For newly minted accountants and advisors entering the workforce out of college, the “Big 4” firms offer some of the most coveted spots in the industry.

Over the last several decades, these firms have evolved to meet the growing demand of clients and the increasing complexity of global business. Today, their expansive services go beyond traditional accounting and reach into the world of M&A, valuation, legal services, and consulting.

Through a series of mergers, Deloitte, PricewaterhouseCoopers (PwC), EY, and KPMG have consolidated much of the market in these niches.

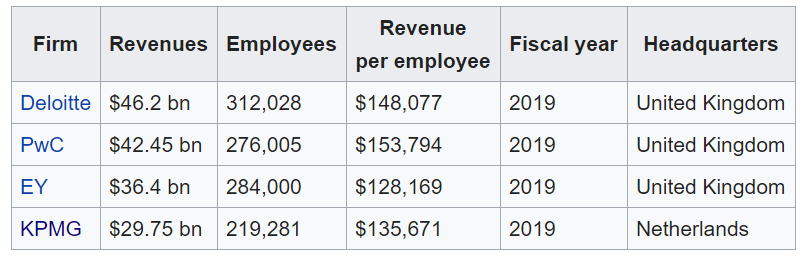

Combined, these firms generate over $150 billion annually and employ a workforce of over 1 million worldwide.

What services do these firms provide?

The Big 4 offer a wide spectrum of financial services and specialties. Each firm and individual office location has certain specialties tailored to meet their local engagement needs.

However, there are 3 primary categories their services are generally grouped: audit/assurance, tax, and consulting/advisory.

For each firm, advisory services comprise a significant amount of total revenue. These services generally differ from traditional “management consulting” where Bain, McKinsey, and Boston Consulting Group dominate.

However, the Big 4 provide niche advisory services that are still higher margin when compared to traditional accounting services. This is because the “advisory” practices are highly specialized accounting and finance-focused areas.

Further Reading: 5 Reasons Accountants (CPAs) Should Know Financial Modeling

For instance, each firm has a valuation practice that issues fair value opinions for clients exploring strategic alternatives – whether acquisitions or divestitures. In conjunction with fair value opinions, these groups may also perform purchase price allocations or impairment calculations.

Financial Due Diligence (FDD) is another service area the Big 4 provide. Before executing on a transaction, the acquirer may want to ensure the target company’s financials are not fabricated or appropriately reflect GAAP. FDD groups facilitate the transactions by examining the quality of earnings of the target company. Further, specialized groups within FDD also evaluate the tax and legal structure to maximize returns. When a company divests or spins-off a business, these groups help determine the “carve-out” financials of the specific segment.

Given the volume of market transactions, these services are highly valued and in high demand.

The Big 4 Revenue Summary

Subsequent to the collapse of Enron and ensuing regulatory environment, the biggest driver of revenue for each firm has been the assurance practice.

By performing audit procedures on the company’s financial statements and internal controls, auditors are able to statistically prove the company’s financial statements are materially correct. Essentially, this means investors and creditors can trust the company’s financial reporting. With so many public companies, this is clearly a cash cow for the Big 4.

Plus, there is a high barrier to entry. Most audit committees of Fortune 500 companies require the appointed auditor to be one of the “Big 4.” Further, changing auditors is a huge undertaking. Not only does it give a negative impression to the market, there can be growing pains. Getting new audit staff and firms comfortable and up-to-speed with the business takes time. By contrast, a seasoned audit team understands the client better and how to efficiently perform their audit with minimal business impact. For this reason, companies generally don’t mind paying more each year for the same service.

However, audit is a mature service line. Fewer companies are coming public and many companies are staying private longer. Sure, large private companies still generally require audits. However, the price tag for a private company is much lower. Most do not require the thoroughness of a public audit. Plus, the internal control environment is not scrutinized as heavily. Further, smaller public companies may also employ regional or national audit firms which increases competition (and may lower fees/margin).

Therefore, each of the firms has re-entered the consulting game and expand their advisory services. For good reason: consulting is much more lucrative.

However, not every Big 4 firm is created equal when it comes to their sources of revenue.

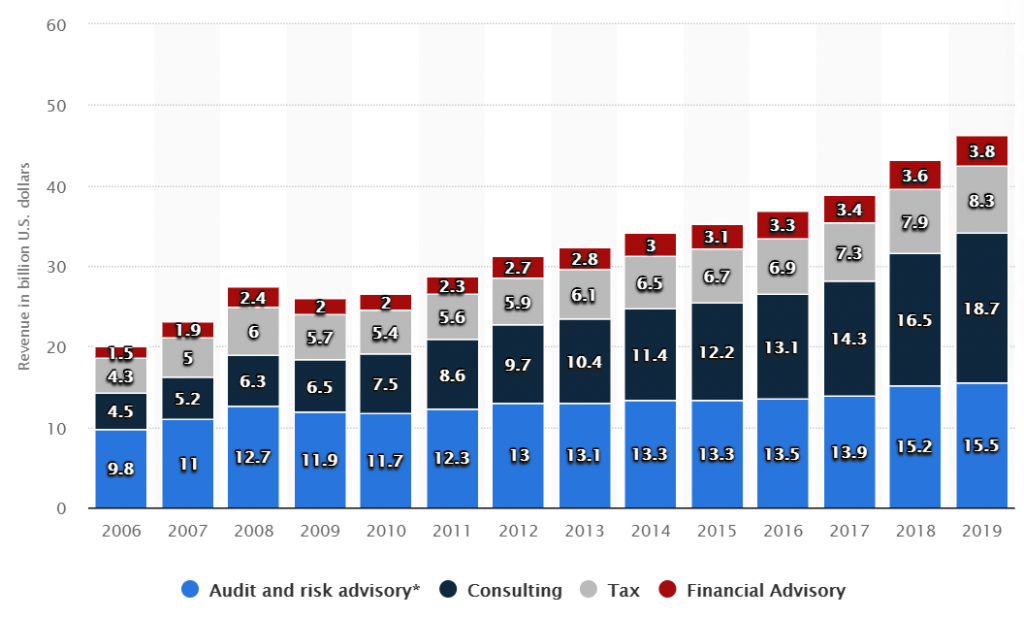

For instance, Deloitte’s reputation centers around their consulting services. Even as other firms divested of their consulting practices in the wake of the downfall of Arthur Andersen, Deloitte kept their consulting practice in-house.

