Unless you are familiar with the fitness world, “cutting,” “maintaining,” and “bulking” may not be part of your normal vocabulary. While fitness and finance may seem unrelated, there’s more similarities than you may initially think.

Both physical fitness and personal finances come in waves. At times, you may find maintaining your workout regiment and diet easy. You may hire a personal trainer and see amazing results the first month or two. However, after a few months, the results become increasingly hard to attain. The “Law of Diminishing Returns” can often leave us demoralized and cause us to abandon our goals. Further, we all have busy periods where life intervenes. During these times, we may not have the motivation to workout every day or eat that kale salad. Ultimately, backsliding will cause us to lose the progress we gained.

Similarly, our personal finance journey ebbs and flows. We all have experienced periods where everything “clicks.” We get that promotion at work. The market climbs and our net worth increases. Everything seems to go our way. However, we often experience phases in life where the opposite is true. It feels like each month, we get hit with a new emergency. An unexpected, $500 out-of-pocket cost because our car breaks down. Maybe, a recession hits and our employer lays us off.

Just like maintaining a strict diet and workout regime 24/7/365 is impossible, our financial lives should expand and contract throughout the year and over the course of our lives.

Cutting: Decreasing Consumption

At times, it may be time to “tighten the belt.”

Have you ever been to the gym between January and March? Between New Year’s resolutions and those trying to get that “beach bod,” finding a gym that is not inundated with people can be nearly impossible. Just like New Year’s resolutions lead us to drop a few pounds for health reasons and personal goals, implementing certain periods to “cut” your budget can help you develop healthy spending habits and create margin in your financial life.

Often, reigning in lifestyle spending is no fun. However, keeping your expenses in check and creating extra margin during profitable times of the year will pay dividends in the future. During the year, you will have months of surplus. Conversely, certain months may require you to spend more than you made that entire month. Instead of entering the cycle of debt, implement a plan and account for volatility in your spending.

Over 1/2 of Americans would find it difficult to pay for a $500 emergency. Evidently, Americans have an issue planning and predicting spending needs. Our consumer mentality gives us permission to spend when we have a little money in the bank or some cushion in our credit limit.

Creating Monthly Margin

However, instead of waiting for an emergency to happen, proactively save before issues arise. The only way to create margin is to spend less than you earn during the “good times.” While this may mean you have less fun when life is going well, saving money will help you weather dips in your earnings or a sudden expense.

Aside from emergencies, certain times of the year may be more expensive than others. For instance, Christmas comes the same time every year. Your child or parent’s birthday never fails to fall on the same date. The summer or winter months may increase your cooling or heating bill. Instead of being “surprised” by these expenses, have an account to cover these specific costs. Maybe, you will only need to put $50-$100 back each month to cover these expenses. More than likely, you will not even notice the money is missing each month.

However, you will avoid the sudden panic that comes from living paycheck to paycheck.

Maintaining: Financially Coasting

Who doesn’t love coasting through life?

If you’re in the fitness world, you have probably calculated your “maintenance calories.” In essence, you can consume this amount without gaining (or losing) weight. A perfect equilibrium.

Similarly, many of us find the happy financial medium that keeps us tiptoeing along the fine line between the black and the red.

Perhaps, you have a six-figure income that affords the lifestyle you want. Maybe, you can even put away a hefty amount for your financial future.

However, for most Americans, we fall squarely in the “Maintaining” bucket.

With our median household income of $60,000, we dine out in restaurants 4.9 times per week, pay an average of $34,000 for a new car, maintain student loans of around $30,000, and hold a credit card balance of over $6,000. Our lives are defined by relative comfort and modest savings. We’re able to make our monthly obligations but not much more.

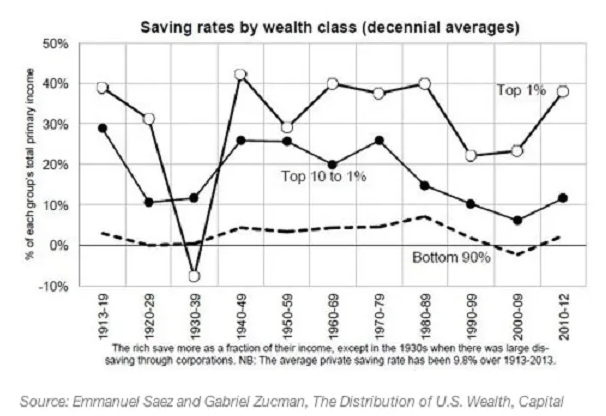

Based on the chart below, the vast majority of Americans struggle to save between 2% and 5% of their income. When times are bad (2008-2009), we save even less. During the economic booms, our savings improve only slightly.

