According to Cleveland Clinic, stress is the normal bodily reaction when changes occur.

Sometimes, stressors come in handy. Stress activates our body’s natural “fight or flight” mechanism. This natural reaction can keep us alert and motivated. This helps us avoid danger. Many times a stressful situation prompts us to find a more conducive or safe environment.

However, we more commonly associate stress with those negative connotations. Prolonged stress is associated with headaches, elevated blood pressure, chest pain, and panic attacks. Eventually, excess and continuous stress can even lead to severe, life-threatening health issues.

Clearly, some level of stress is virtually unavoidable. At some point, we all experience tight work deadlines. We may have a family or financial situation go awry. Ultimately, we all want to avoid those nasty symptoms that can lead to mental health issues and can provoke severe illness.

According to the Houston Behavioral Health Hospital, our occupation is one of the top 3 sources of stress.

If you’re interested in becoming a Certified Public Accountant (CPA), you should understand the stresses inherent with the job.

As a CPA myself, I have experienced the stressful 80+ hour work weeks in public accounting. Our teams worked significant hours under tight deadlines and pressure to ensure the work was finalized on time and under budget.

Conversely, certain days were a breeze. During more relaxed times of the year, I’ve had days with little pressing work. Generally, this allowed ample time to prep for busier times, obtain hours of required continuing education, and even make doctors’ appointments during work hours.

Hopefully, my experience and this article can provide a little insight and can help you decide for yourself if becoming a CPA is stressful.

Let’s dive in!

Stress and our occupations

We all know that some careers are more stressful than others.

Most of us envy the lifestyle of a college professor. We assume that massage therapists and yoga instructors have learned to channel their inner Zen. Generally, there are plenty of careers that are relatively “low-stress.”

Alternatively, we know that active duty and deployed military personnel undergo an enormous amount of stress and anxiety. Often, this leads to lingering effects such as Post Traumatic Stress Disorder (PTSD).

Clearly, CPAs do not deal with life and death situations!

Automatically, the stakes are much lower for CPAs.

However, just because CPAs and accountants don’t “save lives” doesn’t mean there aren’t other job characteristics that induce stress.

Let’s talk about the types of work-related stressors and how that may manifest itself in the accounting world.

What are the most common work-related stressors?

Often, circumstances and issues that may stress one worker to their core may not be stress another whatsoever.

We all have different tolerance levels for stress. Some of us enjoy working under tight deadlines. We may enjoy complicated or challenging work. However, others may want a job that just allows them to “coast” throughout the day. One person may be bored to death performing certain tasks. Alternatively, someone else could find the work exhilarating!

According to BetterHealth Channel, here are some of the most common factors of work-related stress:

- Long hours & tight deadlines

- Changes in work environment or duties

- Job insecurity

- Lack of autonomy/over-supervision

- Boring work

As an accountant or CPA, you’ll more than likely experience one or more of these stressors during your career. Learning to manage these stressors is imperative.

1. Long hours and tight deadlines

For the most part, accountants work in structured environments driven by regulatory agencies and Generally Accepted Accounting Principles (i.e. “GAAP”).

The regulations and reporting requirements impose pretty stringent constraints on when companies must report earnings or file tax documents, the extent of the disclosure requirements, and level of documentation and review.

All of these factors make the accounting pretty laborious and add to the time necessary to complete the work.

Sure, during slow periods, some CPAs probably work ~45 hours per week. Around quarter, corporate accountants may work 50+ hours and a few weekends.

During “busy season,” auditors may regularly exceed 70+ hours per week for multiple months. In fact, nearly 30% of CPAs work more than 70 hour weeks and 90% of CPAs work at least 50 hour weeks during “busy season.”

The constant overtime hours and lack of work/life balance for an extended period of time can easily result in stress.

In fact, according to the American Institute of Certified Public Accountants (AICPA), nearly 98% of CPAs report feeling some level of stress. Nearly 47% are frequently stressed and 11% of CPAs indicate they are at a “crisis point.”

