Integrating two financial lives can be difficult. Each of us has certain values, life goals, and varying propensities to spend.

On one hand, you may be frugal and exhibit tendencies to hoard or “collect” money. For you, a big bank account or large investment portfolio may provide security.

By contrast, your spouse may undermine your ability to save by overspending on things you may not need or value. Often, this misalignment will cause conflict.

In fact, over 70% of American couples fight about money.

While living below your means is financially wise, agreement and compromise is key to maintaining balance in life. Often, we obsess about growing our net worth or earning more money. For the spenders, they dream of buying that item they’ve always wanted.

To live in harmony, a proper perspective on finances will help you treat money objectively.

After all, money is merely a tool that can help you accomplish your dreams and life goals. By working together with your spouse, you can both find that “sweet spot” to accomplish your savings goals AND live the lifestyle you can afford without feeling the sacrifice.

1. Discuss your financial goals and money strategy

Getting on the same page financially isn’t intuitive. It takes empathy and comprise from both parties.

Often, misalignment and lack of communication around our financial goals is at the root of money fights between couples. For many of us, we have never even given the slightest thought to laying out a long-term financial strategy.

For all too many Americans, living paycheck to paycheck is the norm. In fact, according to a survey conducted by Charles Schwab, 59% of Americans indicated they live paycheck to paycheck. However, these individuals also said they spend an average of $483 per month on non-essential spending every month.

That’s nearly $6,000 a year in discretionary spending! For the average American household, that’s around 10% of their total annual income.

Deep down, we may know our current money habits or behavior isn’t sustainable. Subconsciously, this could cause resentment and negativity when we see our spouse “wasting” money.

However, communication with your spouse can alleviate much of the unnecessary drama. Instead of feeling stuck, your household will have measurable goals and can see progression on the path to conquering your financial dreams.

What are your dreams in life?

From time to time, every one of us catches ourselves thinking about what life would be like if we hit the lottery.

What would your daily routine look like if you had the freedom to pursue and do whatever you wanted? Granted, the odds of hitting the lottery are slim to none. However, that doesn’t mean you have to sacrifice on your dreams in life.

After all, most of your dreams in life probably do not (and should not) revolve entirely around accumulating a certain figure in the bank. You and I can never have “enough” money.

Really, how much money is enough?

According to Schwab’s Modern Wealth Index Survey, Americans believe a net worth of $2.3 million is necessary to be considered “rich.” However, 72% of the respondents also indicated the way they live their lives impacts if they “feel wealthy.” The quality of your life and relationships with family, friends, and co-workers all play a valuable role in determining when “enough is enough.”

Alternatively, building up a substantial net worth and achieving a certain figure in their investment portfolio represents a sort of game for some people. However, saving one more dollar shouldn’t be the sole dream you have for your wealth.

Your household money philosophy

View your nest egg as a tool that provides the means to meet a specific goal.

Maybe, one of your dreams is starting your own business. After all, nearly 2/3 of Americans would love to be their own boss. Can you start a small business from scratch? Sure.

However, accumulating a cushion of savings allows you to jump in with both feet as your business gets off the ground. A substantial nest egg bridges the gap between earning a W-2 wage until you can start drawing money from your small business. Further, dedicating 100% of your effort to providing the best customer service without financial worry can be a deciding factor in your business’s success.

What if you could retire while you’re young and healthy?

Your nest egg could provide the means to retire early.

According to a recent Gallup poll, American’s expected retirement age has steadily risen from 63 in 2002 to 66 partly due to a lackluster savings rate. In fact, the average retirement nest egg for Americans in their 60s is only $172,000. Living by the 4% rule, a portfolio of this size provides less than $600 per month of additional income. Unfortunately, many Americans are forced into retirement before they are financially ready by unforeseen health issues, stalled careers, or layoffs.

However, what if you had the financial means to passively replace your income? While you won’t accomplish this feat overnight, you can work to replace your income through a variety of investments including stocks and dividends, rental property, or side-hustles.

While most of us would love to be our own boss and gain control of our daily schedule, our financial obligations keep us from pursuing the life we want.

However, you could take steps to achieve this goal by greatly reducing your obligations. Perhaps, you can accumulate a portfolio that subsidizes your lifestyle and allows you the freedom to pursue other endeavors. Even if you can’t cover 100% of your expenses through your accumulated wealth, you would still have the flexibility to pursue a less demanding career or build up your own business.

