Ever dreamed of quitting your 9-5 job and having complete financial independence before your Golden Years? While the average retirement age in the United States is 61, there’s one social lifestyle movement aimed at changing America’s mindset on retirement.

Those subscribers to the Financial Independence Retire Early (FIRE) movement aim to drastically reduce lifestyle consumption. By producing the highest possible savings rate, plenty of their paycheck is leftover to invest like crazy.

The goal and result? Replace their income by generating passive income. By producing enough passive income (through stocks, dividends, and/or real estate) to cover their living expenses, they no longer need to work in the traditional workforce.

Instead of spending 40+ hours per week working, they free-up their time to pursue their passions, travel, or even earn money on their own time.

How is FIRE achieved?

Achieving FIRE takes INCREDIBLE sacrifice.

For many of us, retiring at 65 finally provides the opportunity to spend our time how we want. FREEDOM!

Maybe, we’ll finally catch up with family and friends. Perhaps, we’ll take that Mediterranean vacation or travel to our dream destination.

Our goal is to finally live our ideal life during the latter part of our years.

Those on the path to FIRE are looking to expedite this result into their 50s, 40s, or even 30s. Achieving FIRE is just like saving for traditional retirement but on steroids.

The traditional savings rate for retirement

Most financial advisors recommend saving 15% of your income for traditional retirement at 65. This provides ample cushion for a retirement in 30+ years.

Saving 15% of your income over an entire career allows your contributions to compound over the decades. In traditional retirement, 90%+ of your portfolio will be due to market returns.

However, for those who have chosen the FIRE path, they must supercharge their savings rate because of the shortened timeline to retirement.

By choosing to retire early, you wouldn’t have the decades for your money to work for you and compound. Instead, the bulk of your portfolio comes from contributions rather than market gains and dividends.

However, the portfolio provides immediate income necessary to replace your income.

Those who achieve FIRE often have savings rates exceeding 50% of their gross salary. Even with a savings rate at 50%, it would still probably take ~10-15 years to replace your income. However, this is still substantially shorter than the typical 30-40 year career.

Now, lets look into the numbers…

The FIRE movement is re-shaping what retirement looks like. After all, retirement isn’t simply an AGE. Financial independence (FI) is a NUMBER.

Unfortunately, it takes most families decades to finally achieve that number capable of sustaining their lifestyle. Why is that? Our spending is out of control. We end up limping through life until we can receive Social Security or tap our 401(k)s.

Instead, those on the path to FIRE are INTENTIONAL with their dollars. Based on their annual expenses, they know the value of their portfolio needed to produce the income necessary to survive.

How do you determine your FIRE number?

Simply determining the portfolio necessary to sustain your lifestyle isn’t too difficult.

Those who have achieved FIRE typically adhere to the 4% Rule. The 4% rule is achieved by accumulating a portfolio of 25x your annual expenses. Based on historic market returns, retirees can generally withdraw 4% of their portfolio in perpetuity.

But how do you build such a large portfolio?

Those on the path to FI accomplish this feat through a variety of strategies.

Often, many earn more money through side hustles, blogging, and real estate. Further, many lower their annual expenses by paying off debt and/or reducing their housing expense by house-hacking. Most avoid cost drains such as new vehicles or dining out for meals.

With the excess, they have surplus that they can diligently invest and generate passive income or grow in low-cost index funds.

The Journey to FIRE

Currently, I’ve been hard at work on the corporate grind since graduating from university a few years ago.

While I don’t necessarily love my current job, I tolerate the work (at best). My biggest grievances center around the fact that the corporate structure can be quite stifling at times. Several times a year, I find myself tied to a chair until 9:30PM and staring at the four walls of my cubicle. These moments leave me longing to escape the rat race.

Perhaps, you feel the same way.

Finding an escape through financial independence

All of these issues (and time spent in the office) led me to look for a way out BEFORE I’m 65 years old. I want to enjoy all life has to offer before I’m too old to travel. I don’t want my adventures in life to be limited to two weeks per year for the next 4 decades.

Further, I’d love to build the financial wealth to pursue my own endeavors. Perhaps, I’ll open my own business or delve into real estate.

All dreams aside, my biggest priority is to ensure my family is taken care of and our quality of life doesn’t suffer. I wondered if this was even possible without traditional employment.

After discovering the FIRE movement through a few podcasts, I realized this may be my escape from the corporate world. While I never want to stop working and learning, I want the freedom to pursue work that is meaningful to me.