Clearly, the excess overtime hours can greatly impact the overall stress of the accounting profession.

Industry hours and deadlines

Generally, the hours in “industry” (i.e. private or public companies) tend to be better than public accounting (i.e. CPA firms).

In public accounting, the CPAs are both “revenue-generators” and “cost centers.” Therefore, the more clients and hours that are billed by staff, the more the partners of the firm can charge (and earn).

This has a direct correlation to the number of hours worked and the level of stress felt.

According to the AICPA, public practitioners report the greatest number of hours worked and the highest levels of stress among the profession.

During the first 12-15 years of their career, these CPAs can expect to be absolute workhorses. However, the holy grail of “making partner” means you’ll reap extremely lucrative financial rewards.

Conversely, CPAs in industry are generally cost centers.

However, that doesn’t mean the work isn’t valuable. CPAs in industry have unique skills and abilities to interpret financial data. Often, the Corporate Controller, Chief Accounting Officer, and/or Chief Financial Officer are all trusted advisors. Their insight is valuable when business decisions are made. After all, their in-depth understanding of the business and financial impact helps determine the best course of action.

Even though the hours are generally better in industry, certain times of the year typically require more than 50 hours. The hours are typically dependent upon the particular department the CPA works.

CPAs in Corporate Accounting: Internal Reporting

Internal and external reporting are two main departments within the Corporate Accounting function.

CPAs that work in Internal Reporting may be responsible for recording or reviewing accounting entries, preparing schedules for management outlining variances, and reconciling accounts to ensure the general ledger is materially correct.

While Internal Reporting may record and review entries throughout the month, the work generally accelerates during month-end or quarter close. During this period, Internal Reporting must ensure the transactions are recorded in the proper period and flow through to the financial statements.

Because of the volume of work, Internal Reporting accountants may need to work extra hours during these busier times. Depending on the particular company, a CPA in internal reporting may work anywhere from 45 to 60+ hours to “close the books.”

Clearly, the pressure of hard deadlines and overtime can make the job of an Internal Reporting Accountant quite stressful.

CPAs in Corporate Accounting: External Reporting

CPAs that work for publicly-traded corporations must prepare quarterly and annual financial statements and disclosures under strict deadlines.

Generally, External Reporting accountants must wait until Internal Reporting “closes the books” to begin populating the financial statements and disclosures. Often, these CPAs only have a few weeks to finalize their reporting due to the stringent reporting deadlines imposed by the Securities Exchange Commission (SEC).

Because of tight reporting deadlines, CPAs in External Reporting generally must work fairly substantial overtime during these times of the year (i.e. January, April, July, and October). It’s not unusual for External Reporting Analysts to work 55+ hours for quarterly and annual reporting.

However, during non-reporting periods, the hours are much more in line with a standard 40-hour workweek. During their down time, External Reporting CPAs may prepare other required filings, perform accounting research, or gear up for the looming quarter.

Public accounting hours and deadlines

Public accounting is akin to “boot camp” for CPAs.

Most public accounting firms hire recent college graduates eager to learn and accelerate their careers. In the “Big 4” firms, you’ll work with some of the best and brightest in the accounting world. Often, 2-3+ years of public accounting experience is a prerequisite for the more lucrative (and rewarding) corporate gigs.

Public accounting firms specialize in assurance, taxation, advisory, and valuation to help their clients solve complex financial issues.

While most of the larger firms have focuses on growing their advisory practices, audit and attestation services is still the “bread and butter” of public accounting.

These CPAs review or conduct thorough audits of the company’s financial statements and internal controls prior to issuing reports. During “busy season,” working 70+ hours from January through March is fairly standard in the “Big 4.” Even during “non-busy” periods, a 40-hour workweek is rarely the norm in public accounting.

Extra hours and stress

Are the extra hours directly tied to the level of stress many CPAs may face? Maybe not if you enjoy the work.

However, the fact that many CPAs MUST work additional hours to complete their work in the allotted time is a symptom of broader issues in the field of accounting.