While saving a modest percentage of your income is better than overspending, building wealth and financial independence is next to impossible if you just choose to “coast” through life.

Combating the Status Quo

Although there may be periodic months where you only save 2%, you should aim to save at minimum 15% of you income. The bulk of that (~10%+) should be invested in tax-advantaged accounts such as a Roth IRA or 401(k). This can help secure your financial future. As you earn raises, continue increasing your retirement contributions until you reach 15%. Then, allow for any extra savings to be stored in a high-yield savings and/or invested in a brokerage account.

While it may be OK to coast at times, if you want more than average results, you have to define yourself as something other than average.

Bulking: Increasing Your Spending

In the fitness world, consuming more calories to gain weight enhances strength. The extra caloric intake promotes and enhances muscle gain. When the the individual drops the added weight, they still maintain much of the added strength.

While spending money may feel painful to the diligent saver, you should feel empowered to spend money lavishly on the things that bring you joy and charitable causes.

When Increasing Spending is OK

When John D. Rockefeller died, his accountant was asked how much he left to his estate. The accountant’s response? All of it.

No matter how much we manage to save and accumulate during our lives, we will not be able to take a single penny with us when we pass. However, should not be misinterpreted for spending every dollar because “YOLO.” By accumulating wealth, you can enjoy your “Golden Years,” maintain financial independence as you age, and pass along a legacy to your family or charitable causes.

For around half of Americans, dying without any savings is all too common. After all, nearly 46% of retirees die with less than $10,000 to their name. While wealth alone does not define our legacy, individuals who have amassed a sizable nest egg have the ability to enjoy life’s pleasures and increase their generosity.

If you have diligently saved and maintained a conservative lifestyle, there comes a time when you should enjoy the fruits of your labor. Financial discipline is hard work. You’ve earned it! Give yourself permission to pursue experiences you never dreamed you would. Travel the world. Re-enroll in college or take classes that expand your knowledge base and enhance your appreciation of certain subjects.

Perhaps, you can invest for the next generation. Open a 529 Plan and invest for your children or grandchildren’s education. Write a six-figure check to your church or charity you care deeply about. Because of your diligent saving, you have the ability to positively impact those around you.

Why Wait Until Retirement?

While most people generally think of “living the good life” as retirement, certain times and situations may allow you to periodically increase spending during your working life.

Maybe, you have your eye on a newer vehicle. Instead of impulse-buying such a large expense (that depreciates), save and invest to accomplish your goal. Identify how much to invest each month based on historical market returns and how long until you make the purchase. Depending on your time horizon, much of your payment will be made up of “free money” (i.e. market gains and dividends). Let your investment returns subsidize your purchase.

If you have managed to pay off all consumer debt and have a savings rate well beyond 20%, you may be addicted to saving. In of itself, this may not be a terrible habit to have. However, your spouse or family’s patience may wear thin if you are constantly counting the cost of “fun.”

Certain times may call for you to loosen up a bit. Enjoy life. Invest the time you have with your kids – not earning an incremental dollar. Spend your money on experiences and items that bring value to your life. After all, the vast majority of the total time you will spend with your children will occur before the age of 18.

Certain instances may call you to increase spending periodically. If you have a savings plan, you can be well-prepared to cover the costs and enjoy life.

Your Financial Routine

Just like elite fitness models experience cycles in their physique, you will experience cycles in your financial life.

After all, living a well-balanced lifestyle is key. If you find yourself leaning too heavily on the spending side, redirect your focus to increasing saving. If you cut expenses to the bone and have no room for fun, lighten up and enjoy life.

You will experience times where cutting back expenses is the logical and appropriate step to take. Similarly, certain situations will call for outrageous generosity or lavish spending on the experiences that bring value to your life.