Changing your money philosophy from a consumerist mentality to viewing money as a tool will help you build a portfolio that provides optionality in your life. Ultimately, your nest egg can help you achieve your dreams.

Together, you must settle on what your ideal life looks like. Cut out activities and expenses that aren’t getting you closer to the life you want.

What are your spouse’s dreams?

You may think that you know your partner’s lifelong dreams. However, you could be surprised what you will learn from having an intentional conversation about their goals and dreams.

You may think they daydream of spending days at the spa or out on the lake. By contrast, your spouse may picture their dream life with you entirely differently.

Once married, it takes commitment from both spouses to work towards specific goals. After all, dragging along a reluctant spouse may end up causing issues in the relationship or even the dreaded “D” word.

In fact, over 36% of divorcees cite money differences and issues as a contributing cause of divorce. The added stress the financial obligations bring can shatter a relationship that’s “on the rocks.”

Instead, you can solidify your relationship by learning to work together on finances. Perhaps, this will spill into other, non-financial aspects of your marriage.

In order for your spouse to get on board, you may need to compromise certain aspects of your own dream life. Maybe, you can’t spend all day on the golf course if your wife wants to live abroad for a few months. Perhaps, you will need to delay retiring early if one of you wants to stay at home with the children while they are young.

Finding the balance between both of your life goals can help facilitate a response that helps you both achieve your dream life.

To facilitate the “dream talk,” ask your spouse the following questions and LISTEN intently:

- How would you gauge our overall relationship?

- Do we have open communication and trust in our finances?

- What would you want to improve in our household finances?

- If money wasn’t an option, what would a day in our lives look like?

- Do you think achieving this idealized life is reasonable to expect or achievable? If not, why?

- Could we work towards achieving certain aspects of our dream life together?

- Are certain behaviors and spending patterns prohibiting us from living out our dreams?

- Are we willing to sacrifice expenses and luxuries that don’t align with our dream life?

- What short-term and long-term goals can we set to move our finances in the right direction?

- How can we hold each other accountable while enjoying life today?

Discussing your dreams and how finances impact them may be a bit awkward the first time you discuss with your partner.

However, just a single discussion could start the plan into motion.

Even if your spouse is hesitant at first, they may find themselves thinking back to the conversation. They could experience a trigger at work or a life event that really spurs them into working towards their dream life.

2. Determine a “Pre-Spending” Plan

Intentionally agreeing on and living by a spending plan provides one of the best ways to ensure financial success in marriage.

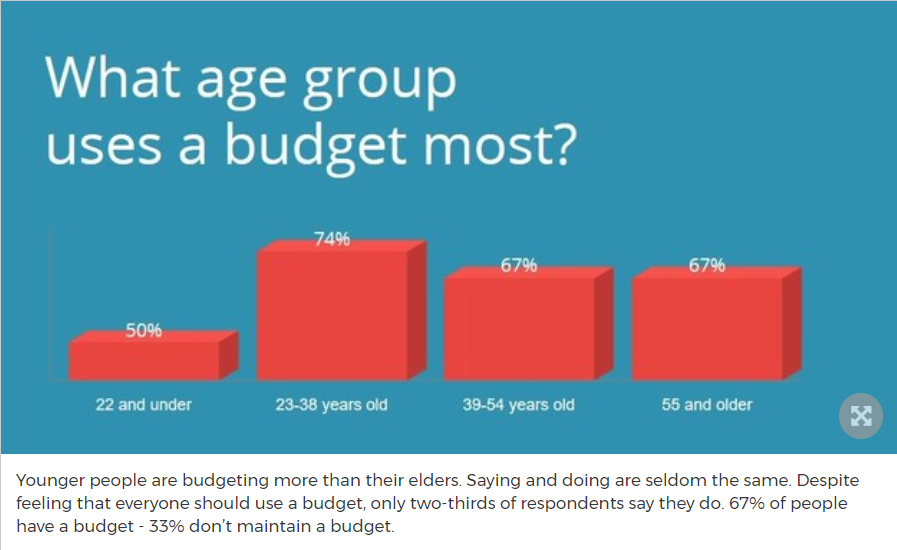

In fact, nearly 97% of women and over 90% of men say that everyone should live by a budget. However, only 67% of Americans actually do live by a budget in their own household.

