Obtaining the CPA designation is quite a grueling process.

However, becoming a Certified Public Accountant represents the “gold standard” for those in the accounting profession. Surviving the rigor and difficulty proves to potential employers that you have both the commitment and knowledge to succeed in the workforce. Often, your compensation upside and career opportunities will reflect the added value the designation offers.

Even though passing the Uniform CPA Exam is very difficult, exam prep courses are designed to equip you with the knowledge to substantially increase the likelihood of passing.

Every accounting student and professional thinking of going through the licensing process needs to determine if the financial and career opportunities are worth the effort, time, and cost.

Is the investment really worth those three letters after your name? Will I even enjoy being an accountant, or is accounting boring?

The required educational investment

Before even becoming eligible to sit for your first section of the exam, you must meet stringent educational requirements. This often requires an educational commitment beyond the bachelor’s degree’s standard 120 credit hours.

In fact, most states require candidates to complete 150 credit hours at an accredited college or university. Further, candidates must complete specific higher-level accounting and ethics courses tailored to their licensing state’s board in order to obtain the designation.

Many candidates get the additional hours by obtaining their Master’s in Accountancy or Master’s in Business Administration. Getting into a good Master’s or MBA program will require commitment and hours of study for the GMAT.

Clearly, investing in these programs can be extremely expensive.

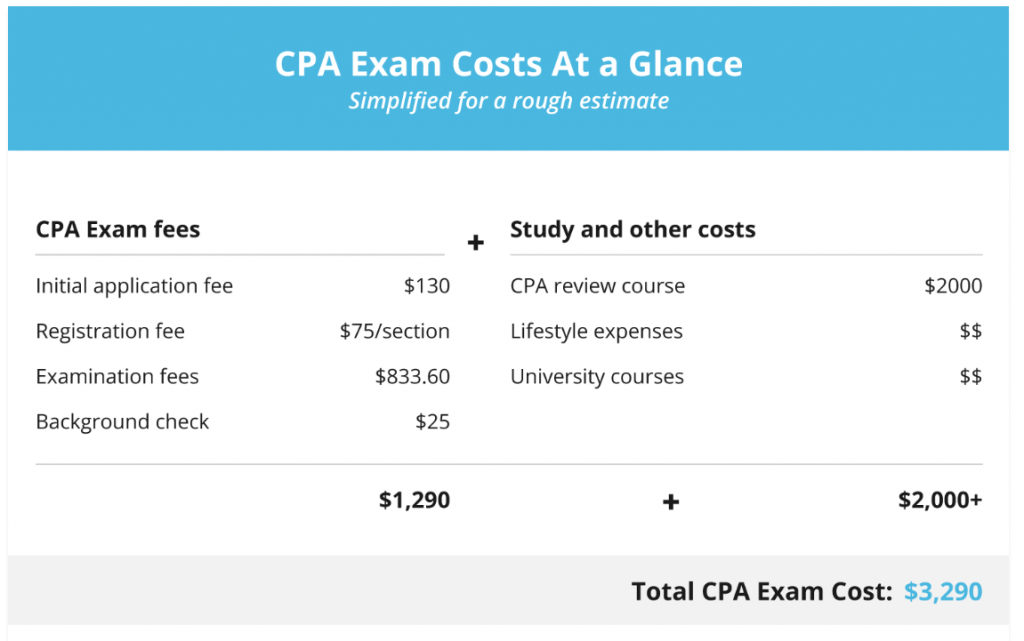

Not only will you have college tuition and living costs, exam preparation materials cost thousands of dollars on top of the exam and testing fees as shown below.

Even with all of these financial investments, there’s still no guarantee of success.

