $291,000 in 2041.

Depending upon how long you have before your child enters college will dictate how big of a role inflation will play. However, at a 4.7% inflation rate, you could generally expect the cost of college to double approximately every 15 years.

Step 3: Determine Monthly Investment Amount

Now that we have determined historical market returns (12%), my investment time horizon (22 years), and ending amount needed ($291,000), I can easily determine how much I need to invest each month to reach my 529 savings goals.

Based on these parameters, I would need to contribute $262 per month to accumulate $291,000 by 2041 which should cover the full cost of attendance.

| Today’s Cost | Cost in 2041 | |

| Total Cost of Public, In-State University | $101,160 | $ 290,926 |

| Average Total Grants & Scholarships | $28,240 | $77,570 |

| Net Total Cost of Attendance | $72,920 | $213,356 |

| Monthly Investment for Total Cost ($290,926) | $262 |

Including inflation, if my future college graduate receives the average amount of scholarships of $76,000, I will be able to withdraw this amount and only pay ordinary income taxes on the growth. Alternatively, any excess balance could be transferred to another child and avoid any taxes or penalties if used to pay for their qualified education expenses.

Overview: Buying Investment Real Estate Property Using Your 529 Plan

Another huge financial burden of sending your child to school centers around the fact that they will have their own housing expense. Not only do you have your own mortgage or rent to pay each month, you may wish to subsidize your child’s rent while they further their education.

However, what if you owned investment real estate where your son or daughter attended college? Instead of enriching corporate apartment complexes or other landlords, you could virtually eliminate the extra housing cost by purchasing appreciating, cash flowing real estate.

Buying property with funds from a 529 Plan allows you to keep more of your dollars, avoid taxes on the capital gains in your 529 portfolio, and minimize the already exorbitant cost of attendance.

Let’s Look at an Example for Context

As shown in the “Cost of Attendance” summary chart above, the average public, in-state cost of room and board is $10,800. While each university varies based on location, the amount allowable for room and board will correspond to the cost of living in that college’s particular city.

However, on average, this means you could withdraw up to $900 per month to pay for housing costs – even if your student lives off campus as long as they are enrolled at least half-time.

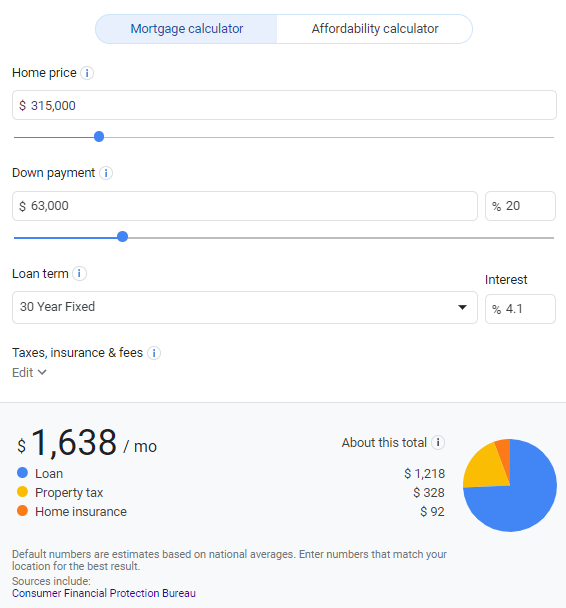

Let’s use the median price of 3 bedroom/2 bathroom house of $315,000 to represent a typical house we may consider buying in your son or daughter’s college town.

While the $1,638 monthly payment is $738 more than you would be allowed to withdraw from the student’s 529 Plan portfolio for housing costs ($900 in our example), you could simply rent out the other two rooms to college friends to offset (or make money) on the home purchase.

Some Stipulations to Consider

Remember, to qualify as a tax/penalty-free distribution from the 529 Plan, the student must bare the qualified expense. Therefore, even if you own the home your student/child resides, they must theoretically be charged rent. Subsequently, this will be taxed as “rental income” on your personal tax return.

You should probably seek tax advice for specific deductions such depreciation which may offset the rental income.

Additionally, qualified distributions for room and board require the student to be enrolled at least half-time. For example, full-time enrollment is 12 hours, they must be taking at least 6-hours of college credit for the plan to cover room and board.

What About That Hefty $60,000 Down Payment?

Coming up with a $60,000 is no joke for most families. However, 529 Plan rules permit you to withdraw your contributions as well as the amount of scholarships and grants without penalty. You would simply owe ordinary income taxes on the investment gains related to the scholarship amount.

If your student receives the average scholarship amount of $28,240, you could theoretically withdraw a portion of your contribution amount in the 529 Plan and/or the awarded amount of grants and scholarships (without penalty) to help cover the $60,000 down payment.

As always, you should seek the opinion of a qualified tax or financial professional for tax planning to your specific financial situation.

What if You Only Want to Use Your 529 Plan for “Qualified Expenses?”

If using a portion of your child’s 529 Plan as a down payment to purchase real estate seems less appealing to you, consider opening an ordinary brokerage account and putting away money each month in a low-cost index fund in tandem with 529 savings.

In order to have a portfolio big enough to use for the $60,000 down payment (after capital gains taxes), you would only need to contribute about $100 per month into a Total Stock Market Fund (VTSAX) averaging ~12%. While a S&P 500 or Total Stock Market Fund are great index funds to use, you could also consider more growth-oriented funds that track NASDAQ-100 companies that have outperformed both of these options. This could help you reach your goals faster.

Together, you could have two separate funds for your college student’s education and living expenses. One portfolio to cover qualified expenses through the 529 Savings Plan and another investment portfolio to use as a down payment on real estate. You could then tap the 529 Plan (up to the qualified distribution amount for housing) to pay a portion of the mortgage.

You could make up any difference in cost by leasing the other bedrooms to your son or daughter’s college friends.

Higher Education is EXPENSIVE: Get Ahead of the Game by Opening a 529 Plan Today

Hopefully, after reading this article, you have a little more faith that saving, investing, and paying for your future child’s college education is possible.

By utilizing a 529 Savings Plan, you can efficiently save and invest for the qualified education expenses your child (or future children) will inevitably face.

If you are a super thrifty planner and like the idea of owning rental real estate, you can also begin putting money aside as a down payment and use distributions from the appreciated 529 Plan to cover all or a large portion of the mortgage payment. This will all but eliminate the extra housing costs your student would face, and allow you to gain wealth through real estate.

Even if your financial situation isn’t perfect, you can begin today by putting away a few hundred dollars each month as an investment in your child’s education. By investing for your child’s (or future children’s) education, they will be well on their way to independence and avoid the financial pitfalls of student loans.