Implementing a budget

Budgeting is a financial strategy that will help avoid financial conflict by setting a spending plan BEFORE the first dollar is spent each month.

Unfortunately, most Americans live their financial lives from the rear view mirror. We see that we have a little money in the bank and this provides permission enough for us to go out and buy what we want. At the end of the month, we look up “broke” and wondering where our hard-earned paycheck went.

Sound vaguely familiar?

For these families, one unexpected emergency can be the difference in living in the black or turning to debt or credit cards to meet their monthly obligations. In fact, only 40% of American families have the ability to cover an unexpected, $1,000 emergency.

Living in perpetual financial instability will inevitably lead to financial strain in your relationship. Left untreated, financial stress can turn to resentment and lead to more extreme marital problems.

However, you can change your financial habits and dynamic of your family’s finances with a little intentionality.

Imagine…. What if you never had to worry about making rent? What if you and your husband or wife could go out to eat at your restaurant of choice without feeling guilty?

Instead of living paycheck to paycheck, set an intentional spending plan before the month begins. Your budget provides permission to spend on experiences you BOTH value.

Compiling a Mutually-Agreed Upon Budget

A key aspect of setting a spending plan is that it must be done TOGETHER.

Is it okay if one spouse pays the bills, tracks the spending, monitors the investment portfolio, and leads in the budget discussion? Sure! More than likely, one person in the relationship will be more comfortable with personal finance or has a greater financial IQ.

However, too often, one spouse dominates the finances and tries to force the other spouse to bend to their own view of how the household should operate. Inevitably, this will lead to conflict. Instead, both spouses should feel empowered to provide input for where their money goes.

No matter how much money each spouse makes, both individuals in a relationship should have equal say in the household finances.

For many people, the word “budget” invokes negative connotations. Saying “it’s not in the budget” or my spouse “put me on a budget” feels like a limiting factor keeping your from doing what you want.

Instead, your budget should empower you. Once you agree on the plan, your budget provides permission to spend. Therefore, you can spend guilt-free and with abundance as long as it falls within the confines of your budgeted category.

When determining the preliminary budget, both individuals should provide input for where they’d like to spend their money.

Perhaps, one spouse values an expensive fitness class or hobby. A certain amount should be set aside each month without guilt to accommodate these expenses. Maybe, the other spouse prefers shopping for new clothes or shoes each month. Nothing is wrong with allocating a certain amount each month to scratch the shopping itch.

Each month, any unspent amount in the various categories can be “rolled” into the next month. This provides for an even more lavish amount of spending or can help you save for more expensive goals.

Practical Steps to Setting a Budget Together

Where do you even start with setting a budget?

If you or your spouse have never lived on a budget and have little financial experience, putting together the initial budget may not be very intuitive. However, budgeting and tracking your monthly expenses is NOT hard. Instead, financial discipline just takes a little self-control and an hour or two each month to monitor where you stand.

However, this small investment will pay immense dividends as you gain control of your household’s financial future.

Step 1: What’s your household’s top-line?

The first place to start is determining how much money you bring in each month.

While most people know their individual salary, too many married couples operate their financial lives separately. They may have an idea of what their spouse earns, but they do not intentionally combine their incomes into one bank account on payday.

Often, this leads to bickering and resentment as one spouse may be responsible for paying for housing while the other spouse makes their car payment and student loan debt.

However, operating as two separate entities is not healthy in marriage. In fact, nearly half of married couples have individual bank accounts. Who wants to split bills like their spouse is a roommate? Instead, commit to combining your incomes to jointly accomplish your financial goals.

Combining your incomes provides leverage and synergies along your financial journey.

Examples of what to include in your top-line household income:

- Base Salary

- Bonus

- Commissions

- Side Hustle Income

- Passive Income (dividends, interest, etc.)

- Rental Income

If you and your spouse are salaried, determining your total household income is quite easy. After all, the same amount is deposited in your bank account on payday each month. However, for those who work hourly or earn a substantial amount from commissions or a side hustle, forecasting your monthly income may not be as straightforward.

Even for those with volatile incomes or who are self-employed, you probably have some idea of how much you will make each month after taxes.