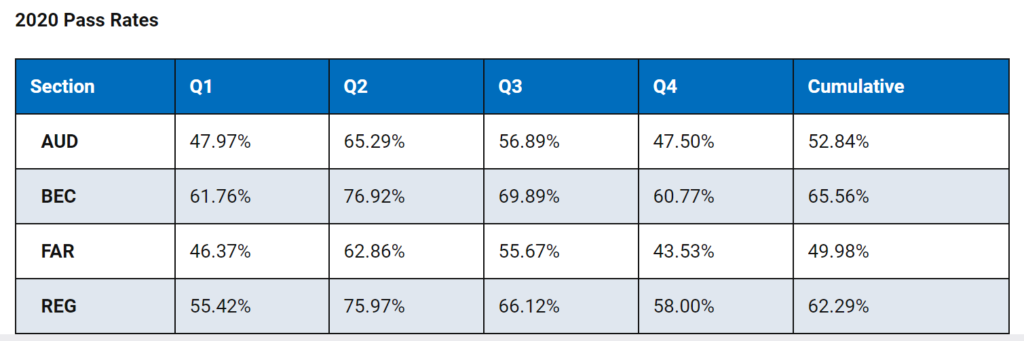

As we will discuss further, the average pass rate for each of the section hovers around 50% per section. Considering there are four sections a candidate must pass to complete the exam, the odds of passing can be daunting.

However, with the right study materials, you can drastically increase your odds of passing.

The CPA Exam Overview

Passing the exam is certainly no accident.

The test is specifically designed by the American Institute of Certified Public Accountants (AICPA) to ensure candidates have the proficiency and skills required to succeed in the accounting world.

During your studies, you’ll gain practical knowledge in the areas of auditing, regulation, financial accounting and reporting, and business economics. Each of the 4 sections must be passed with a minimum score of 75.

However, this is easier said than done.

In fact, the pass rate for the CPA sections is quite low. Each section has an average pass rate that ranges from ~44%-65%. Complicating passing the exam further, all 4 parts must be passed within a rolling 18-month period.

If you pass the one part but can’t pass ALL of the remaining sections within the allotted time, you’re back to square one. If you pass 3 of 4 sections and hit a bump on one section that’s your Achilles heel, you could end up having to retake all of the sections you previously passed.

Therefore, passing the exam takes an extreme concentration of effort and preparation to ensure you have the knowledge necessary to be successful.

Developing a core competency in these areas sets you apart from non-CPAs. Employers understand the value you as a CPA can add!

A Friendly Word of Caution

A career in accounting as a CPA can be very rewarding. However, the work is not for everyone. Often, you are overworked and underpaid – especially, in the beginning of your career.

Before you invest the hours into obtaining and maintaining your CPA license, make sure the career is right for you.

First, identify your dream job and see if there are alternative ways to enter that field. Maybe, your CPA will be helpful. Maybe, there are more direct paths.

As best-selling author Ken Coleman outlines in his book The Proximity Principle: The Proven Strategy That Will Lead to a Career You Love, the best way to land the career you want is build connections and a network with people doing what YOU want to do.

If you love investing, spend time becoming an “Intelligent Investor” by reading books on the subject. If Wall Street is your ultimate goal, find mentors who can help you get there. Soak up all the information you can for breaking into Wall Street.

Perhaps, your ambitions are more entrepreneurial and you want to work for yourself.

Building a business or identifying careers that offer more flexibility than those in accounting and finance may provide for the lifestyle you are looking to achieve!

These tactics will have a much higher ROI than becoming a CPA.

Auditing & Attestation

One of the principle focus areas tested on the CPA exam centers around auditing and attestation. This section focuses on designing and developing audit procedures, executing the audit or review, and issuing audit and attestation reports.

Many CPAs who specialize in assurance work in public accounting firms. These accountants perform independent, external audit procedures to ensure the company’s financial accounts are materially correct. Further, they also certify that the internal controls of some of the largest companies in the world are designed to detect material misstatements and operate effectively.

Auditors are also employed outside of public accounting as internal auditors. These CPAs also test the financial accounts to ensure they are materially correct. Further, they also conduct efficiency and process audits to ensure the company operates efficiently and proper procedures are followed.