The dream of achieving true flexibility

The most appealing part of the individuals who are “FIRE” is that many of them haven’t stopped working. They simply do not NEED to work anymore. They have accumulated a portfolio of investments capable of sustaining their lifestyle.

Further, while most have left the structure of their office jobs, many perform freelance work on the side. Some have online businesses. With 8-9 extra hours per day, they have the ability to invest in themselves, their hobbies, and their own business.

Who wouldn’t love to live that life?

While I’m not currently able to save 50%+ of my income, I am well on my way to investing ~33% of my after-tax income. While I hope to increase my investments as I pay down low-interest debt (~2.3%), this represents a good start for my financial independence journey.

Investing for FIRE

One of the cornerstone strategies for building financial independence comes through investing in index funds. However, I wondered if I could “supercharge” my portfolio and achieve FIRE sooner.

I’ve been investing in index funds since high school. In college, I started buying individual stocks to test the waters and begin learning more about business and the investing world.

Buying individual companies has forced me to spend time learning WAY more about markets and business compared to index funds. However, buying individual stocks requires a bit more of a time commitment. For me, it also represent a hobby that I enjoy.

Why does the FIRE community love index funds?

The right index funds provide a simple, ultra-low cost way to immediately diversify your portfolio. By dollar-cost-averaging, you buy incrementally more shares on the market dips. As the market generally rises over time, your investment portfolio subsequently increases along with the stock market. Plus, your additional contributions and dividends are buying incremental shares along the way. Over time, this helps create substantial wealth.

The key investing philosophy of ChooseFI, one of the premier podcasts on the FIRE movement, is to buy and hold shares of the Vanguard Total US Stock Market Index Fund (VTSAX).

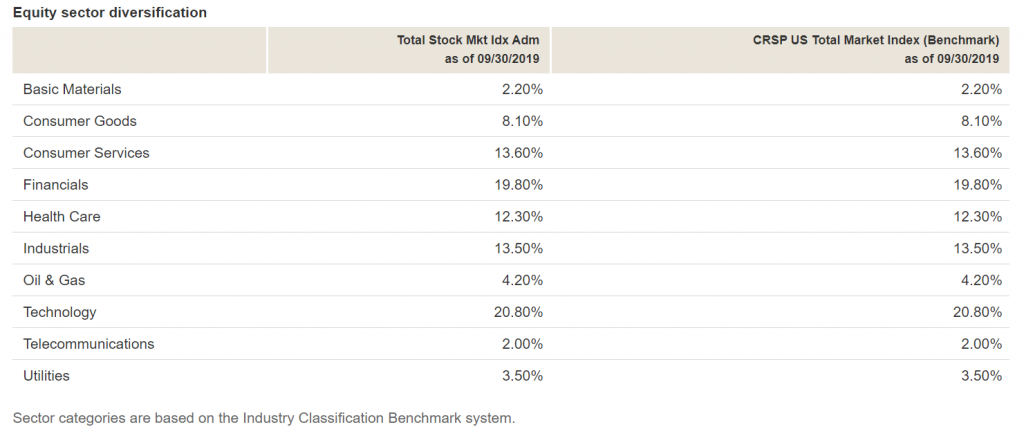

As shown below, VTSAX holdings span a wide variety of industries ranging from technology to utilities. This diversification across market segments helps stabilize your portfolio.

Total Stock Market Returns

Over the long run, the overall stock market has averaged ~10% annually.

While this may not sound significant, over decades, a compounded 10% annual return means your invested balance will double in approximately 7 years. Adding in additional contributions, you can generate substantial wealth.

In fact, if you were to invest just $500 per month from age 22 to 65, you would accumulate a portfolio of over $3.6 MILLION. Out of the total balance, only $258,000 comes from your $500 monthly contributions. However, the 10% annualized market gains and dividends comprise the remaining $3.3 million. Therefore, 93% of your portfolio is “free money.”

What if I could find a fund that beats the market by just a mere 2%?

Over the same time period, annualized returns of 12% would result in a $6.3 MILLION portfolio. Just a measly 2% of outperformance each year results in a portfolio that is 90% larger.

Hopefully, I’ll be able to achieve FIRE before 65. However, this provides a good illustration of how just a percentage or two makes a TON of difference.

Investing in Mutual Funds: a source of outperformance?

Many of the voices in the FIRE movement advocate for index funds (like VTSAX) over mutual funds.