If not, you can start with your prior year tax return and divide by 12. This will provide a basis to estimate your monthly income. Maybe, you know a big sale will close this month or your business is seasonal and this month will be slim. More than likely, you probably have the ability to accurately estimate how much money you will bring in on a given month.

The key for those with volatile incomes is to maintain conservative estimates. Any extra will just be a bonus!

Step 2: What are your mandatory household expenses?

For many couples, this is often the most difficult aspect of budgeting. What constitutes a MANDATORY, monthly expense?

This definition can be applied fairly liberally and misconstrued as a lifestyle expense. Often, these lifestyle expenses leave less money to achieve other financial goals such as saving for retirement or that next car.

Keep in mind that the poverty level in the United States is around $17,000 for a married couple and $25,700 for a family of four. For example, if you find your “mandatory expenses” are more than twice the federal poverty level, then you may be mixing in lifestyle expenses.

Instead, you should apply a fairly strict definition to “mandatory expenses.” These represent expenses necessary for survival at a basic level with no lifestyle fluff.

Examples of mandatory expenses include the following:

- Mortgage or rent in an affordable residence

- Necessary utilities (electricity, gas, and water)

- Enough groceries and food for your family to survive (excluding dining out and “luxury foods” such as filet mignon)

- Other mandatory expenses (including required transportation and debt obligations)

Living on only mandatory expenses may not be sustainable over the long-term. However, knowing your base required spending helps keep other expenses in the proper perspective. If forced, your mandatory expenses provide the bare necessities for what you can afford to survive.

Step 3: Add in a little lifestyle “fluff” to keep your sanity

Alright, you’ve both determined your mandatory monthly expenses. If you want to stay in a happily committed relationship, you’re going to have to add just a bit of lifestyle expense to certain categories.

However, do not go overboard and drastically increase lifestyle spending. Greater lifestyle spending and luxuries should come from surplus AFTER you’ve reached other goals.

If you or your spouse value healthy foods options, add in a little more to the monthly grocery budget to accommodate pricier organic options. Maybe, budget in a few date nights a month to dine out with friends. For entertainment, properly budget for internet and cable (excluding premium offerings such as HBO, NFL Sunday Ticket, etc.).

Determining the right amount of lifestyle “fluff” to add can be challenging. After all, this additional amount should allow for the minimum spending to be somewhat content. However, this may not represent the ideal budget for that particular spending category.

Remember, after you’ve achieved other basic goals, you can always come back to replenish or “top-off” these categories with surplus.

To help gauge the right amount of initial spending, you will need to properly communicate with your spouse. During the first budget meeting, talk with your spouse about the very minimum necessary to achieve their baseline needs. Then, ask if money wasn’t an option, how much would you spend on this particular category?

More than likely, the initial “fluff” to add at this point in the budget is a compromise and somewhere in the middle.

Examples of initial lifestyle “fluff”:

- Healthier/premium food options to cook at home

- An occasional date night or night out with friends

- Basic, obligatory travel for family functions or visit close friends (i.e. not vacations)

- Basic entertainment for enjoyment (cable/internet, inexpensive fitness memberships or hobbies)

- Required, inexpensive clothing (not designer brands)

- Basic, necessary pet care expenses

Step 4: Set automatic investments and transfers to achieve savings goals

After meeting your basic living expenses with enough of your income to stay sane, you should aim to take actionable steps to accomplish your savings goals as a couple.

Let your mutual dreams and goals drive your savings plan

Many couples fight over money because they are not in alignment on their long-term goals. Maybe, they do not even know what their spouse dreams of achieving.

Since most of us sacrifice our time and freedom in a job we may not enjoy for the benefits and paycheck, the money we accumulate is relatively precious to us because of the time and effort of earning it.

When we see one spouse “wasting” a few hundred bucks each month on something we personally do not value, it causes resentment to creep in. Subconsciously, we associate our spouse with undermining our dreams. Ultimately, we feel disrespected and devalued. If left unchecked, seemingly small instances of “waste” in our eyes can morph into disdain for our spouse’s spending habits.

However, if together, you and your spouse elect to put aside money for your financial goals FIRST, these feelings can be mitigated. You can comfortably spend knowing you’re well on your way to achieving your long-term goals.

Communicate your dreams and listen to your spouse’s goals

Have you ever even asked about your spouse’s ideal life? What would a “day in the life” of their dream world look like? Hopefully, you’ve had the “dream talk” with your spouse before implementing the budget.