For those interested in the areas tested by the Audit and Attestation section of the CPA exam, here is the breakout from Gleim:

Ethics, Professional Responsibilities and General Principles…..15-25% Assessing Risk and Developing a Planned Response…..20-30%

Performing Further Procedures and Obtaining Evidence…..30-40%

Forming Conclusions and Reporting…..15-25%

Regulation (Reg)

If you tell someone you’re an accountant or pursuing your CPA, chances are that their first question probably will be for tax advice.

The Regulatory section ensures that you’ll probably have the answer to these questions and much more! Passing the Regulation section ensures CPAs understand the basics of the legal environment in which businesses operate as well as taxes.

However, the bulk of the exam focuses on the IRS tax code for both businesses and individuals. This focus ensures CPAs have advanced knowledge of the tax code and how taxes impact scenarios for both individuals, corporations, and partnerships.

As you would expect, the skills tested in this section are most applicable for those who work in the tax group in public accounting or in a corporate tax department in industry. These professionals focus on calculating the tax provisions or refund a company or individual can expect to be due. Often, they focus on structuring legal entities or transactions in a tax-efficient manner.

Here’s the Reg section breakdown:

Ethics, Professional Responsibilities and Federal Tax Procedures…..10-20%

Business Law…..10-20%

Federal Taxation of Property Transactions…..12-22%

Federal Taxation of Individuals…..15-25%

Federal Taxation of Entities…..28-38%

Financial Accounting & Reporting (FAR)

As evidenced by its lowest overall pass rate, Financial Accounting & Reporting is the most difficult section of the CPA Exam to pass. This is because FAR focuses on the “nitty-gritty” details specific to the accounting world. FAR tests candidates’ working knowledge of debits and credits and impacts to financial statement accounts.

To increase your chances of passing, investing in a review course and prep materials can end up saving you money and A LOT of time in the long run!

Further, candidates are tested on the required disclosures that accompany the income statement, balance sheet, and cash flow statement. They’ll also be tested on their knowledge of Financial Accounting Standards Board’s (FASB) Codification, and demonstrate how to research the standards.

This section also tests (to a lesser extent) governmental and not-for-profit accounting concepts.

Virtually everyone in the accounting profession uses the concepts tested by FAR. However, anyone responsible for recording or reviewing accounting entries or compiling quarterly and annual reports must understand the material tested by FAR in detail.

Even those in finance department can benefit from understanding the impact of transactions, capital raises, and leverage on the financial statements.

The breakout is as follows:

Conceptual Framework, Standard-Setting and Financial Reporting…..25-35%

Select Financial Statement Accounts…..30-40%

Select Transactions…..20-30%

State and Local Governments…..5-15%

Business Environment & Concepts (BEC)

The “easiest” section (based on the relatively “high” pass rate of 60%) is BEC. In this section, candidates are tested on the basic concepts of economics and financial markets. Candidates must also demonstrate a proficiency in operational accounting.

Those who work in cost accounting or in roles focused on operational efficiency use knowledge tested in BEC on a daily basis. Further BEC is one of the sections that helps “bridge the gap” between the accounting world and other business functions. This section ensures you are a well-rounded business professional.

Here are the main topics tested by BEC:

Corporate Governance…..17-27%

Economic Concepts and Analysis…..17-27%

Financial Management…..11-21%

Information Technology…..15-25%

Operations Management…..15-25%

Who is the CPA designation right for?

The primary target audience for the CPA license is obviously those in the accounting profession.

Accounting and advisory firms, Fortune 500 companies, and even consulting firms employ armies of CPAs. The roles for CPAs vary from tax preparation and financial reporting to financial planning and/or analysis. Even though there are a ton of different types of roles for CPAs within the accounting and finance functions, the work varies in complexity.

