Lately, the price of real estate has been out of control!

Just a year or two ago, houses we would have considered purchasing one day were selling for 20% less than they are going for now. With the recent declines in the stock market and higher interest rates to curb inflation, the cost of buying a new home has gotten increasingly unaffordable.

However, market declines are often an opportunity. With the stock market on sale in 2022 and the real estate market humming higher, I decided it was a good opportunity to begin investing for our next home.

Timeline for our next house…

My wife and I were fortunate enough to buy our first starter home in late 2020.

We knew going in that our first home would not be our “forever” home. Although we have great community amenities, there is virtually no yard space and the public schools leave much to be desired.

However, in the meantime, our current home provides a great space to live and has allowed us to participate in the market appreciation. Plus, the sunk costs of our house (property taxes, interest, and insurance) is approximately what my old apartment cost per month. But, we get a lot more space and are closer to family!

Even though we could probably stick it out in our current residence a total of 6 or 7 years, we plan on being in our current home another 4 or 5 years – MAX. Eventually, we want yard space and a little privacy which we do not get in our current community.

Timeline to invest: 4 years (with 1 extra year of breathing room if needed!)

Investing Strategy

The investing strategy for our next home is three-fold:

- Automatic savings via principle paydown

- Real estate appreciation

- Investing in a brokerage account

1. Automatic savings from principle paydown

One of the reasons homeownership is correlated to wealth is because of the “forced savings” aspect.

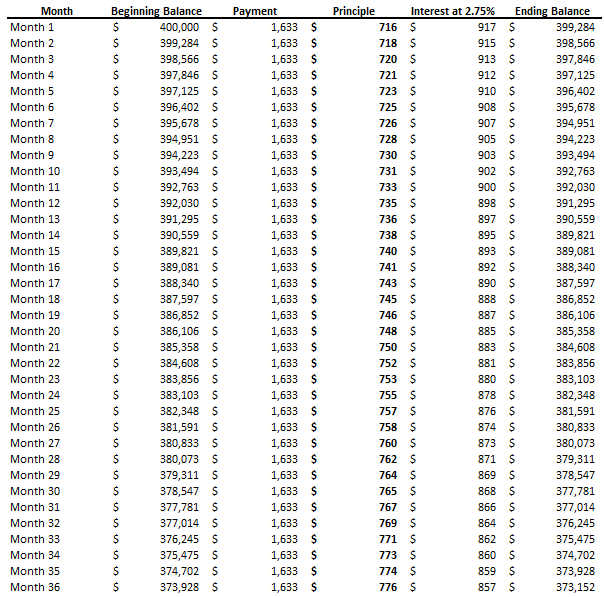

Each month, a portion of the housing payment goes to principle. Although, most of the payment early on goes to interest. However, as more of the loan balance is paid down with each payment, a higher percentage of the total payment goes to principle.

As you can see in this example, only ~43% of the mortgage payment goes to principle in Month 1. However, each month, a few more dollars is allocated to principle and less to interest. This is because the new interest amount is calculated based on the remaining loan balance.

By Month 36 (or year 3), ~48% of the payment is going to principle paydown.

Therefore, as more of the loan balance is paid down, less of the payment goes to interest and more goes to EQUITY!

Around month 60 in this example, a majority of the payment is going to principle instead of interest.

Essentially, this works like a forced savings account.

Even though the money is locked away in our primary residence, when we turn around and sell our first home, we will be able to use the funds leftover for our next down payment.

I estimate that ~40% of our future down payment for house #2 will come from the original down payment and principle paydown from our current house.

2. Appreciation from our current primary home

Over time, the price of real estate generally increases in value.

This is because of many reasons. However, the principle of supply and demand is the root cause.

You see, there are generally more net buyers than sellers. Obviously, real estate is based on local market dynamics, but population growth causes increased demand for housing.

Plus, since the mortgage and real estate crisis of 2008 / 2009, we have been perpetually undersupplied. We simply cannot build homes fast enough to accommodate the demand for housing. This problem was exacerbated by supply chain shortages and bottlenecks due to the pandemic.