As previously discussed, determining your mutual long-term goals requires communication. These conversations will help you learn what you and your spouse value. Remember, discussing your dreams can be quite fun and help give you purpose as a household.

Unfortunately, too many couples “live in the moment” or only plan from week-to-week. Instead, take a long-term perspective. What do you want life to look like in 5 or 10 years? What about 30 or 40 years?

Failing to plan for your future is admitting defeat. However, you can sacrifice a little bit today to drastically change your future lifestyle and live your dream.

You and your spouse can use the budget to accomplish your dreams.

Set a plan and automate your way to achieving your goals

While this is not a “get rich quick scheme,” you can steadily maneuver your way along the path to achieving your goals by setting up direct deposits into separate accounts.

“Pay yourself first” with automatic investment contributions off the top of your income.

As a couple, one of the most obvious mutual goals should be financial independence in retirement. After all, you do not want to be a financial burden to your children and grandchildren. Instead, your goal probably consists of maintaining independence and even generously providing for your family.

One way to automate your retirement savings is through payroll deductions through your employer.

If you have a 401(k) or other retirement plan at work, have your employer withhold 10%-15% of your income into this tax-advantaged account. Eventually, you won’t even notice the money is missing from your paycheck and you will adjust your spending accordingly.

Even if you do not have an employer-sponsored plan, you can set up automatic deposits into an Individual Retirement Arrangement (IRA) through different brokerage houses such as Fidelity or Vanguard.

Investing for retirement over decades will inevitably secure your financial future.

Saving for other goals

Consider setting automatic transfers into other investment or savings accounts to achieve other goals.

For example, maybe your spouse needs a newer vehicle. Instead of waiting until your current vehicle dies and stressing over how to suddenly pay for the costly expense, determine how much you need to put back each month to replace the vehicle.

Maybe, your spouse dreams of staying home with young kids until they are in school full-time. How can you invest, earn more, or spend less to stay on track financially? Can he or she start a side hustle that allows them to work on their own schedule while still earning an income?

Perhaps, paying off the mortgage and eliminating your housing expense frees up enough margin to take a less stressful job or retire early.

You can set a spending or savings plan that will help you reach your long-term goals.

Step 5: Increase your lifestyle with any surplus

After providing for your basic expenses and putting money aside to secure your future, hopefully, you have enough leftover for lifestyle expenses.

Even if you only have a few hundred dollars extra per month, you and your spouse can use this money to pad categories in your budget. Simply, go down your list of items in the budget and identify areas you both believe could use a little more cushion.

If you’ve been living on a pretty strict budget, now is the time to splurge a bit without feeling guilty. After all, you’ve eliminated wasteful spending and have allocated your money in an intentional way to live your best lives.

3. Eliminate the financial strain of debt from your household expenses

While “big picture” strategy and spending disagreements tend to be the largest culprit of money fights, another huge source of financial stress stems from burdensome debt obligations.

All too often, Americans turn to debt to finance purchases they simply should not make.

Can’t really afford that new SUV? No worries, the dealership will be more than happy to let you finance that sweet ride over 6 or 7 years. Is that private university dream school financially out of reach for your child? With a seemingly infinite supply of student loans available, why settle for a cheaper alternative? Rationalizing expenses and going into debt is the reason Americans are holding the bag for over $1.6 trillion in student loans.

While you will not feel the initial sticker shock, you will inevitably take the hit to your wallet each month until your balance is $0. These payments ultimately rob from your ability to save for the next expense. This behavior forces you into a vicious cycle of taking on and paying off debt.

One negative life event and you may find yourself hanging on by a thread with no emergency savings and in default on your loans. This financial strain can greatly hamper your relationship.

Change your perspective on debt obligations

Sure, debt may be necessary sometimes in life.

Most of us cannot afford to pay cash for a house. Maybe, some people take out a small, short-term loan to cover part of the purchase of a relatively inexpensive vehicle they plan to drive for the next decade. Perhaps, you choose to finance a small portion of an affordable university program while still working and earnings an income.

While Wall Street may tell you it’s a good idea to borrow at a low interest rate and invest to earn higher market rates of return, making continual debt payments robs from your monthly cash flow. Even seemingly “good debt” ultimately must be repaid and will add risk to your life.