But, why is that?

Here’s the argument:

Generally, index funds have very low fees (often under .1%). By contrast, some actively manged mutual funds can come with relatively hefty expense ratios.

To provide “value” for these fees, the goal of most mutual fund managers is to outperform the benchmark. If they can deliver, they can justify the higher fees and attract more investors.

Could investing in funds other than a broad based index fund like VTSAX help juice returns?

In theory, buying mutual funds could drive outperformance. After all, you can’t beat an index if the fund is designed to mirror said index (just like VTSAX mimics the market).

However, fees and lackluster performance make most mutual funds sub-optimal. In fact, studies show that over the last decade, 85% of mutual funds underperformed the S&P 500. Over the last 15 years, 92% lost to the overall market.

Even Warren Buffett, the greatest investor of all time, recognizes the power of buying a simple index fund. He believes in the S&P 500 index fund so much that the has instructed the trustee of his estate to invest 90% of his wealth in a low-cost, S&P 500 index fund for his wife when he passes.

Clearly, if the greatest stock picker of all time believes the S&P 500 is the best place to park his wealth, shouldn’t that be good enough for me?

Then again, Buffett is already wealthy

Obviously, Mr. Buffett has already won the game.

Buffett is worth BILLIONS. He has substantially more zeros in his bank account(s) than me! In turn, his (and his heirs’) financial future has been secured.

However, let me tell you a little secret…

Buffett didn’t build his wealth by dollar-cost-averaging in the S&P 500 index fund. His performance through Berkshire Hathaway has beaten the S&P 500 by 155x. Instead, Buffett built a business empire on buying the stock of great companies at a reasonable valuation.

While I’m certainly no Buffett, this shows that outperformance can be achieved.

Clearly, those who are still in the accumulation stage of wealth (like me) should invest differently than those who have already built a massive empire (like Buffett).

My investing strategy before FIRE

Like many new and experienced investor, I idolized Buffett. I wanted to emulate his success and did everything I could to learn how he invested.

I watched movies, YouTube videos, and read books on Buffett and other notable investors. By researching and reading books on books on Buffett’s mentors like Benjamin Graham, I hoped to pick a magic portfolio capable for generating outsized returns.

Even though I spent a ton of time researching, buying, and tracking my individual stocks, I found it extremely difficult to beat the market.

In my early 20s, I generally bought blue chip stocks along with an S&P 500 index. Most of my stock portfolio centered around value plays and dividends.

Instead of looking for revenue growth and capital appreciation, I focused on earnings per share growth, dividends, and stock buybacks. I honed in on price to earnings ratios that were substantially below the overall market.

Often, I found myself scanning the 52-week lows list for new ideas. I waited for a stock to get beat down after a negative earnings report before buying my first position. Then, I waited for the stock to continue dropping, and I made incrementally more purchases on the way down.

The proverbial attempt to “catch a falling knife” clearly didn’t work for me.

Unfortunately, I was lucky to just keep up with the market much less outperform the index. Including the opportunity cost of the time I spent researching, the lack of outperformance was clearly not worth the risk. This put me no closer to FI.

Adopting a strategy for growth

However, after a few years of lagging to merely keeping up with the market, I shifted strategy. I realized that I had the biggest asset for investors – TIME.

I had time to take more risk in my investment portfolio. With a stable occupation as a CPA, I had both the knowledge of reading and interpreting financial statements and the benefit of youth.

Therefore, I shifted my strategy to growth which paid dividends (even though my portfolio did not). Instead of barely tracking the market, my portfolio began beating the market by double digit percentages.

Expanding beyond VTSAX

Along with my individual stock picks, I began investing in index funds with a track record of beating the S&P 500:

– First Trust NASDAQ – 100 – Technology Sector ETF (QTEC)

– Invesco QQQ Trust (QQQ)

– Fidelity NASDAQ Composite Index (ONEQ)

While I still own a Total Stock Market index fund, I have found these growth and technology funds to be great additions.