Often, accountants and CPAs have deadlines that simply cannot be accomplished within the traditional 40-hour workweek. A material acquisition may close March 30th. Preliminary purchase accounting must be performed on the acquired assets and liabilities by the time first quarter financial statements are issued.

For auditors, they may not receive financial statements until Internal Reporting “close the books” and External Reporting prepare the financials and disclosures.

Ultimately, we all only have 24 hours in the day. Spending 10-12+ hours/day at work means you’re spending less time at the gym, pursuing hobbies and interest, or with family. Over time, work/life balance could become skewed. Your employer may be getting your best while your family and personal interests lag on your list of priorities.

Ultimately, this could cause friction in marriage or relationships. You could experience burnout in your career.

All of these factors could make the work of a CPA fairly stressful.

2. Changes in work environment or role

As human beings, we all appreciate some level of familiarity as we go throughout our days.

Most of us have certain daily habits or routines and may feel off-kilter if something knocks us off track. Major life changes such as a job loss or career change can certainly provoke stress or spin us into a panic.

Is it good to break up the monotony every now and then? Absolutely! New experiences keep life from getting too stale.

However, those of us in the accounting profession are especially vulnerable to experiencing stress when unusual circumstances break up our usual routine.

Fortunately, one of the greatest advantages of earning an accounting degree and obtaining your CPA license is the career stability provided.

The stability of being a CPA reduces the potential for stress

Thankfully, the services that a CPA provides for both individuals and companies is extremely stable.

While the work environment, technology utilized, and even accounting treatment will likely change over time, the profession is unlikely to experience an overnight, sweeping change.

Don’t get me wrong, as a CPA, you still must stay updated on the latest accounting standards. Utilizing the latest technological innovations drives efficiency in your work. Expanding your knowledge certainly allows you to be a greater resource to your company and/or clients.

While developing in all of these areas will help you cultivate a prosperous career, most CPAs probably don’t need to worry about being replaced by a robot, machine, or a new line of source code.

Instead, the role may change incrementally each year and allow CPAs to better spend their time focusing on analytics and “bigger picture” issues.

After all, compiling information and analyzing financial data (with the assistance of technology) will probably always have some level of human effort. The financial expertise of a CPA will probably continue to be well positioned to provide advice to decision-makers and clients.

CPAs are in high demand

As discussed, there’s not a lot of volatility in the roles CPAs fulfill.

Since losing a job can cause stress on your finances and mental health, CPAs are fairly insulated in this regard. In fact, the unemployment rate for accountants range from 1.5%-3% (depending upon the role) as their services are in high demand.

With the CPA license, you’ve signaled to the market that you have the mental aptitude and commitment to meet the stringent requirements of passing the exam. This increases the likelihood of finding a new role even if you are laid-off.

Further most accounting skills are fairly transferable across industries.

Is it hard for a tax CPA to move over to Corporate Accounting? Sure. If you’ve invested 5-10+ years honing your skill-set in one particular niche area, you may not be suited for a totally different segment in the accounting world.

However, a CPA who has extensive oil and gas experience can still prosper in a similar role but in a totally different industry. Maybe, they want to move to financial services or retail. They may experience a learning curve over the first year as they learn the business. Maybe, they will have to accept a job title a position lower in the worst case scenario. Eventually, they can develop the necessary understanding of the business to make decisions requiring judgement and continue on their career trajectory.

By contrast, a petroleum engineer will probably have a much tougher time making the switch into an industry outside of oil and gas.

Therefore, the skills you develop as a CPA are transferable.

CPAs generally work in stable environments

CPAs are generally found in “back office” roles.

Unlike those in sales roles, CPAs aren’t responsible for generating revenue (outside of financial services).

However, in the business world, the work accountants perform is vital to the function of the business. Without accountants, management could not make strategic decisions. Vendors and employees wouldn’t get paid. Banks would not lend money. Investors would not deploy capital.