For instance, some lower-level accounting roles involve mundane, repetitive tasks. A staff internal reporting accountant may spend most of their day booking and reconciling journal entries and producing schedules for management.

Obviously, these roles can be boring but may not be representative of what most accountants do!

Alternatively, some accountants focus on complex issues and use their professional judgement for decision-making or business analysis. These roles may be centered around technical research, new standard implementation, or even valuation and financial analysis.

Those with the CPA designation typically make up the latter.

CPAs are needed beyond accounting roles

While the Chartered Financial Analyst (CFA) is the equivalent “gold standard” in the world of finance, CPAs can also be found in traditional finance roles. Recovering accountants may find their niche as a financial analyst, in valuation and financial modeling, or even working in transactions.

If you’re accountant wanting to move into finance, consider reading the 3 Proven Strategies for How to Transition from Accounting to Finance.

Because of the flexibility of skills accountants have, employer’s love having CPAs on the payroll.

Depending upon the type of role, you’ll generally see “CPA or MBA” preferred for those higher paying, analysis-oriented jobs. Even though they’re distinctly different, employers understand that CPAs can offer valuable insights beyond the historical numbers.

Therefore, if you’re interested in accounting, obtaining the CPA is a must to advance at most larger organizations. While not specifically designed for the finance function, those who are interested in the finance world can certainly find a benefit in obtaining their CPA license.

A CPA’s expertise in analyzing the income statement, balance sheet, and its impact on cash flows can be exceedingly helpful when combined with advanced Excel and modeling skills.

What about the NUMBERS?

As accounting professionals, we’re all concerned about the numbers. Specifically, will the return on our time and money be worth the investment?

The short answer is YES. Because of the demand for highly qualified CPAs, you will generally be able to command a higher salary.

Let’s explore further.

Non-CPA salary

Clearly, not all accountants are CPAs.

Some of the accounting related roles required in public accounting and industry may not require the skills and knowledge tested by the CPA exam.

While these jobs certainly provide good incomes and work experience, the compensation and type of work is generally pretty different that a typical CPA’s role and compensation.

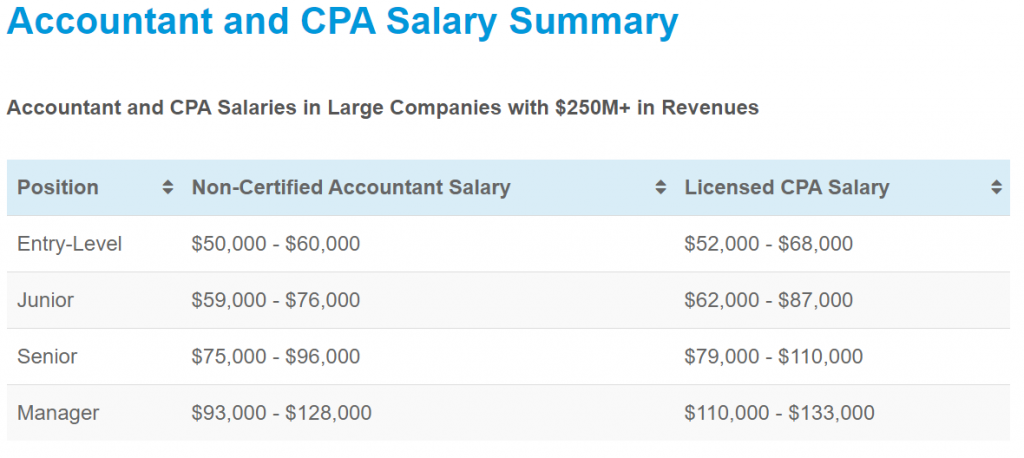

Generally, a non-CPA will earn about 10% less than their licensed CPA counterpart as shown by the graphic below.

How much can you expect to earn as a CPA?

In fact, the average median salary for CPAs is ~$120,000. A newly minted CPA with 1 year of experience earns ~$66,000, and those with 20 years of experience earn ~$152,000. While these are certainly healthy salaries, these figures exclude any bonuses which average ~10%.