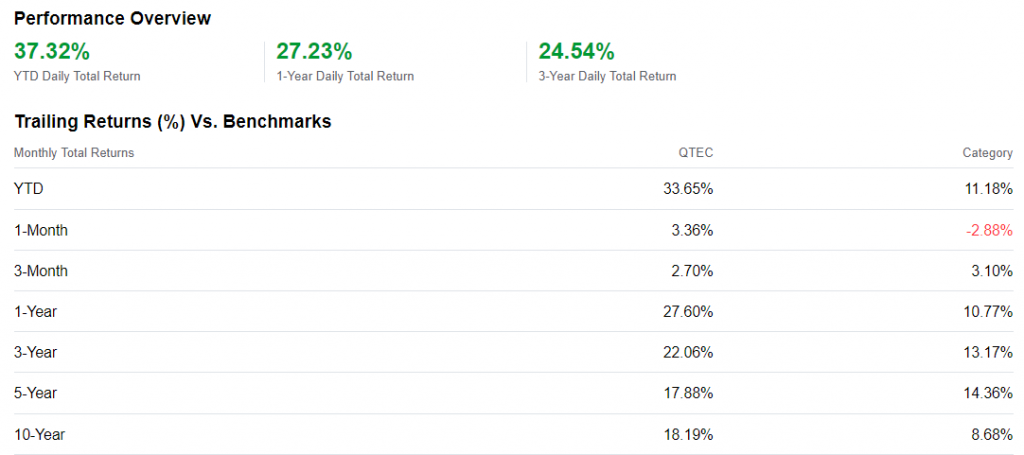

In fact, my largest index fund (QTEC), has a track record of stellar performance:

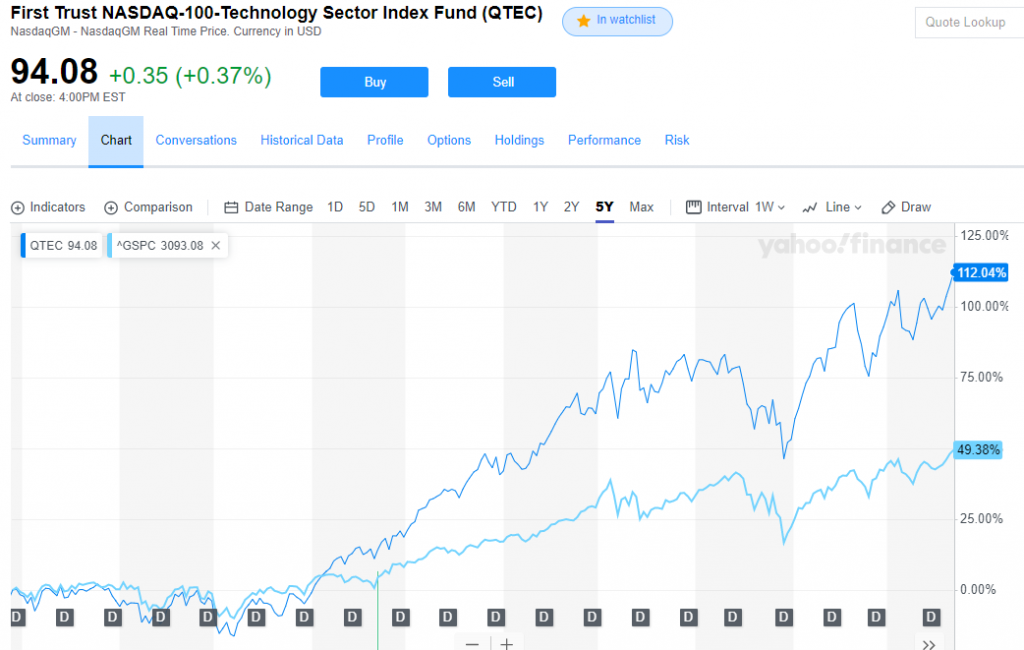

Over the last 5 years, QTEC has outperformed the S&P 500 by over 60%!

Identifying growth-oriented funds such as QTEC and ONEQ have made great additions to my portfolio.

While you should certainly seek professional advice, perform due diligence, and understand the risks associated with investing, perhaps these investments would make a great addition to your portfolio as well.

Investing for FIRE

While reducing the expenses needed to operate your lifestyle is certainly important, this only represents half the equation.

Investing specifically for financial independence is the other part of the battle. While traditional advice to invest in VTSAX or an S&P 500 is certainly solid advice, I wanted more “juice” from my portfolio.

Fortunately, I found this in a combination of individual stock investing and growth-oriented index funds. As always, I’ll continue to monitor my performance. If I begin underperforming the S&P 500, I may consider reallocating the bulk of my investing to this fund.

However, I certainly believe that over the long run, this additional growth (and risk) will allow me to achieve FI quite a bit sooner.