After all, financial markets do not always appreciate. College students don’t always graduate. Vehicles inevitably break down. Therefore, your risk-adjusted returns in the market may not be as favorable as the spread you think you are earning. That degree may not be your ticket to financial excellence. Your new car will suddenly become “used” as soon as you drive off the lot.

However, the constraints on your monthly cash flow will be felt until your debts are repaid. This may leave you with extra worry that inevitably spills into your relationship.

Question: Would you take a pay-cut for that purchase?

One great way to put financed purchases into perspective is to ask yourself, “Would I take a temporary salary cut to experience or own this purchase?”

Essentially, financing larger purchases (like a home, car, or student loan) has the net effect of taking a lower salary for the duration of the loan. When you borrow money, you simply trade your future earnings for the purchase.

Sometimes, the answer may be “yes.”

For example, buying a home with a mortgage gives you the ability to build equity in an asset that generally increases over time. In some instances, your monthly payment may even be lower (even though the total maintenance, repairs, and utilities are generally higher when owning). In the long-run, you will eventually own the home 100% outright when the mortgage balance is eliminated. This allows you to eliminate your largest monthly expense, freeing up thousands of dollars in future income to invest elsewhere. Further, you’ve stabilized the monthly housing expense along the way. As anyone who is a renter knows, rent generally increases every single year.

However, other purchases (such as a vehicle) may require a little more scrutiny.

According to Nerdwallet, the average new car payment in the U.S. is $530 per month over 68.5 months. Applying this train of thought, would you take a ~$8,000 pay cut for the next 5-6 years to purchase a new car? When you take on a car loan with AFTER-TAX dollars, that’s essentially the math of the situation. In order to make the $530 payment, you would need to earn an extra $663 (assuming a 25% tax rate) each month.

Perhaps, you can afford to take the hit. However, most Americans would be better served holding onto as much of their monthly cash flow as possible.

Discuss your tolerance for debt

Unfortunately, most Americans go through life deeply indebted.

We are often impatient and choose to use debt to finance purchases that we can’t afford. Even as we earn more throughout our lives, we increase our lifestyles and pile on more debt. In fact, as the summary below shows, our peak indebtedness corresponds with our peak earning years.

Here’s the average amount of debt by age:

Under 35: $67,400

35–44: $133,100

45–54: $134,600

55–64: $108,300

65–74: $66,000

75 and up: $34,500

Over time, we find these balances have grown into a massive amount and wonder how we can escape. Many Americans lose hope or live in denial, accumulating even more debt.

How can you avoid the stress caused by debt?

Instead, you and your spouse should be on the same page when it comes to your tolerance for debt.

If one spouse hates the thought of borrowing money and the other spouse racks up credit card debt without remorse, conflict will ensue.

If you’re like the average American family who is cash-strapped and maxed out, you can take the steps together to regain control of your income.

However, the first step is to come into agreement about how your financial lives will intersect with debt going forward. Will you never borrow again? Is “good debt” the only approved debt on your household balance sheet? Alternatively, are you both content with living in the never-ending cycle and hangover that consumer debt prescribes?

More than likely, you both will need to discuss, compromise, and hold each other accountable for what is best for your own household’s situation. If you have no self-control, maybe opting to never use your credit cards again is the most prudent choice.

One Team, One Dream

Relationships and marriage can be tough enough without the impact of financial strain.

For two people to deny themselves and sacrifice for the other spouse out of love is simply remarkable. Don’t let financial mistakes and decisions negatively impact your relationship, cause strain, or lead to money fights.

Instead, work together and come into agreement on a plan for your money.

Discuss your hopes and dreams. Learn how money plays into achieving your ideal life. Set a goal to achieve elements of your dream life.

Live by a budget. Take control of your finances and tell your money where YOU want it to go. Give yourself permission to spend and do not feel guilty about spending money when you and your spouse have signed-off on the family’s budget.

Lastly, avoid debt like the financial plague that it sometimes causes. Remember, you must pay back loans with after-tax dollars. Think to yourself, would I take a pay cut to buy this item? Does financing this purchase align with my dreams and fit into the budget? If you and your spouse do not mind debt, consider setting limits for what you will finance, and never tolerate high-interest debt.

By implementing these three strategies, you can greatly reduce the number of arguments stemming from money issues. Maybe, learning to work together on finances will also teach you to work together on other aspects of your relationship.