Another contributor to home appreciation is inflation. Each year, costs generally increase as workers demand more money and the input prices for homes go up in cost. These costs for labor and materials must be passed along to the buyers in order for the builder to remain in business. As the cost of new construction rises, the resale market increases as well as the replacement cost for that home rises.

Historically, real estate has at least matched inflation. However, homes in high demand areas with population inflows generally see trends that more than outpace inflation. According to the Case-Shiller Housing Index, residential real estate has averaged ~4% appreciation in the United States.

However, there are some periods where home prices decline and other periods where prices increase at a significantly higher rate.

Median Home Sales

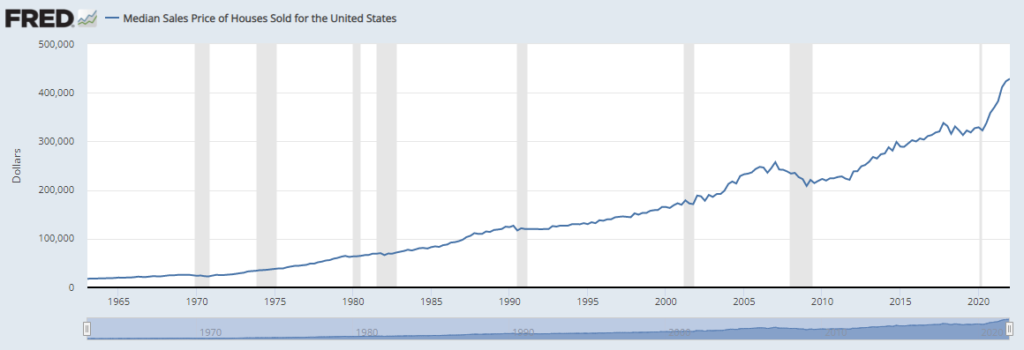

Another barometer for real estate appreciation is the median sales price.

This data is published in the Federal Reserve Economic Data. Similar to the stock market, the residential real estate has periods of ups and downs. At times, the median sales price remains relatively flat. Sometimes, the median sales price declines such as in 2006-2010. However, the long-term trend in home selling price is up and to the right.

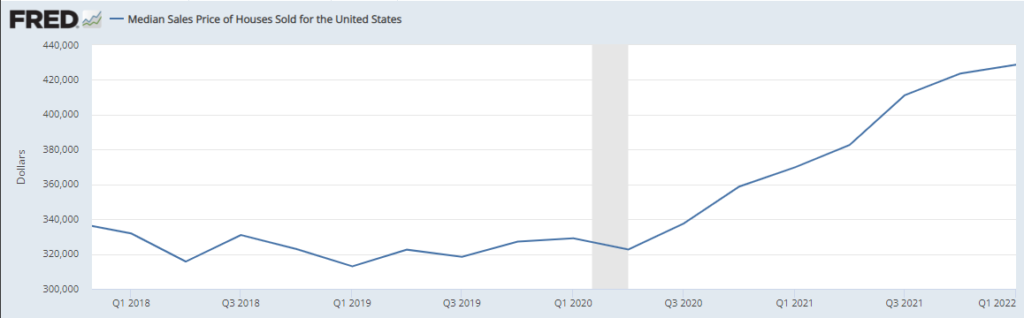

As you can see below, we have seen substantial increases in the price of real estate since late 2020.

In fact, from 2019 to 2020, home prices increased 5.1%. Between 2020 and 2021, homes appreciated another 12.4%. In 2022, the median home price accelerated to 15.9%!

However, in response to record inflation, the federal reserve began “tightening.” This is done by constricting the monetary supply by raising interest rates.

The theory is that higher borrowing costs will restrain the economy and lower inflation back to their 2% target. This should feed into the real estate market as well. However, until the price of homes come down or wages accelerate, the price of residential real estate is becoming increasingly unaffordable for first-time homebuyers.

Home appreciation: How it impacts what we can buy in House #2

Often, home appreciation is only a good thing if you intend to stick it out in your current house forever. Alternatively, downsizing and unlocking some of the appreciated equity may help homeowners realize their gains.

Think about it.

Even though your current residence is increasing in value, other homes are also going up too. It’s often a wash. For new homebuyers, appreciation makes the cost nearly unaffordable. Until they get their foot in the door and can participate for themselves, they’re simply chasing the cost of housing each year.