Thanks to increased regulation and compliance stemming from the Sarbanes-Oxley Act of 2002 (SOX), financial reporting and a company’s internal control processes have become heavily scrutinized.

In order to maintain their share listing on the exchanges, an army of accountants must ensure the income statement, balance sheet, and cash flow statement are all materially correct. Since these statements reflect all of the transactions the company has made during the period, quite a bit of work is performed to ensure they are complete and accurate.

Thanks to the level of rigor of financial reporting and the importance of “knowing the numbers,” the environment in which accountants work will remain strong.

3. Job insecurity

Nearly 60% of Americans have been laid off or experienced a gap in their employment history.

The stress that a job loss causes goes well beyond what you feel personally. After all, losing an income impacts the entire family.

If you haven’t prepared, you and your family may be forced to turn to family, friends, or consumer debt to survive. All of these actions can strain your relationships and certainly induce stress.

Thankfully, working in the accounting world can help mitigate stress caused from job instability.

The employment statistics favor accountants

As previously discussed, the macroeconomic job environment for accountants is strong.

According to Robert Half, the unemployment rate for accountants and auditors hovers around a staggering low rate of 2%. By comparison, the overall U.S. unemployment rate is around 3.6%.

Ultimately, this means there are more job openings and positions for accountants than those available to fill the roles. This is great news if you have the necessary skills that are in high demand!

Plus, the need for accounting services is projected to grow.

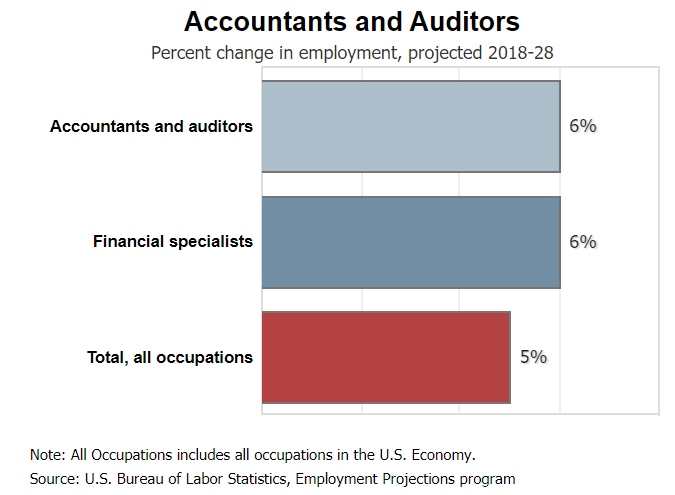

According to the Bureau for Labor Statistics (BLS), the demand for accountants and auditors is expected to grow around 6% from 2018 through 2028.

Much of the growth is tied to the overall economy. As businesses grow, the financial services and expertise that accountants provide will also benefit.

While these statistics represent the demand for accountants overall, those who obtain their CPA will benefit even more.

All about the Benjamins…

Further, a career in accounting can be fairly lucrative.

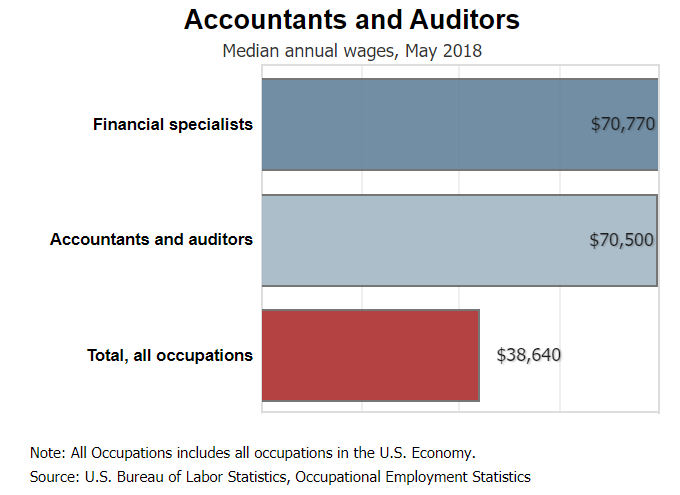

The median salary for accountants and auditors is $70,500. By comparison, the overall median wage in the United States is under $40,000.