Plus, your salary will not be stagnant.

As a CPA, you are in high demand. Therefore, you can reasonably expect standard pay increases above just a cost of living adjustment. The increases vary by firm, industry, and geography. However, most CPAs can expect to earn a 4%-5% annual pay increase (in non-promotion years).

Obtaining your CPA license also provides opportunities for advancement in your organization. According to leading professional services company Robert Half, the CPA license is one of the key certifications to consider if you have C-suite aspirations.

In conjunction with a MBA degree, the combination provides potential Chief Financial Officers (CFOs) with both the accounting and compliance knowledge and broader strategic planning skills.

Since the passage of the Sarbanes-Oxley Act in 2002, the CPA has increased in popularity among CFOs due to the regulatory environment around accounting and financial reporting. In fact, ~45% of CFOs had the CPA designation.

Even if the C-suite isn’t your long-term career goal, the CPA license can help you advance into senior leadership positions while maintaining a higher than average salary and high quality of life.

Passing the CPA exam opens the door for opportunities in accounting and beyond

Because of the practical skills mastered and tested, the knowledge you’ll accumulate will also have utility beyond the accounting profession. As previously mentioned, many CPAs work across a wide variety of finance functions too.

Since accounting is the “language of business,” the CPA designation is your rubber stamp that you can speak it fluently. Even in the finance realm, accounting is an important skill. For many finance professionals, their lack of accounting knowledge (and interest) prohibits them from meeting their full potential.

Even if you’re a CPA working in accounting, plenty of opportunities exist to move into finance. However, the converse isn’t necessarily true for finance professionals.

The CPA designation is 100% worth the investment for those who plan to have long-term careers in accounting.

Although the CFA designation is more distinguished in the finance and investment community, the CPA credential can still be valuable for those who have aspirations in finance. However, obtaining finance-specific work experience or further finance related accreditations may be necessary.

A word of CAUTION!

As a CPA working in Corporate Finance, I can personally attest that the knowledge and skills that I developed from the journey of becoming a CPA has propelled me years ahead in my career.

However, before you invest the time and resources to become a CPA, you must first identify the end goal and the most efficient path to get there.

What is your purpose for work, what problems do you want to solve, and what skills do you need to develop in order to obtain your dream job?

Is your goal to be a Chief Accounting Officer or Financial Controller? If so, a CPA license may be a prerequisite coupled with a decade or two of experience. Obtaining your CPA designation will provide a solid base from which to build your career.

Perhaps, you have aspirations for the C-Suite. While a large majority of Chief Financial Officers once had their CPA license, there is a surprising trend in the rise of non-CPA CFOs. In fact, at the 1,000 largest US public companies, the portion of CFOs with CPAs dropped from 46% to 36% between 2014 and 2019. A strong need for strategy and traditional finance is steadily replacing financial reporting as a “must have” in a CFO’s skillset.

Instead of investing 2-3 years in obtaining your CPA, what if you worked 60+ hours in consulting or finance and used that experience as a launching pad?

In no way is the goal to discourage you from pursuing your CPA if that is a part of achieving your career goals. However, those three little letters will not guarantee success. Only YOU can take control of your career trajectory.

Preparing for the CPA Exam is a tough but rewarding journey

The CPA license has incredible value in the workplace because not everyone has the mental aptitude and dedication needed to pass the exam.

I have personally found more pros than cons in the investment of becoming a CPA. However, passing the exams take a large investment in time and resources. After spending so much time studying, you are still not guaranteed to pass. If you do pass the exams and get your CPA license, there’s no guarantee that it will lead to your dream job in a career you love.

For this reason, it’s vital that you first identify the job you want, put yourself in proximity with those doing what you want to do, and then confirm that obtaining your CPA status will be a valuable tool to achieve your career aspirations!