Eventually, the house we want to buy as our “forever” home will be in a more established neighborhood near our city center. These neighborhoods are already on the upper end of what an upper-middle class family can afford.

To help with affordability, we strategically purchased our first home in a neighborhood that is “transitioning.” While safe, there are certain areas of concern. Plus, industrial buildings and dilapidated strip centers are being torn down to make way for brand new luxury apartments and townhomes. These developments are increasing the market comps of our own house.

Further, our section of the city is one of the last areas within a 20 minute commute to downtown where homes can be purchased below the median. For these reasons, we expect our current home to appreciate faster than the already “developed” neighborhoods.

Over the next 4-5 years, I estimate that houses in our area will appreciate ~6%/year while more established neighborhoods will appreciate closer to the 4% long-term average.

Realtor fees and closing costs

Selling costs are often overlooked when running the numbers on real estate.

However, realtor fees and closing costs are significant! Don’t get me wrong. A good realtor can more than make up for the 6% commissions that are customary in the business.

Generally, 6% of the selling price is split between the seller and buyer’s agents. These costs are generally paid by the seller.

Closing costs are another big expense.

Closing costs are other fees that are charged as part of the home selling process. These include appraisal fees, attorney costs, inspections, and other costs performed as part of the property transfer process.

These costs can range from 2%-5% of the purchase price. However, most of these costs are incurred by the buyer. As with most deals, everything is negotiable. A buyer could negotiate the buyer close some of the closing costs to help alleviate some of the cash outlay.

Cash from Home #1

All in, I would expect selling fees and concessions to cost around 8% of our selling price. This means we only get to keep around 92% of our home’s value.

After the initial mortgage is paid off, I would expect the remaining 60% of the down payment to come from market appreciation (less selling costs and mortgage payoff).

Therefore, the down payment for our next house should come from automated savings and appreciation from our current home.

3. Investing for our next home

The last source of funds for our new home will come from a brokerage account we recently opened.

Even though our next home will be a stretch financially, I am hoping that we will be able to purchase something that we could buy below market value, renovate to our tastes, and then live in for the long-term.

To accomplish this goal, we are aiming to have an additional ~10% of the purchase price invested. This money will be used for renovations. Plus, it will allow a little flexibility in the price range of our next home.

Our home #2 investment portfolio

Truth be told, the market has gotten off to a shaky 2022.

The S&P 500 is in correction territory – down more than 10%. Technology and growth indexes are firmly in bear market territory. While it is tough to lose nearly 25% of our invested money in a matter of months, I believe this will be an opportune time to buy.

Given we have a 4-5 year time horizon, I plan to steadily dollar-cost-average into growth stocks on sale. To me, these beaten down companies offer the best risk v. reward over the next 3-5 years given their longer-term prospects.

In addition to individual stocks, we put away additional money into index funds. This allows us to gain instant diversification.

Currently, around 80% of our new home portfolio is invested in growth-oriented stocks and funds. We own stock in established, dominant companies like Facebook, Google, Netflix, Amazon, and NVDIA. The stock of these companies have been hit particularly hard due to inflation and future growth concerns.

The remaining 20% of our new home portfolio is comprised of more value-oriented stocks – including Real Estate Investment Trusts REITs). These stocks provide a very small amount of portfolio income.

However, as we get within 3 years of buying our next house, we will steadily transition new money into more stable, dividend-oriented stocks and funds. Eventually, when we are ~1-2 years out, I will start moving the portfolio to cash.

Depending on how much we have saved and invested, we can use the proceeds to pay for renovations. Alternatively, we could leave the portfolio invested in dividend-oriented stocks. This would produce another stream of passive income!

Conclusion for our Home #2 Investment Plan

One of the biggest perks of owning a first home is the ability to move that equity into our next home!

Principle paydown and home price appreciation should more than offset the selling costs. The equity that remains should be more than enough to cover the 20% down payment on our next house.

In the event that we need more money, we plan to continue contributing and investing in a brokerage account. Over time, these funds should increase in value and offer a pool of money to draw from. With our investments, we plan to pay for renovations or help alleviate the burden of a higher mortgage payment.