Therefore, the median pay for all accountants and auditors is 82% higher than the median for all occupations.

However, this number also includes relatively low paying accounting roles such as bookkeeping, tax collectors, and accounting clerks that artificially depresses what you could expect to earn as a CPA.

After all, only 50% of accountants are licensed CPAs.

While bookkeeping and accounting clerks play vital roles in the accounting department, many of these roles do not require a 4-year degree (much less a Master’s/MBA or CPA license).

By contrast, CPAs are typically found in more specialized (and lucrative) areas of the accounting and finance functions.

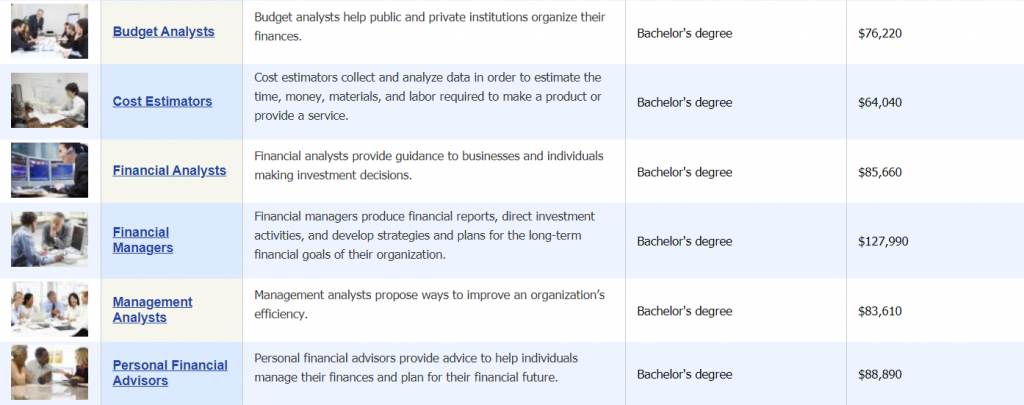

For example, Financial Analysts earn median pay of $86,000. Financial Managers bring home just under $130,000.

In fact, according to the Journal of Accountancy, the median pay for Certified Public Accountants is $120,000 (excluding bonuses).

Obtaining your CPA license will certainly be a difficult process. However, the financial rewards and job stability helps reduce overall stress.

The higher-than-average compensation that CPAs enjoy allows for greater flexibility in your personal life while providing a high quality of life for your family.

4. Lack of autonomy

Another cause of stress in the workforce is the lack of autonomy or independence.

A job in which an employee feels helpless or controlled can lead to high stress levels and even health issues.

None of us want to be micromanaged. We all desire some level of flexibility and choice in our work responsibilities. When important life or family events come up, we should have the ability to attend these functions without experiencing repercussions from our work or boss.

However, most accounting-related work requires multiple levels of review. The documentation requirement is often tedious and laborious.

Sometimes, this leads CPAs to the feeling micro-managed or as if any remaining autonomy has been stripped away.

Improving autonomy in the profession

As previously discussed, CPAs are in high demand.

An increased regulatory environment has driven much of the increased work, low unemployment rate, and the lack of qualified individuals to fill vital roles in a booming economy.

These factors contribute to the excess overtime hours required over certain times of the year.

Not only do the excess hours induce stress, the regulatory environment and complexity of the accounting rules requires a heavily scrutinized process to be continually evaluated and “signed-off” by management.

In turn, CPAs must document and retain vital processes and procedures as evidence of review.

Often, determining the accounting treatment and actual numbers isn’t necessarily the “hard part.” However, most of the work day can be spent documenting the processes, procedures, and support for the accounting conclusions.

After all of the work is completed and the supporting documentation compiled, the review process begins.

In order to ensure the proper conclusions have been reached, each level of management must review and certify the work. After their comments and questions have been answered and the documentation has been properly updated, the work flows to the next supervisor and the “sign-off” process continues.

Often the Senior Managers, Directors, or Partners (in public accounting) have other priorities and the work inevitably stalls. Sometimes, this leads to “fire drills” if there are last minute issues or questions identified.

The lack of control in the entire review process for most accounting departments and public accounting teams often leads to stressful situations. Much of the workload and conclusions are not in control of a single person.

Instead, the process relies on multiple levels of overworked and stressed individuals. Therefore, many CPAs feel immense pressure and stress because of the factors outside of their control.

Improving flexibility

For the most part, accounting is not known for being very flexible. Sure, accounting requires judgement within certain parameters. However, no employer wants the “creative accountant” type unless they are willing to risk becoming the next Enron.

During several periods throughout the year, the workload drastically increases due to the financial reporting requirements or other internal deadlines. This means CPAs lose their independence and autonomy in their own schedule.

Often, the hours can extend well beyond 5PM into the early morning hours. CPAs could be required to give up their Saturdays and Sundays just to ensure the work is completed.

In an effort to retain Millennials and improve stress levels in the workforce, many firms and companies have implemented programs to increase flexibility.

Some companies and firms allow individuals to occasionally work from home. Managers may promote flexible work environments and allow for doctor’s appointments or errands to be done during normal work hours during slower periods (as long as the work still gets completed). Some firms have increased paid time off or vacation hours in order to ensure their employees can recharge after a grueling client or schedule.

Identifying employers who are making a concerted effort to implement these programs is key if work-life balance and flexibility is important to you.

Working with your employer, setting expectations for what you are willing to sacrifice in your personal life, and shaping the trajectory of your own career is key to limiting stress.

5. Identifying work that excites you

Let’s be honest here, most people probably will not find 100% of the work CPAs do exciting.

Digging into the financial details and ensuring accounts balance is tedious (and often not rewarding). Sitting in a cubicle or office all day can leave you longing for fresh air and social interaction.

Unfortunately, boredom and lack of passion is another trigger for stress in the workplace.

But… why does boredom induce stress?

As humans, we all long for purpose in our lives. We want to wake up every day energized and knowing that what we do matters.

However, when we feel like our work has little meaning or importance, we lose our sense of dignity and even self-worth.

Often, we may feel like routine work has become stale or doesn’t really matter in the big picture. We may no longer feel challenged and growing in our careers.

When we feel like we’ve stagnated in our career, we can become bored and discontent with our current job. We may not feel like our employer values us and desires for us to grow professionally. In return, we may lose our drive to perform or put in the extra effort required for that promotion.

Ultimately, our work suffers which may guarantee that stagnant outcome.

Combating boredom as a CPA

Without sugar-coating or glorifying the work of a CPA, I can personally attest that certain aspects of the work CPAs perform within the accounting function are quite boring.

However, some work we do is relatively enjoyable. If you find niche work in the accounting field you enjoy, you may not feel like you are even at work.

The relative excitement is purely dependent on your interests and passions, role and responsibilities, company culture, and fellow employees.

You may be interested in more of the valuation and finance work. If you enjoy working with models, plenty of CPAs work alongside other finance professionals at valuation firms compiling discounted cash flow (DCF) models. If you want to work in M&A, the CPA/MBA combination with relevant work experience could open plenty of doors.

Maybe, you want to work with individuals and solve their personal finance issues. Obtaining your CPA license provides the knowledge necessary to provide a well-rounded perspective on taxation and can compliment other certifications such as the Certified Financial Planner (CFP) designation.

Can accounting be boring? Absolutely. If you obtain your CPA and take a job in a certain role that isn’t in alignment with your interests, you will probably hate your job.

Ultimately, this boredom and disdain for your work will cause stress and make you miserable.

However, the CPA license opens doors beyond accounting for those interested in other areas of business. The knowledge and experience of accounting may give you an extra tool in your arsenal for whatever route you choose.

Public Accounting

Public accounting is notorious for being “boring.”

Very few people in this world enjoy pulling sample sizes, invoices, and documenting processes in tedious detail. For some, the nuances of the tax code or IRS regulations simply doesn’t get them excited.

Further, nobody wants to work until 10PM or later just to put together some obscure memo on why a certain account or tax treatment is higher risk and more work must be performed.

However, public accounting still provides valuable experience for those just starting their career.

As a new college graduate, you will be thrust head first into the “deep end.” It’s sink or swim. All of the overtime hours provide for twice the hands on experience in half of the time.

If you work with a Big 4 firm (EY, KPMG, Deloitte, PWC) you will work with extremely smart peers and develop close relationships as you struggle through “busy season” together to meet deadlines. Statistically, most of these individuals will land in an industry role. Because of your experience in public accounting, your network of colleagues will be greatly expanded. Perhaps, this could lead to landing your dream gig.

Industry

Depending upon the role, industry will probably be relatively more exciting than public accounting.

While the type of work (and hours) will probably drastically improve from public accounting, the corporate culture tends to be a bit skewed to an older generation with more regimented/outdated processes.

This can often feel stifling at times.

By contrast, the vast majority of the workforce in public accounting is under the age of 30. This provides a different level of energy and social experiences outside of the actual work hours. In public, your experience is dependent upon which team and the client(s) you work on. If you don’t like your team or client, you can simply request experience elsewhere. More than likely, scheduling can find a need that suites your interests.

In industry, you’re much more pigeon-holed.

You will work with the same people every day. More than likely, your team will be relatively small. You probably only have one direct boss. If the relationship sours, your life could be miserable.

In public, you’re bound to be “diversified” among several bosses. This can be both a blessing and a curse.

Finding the right role to have an exciting and fulfilling career

The opportunities in business for CPAs can be quite limitless.

If you hate traditional corporate accounting, identify areas or roles that can give you experience to eventually land that dream role. You aren’t doomed to working in accounting just because your are a “Certified Public Accountant.”

The AICPA and other professional organizations offer plenty of additional certifications for those interested in finance-oriented roles. These programs can compliment the CPA license. In combination, you can stand out when you apply for those analytical positions that intersect your passions.

After all, finding work that you are passionate about is key to combating boredom. Identifying where your passions, interests, and proficiencies intersect can lead you to a rewarding career.

Will you have days or periods of time where you become bored? Yes, more than likely you won’t love your job every second of every day.

However, if you find the work that is meaningful to you, you can avoid getting bored at work. This will help you drastically reduce stress in your job as a CPA.

So, is being a CPA stressful?

Hopefully, you have a better understanding of the 5 primary causes of stress in your work and how these relate to a career as a CPA:

- Long hours & tight deadlines

- Changes in work environment or duties

- Job insecurity

- Lack of autonomy/over-supervision

- Boring work

The bottom line is YES, being a CPA is certainly stressful at times. CPAs generally work in a heavily regulated industry with strict reporting deadlines. Often, this leads to regular overtime work. The general accounting work may be boring to most people. Further, the lack of autonomy driven by the review and documentation process could be a trigger for additional stress in our work.

The result: STRESS!

However, other aspects offset much of the stress. As a CPA, you will inevitably be in high demand. This results in a low unemployment rate and comparatively lucrative job prospects as your career progresses. These factors provide for job stability and allows you to have more control of your career path.

Overall, your stress levels will depend on your own stress tolerance, your personal passions and interests, and the corporate culture in which you are employed.

Remember, if you do begin to feel excess stress, talk to your superiors about improvements that can be made. After all, your health and well-being is more important that any debits or credits. Plus, because of the tight labor market, many employers are doing all they can to retain and attract talented CPAs.

Often, you can negotiate a more flexible schedule, better pay, or a better work environment to reduce stress. However, because of the relative importance and complexity of the work, stressful situations are virtually unavoidable for most CPAs.