As such, Deloitte’s revenue is skewed towards their advisory and management consulting. In 2019, over 40% of their revenues came from these activities. Because of stringent independence requirements, only ~33% of revenue came from audit. This provides fewer restrictions on the clients who engage for their lucrative advisory practice.

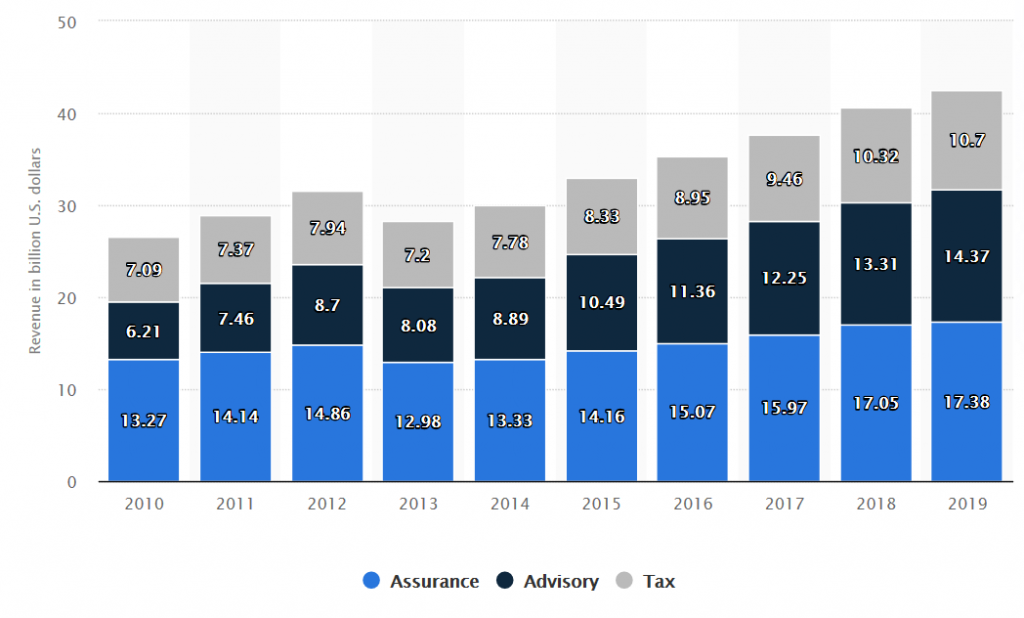

In 2019, ~38% of KPMG’s revenue came from audit, ~40% from advisory, and the remaining from their tax group.

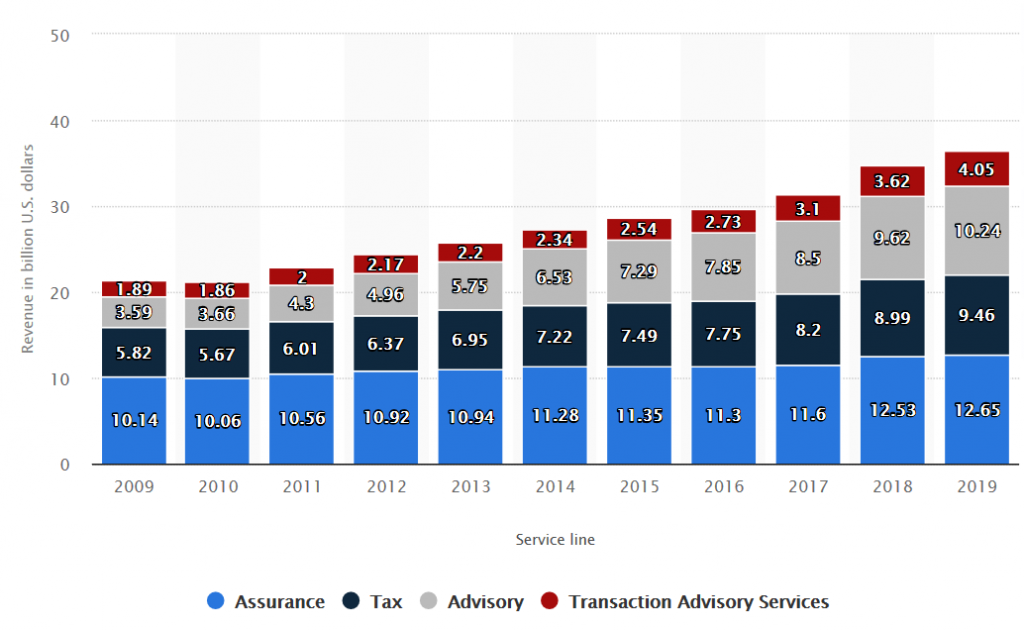

While EY still has a significant advisory practice, their focus tends to be concentrated in assurance (~35%) and tax (25%) services when compared to the other firms.

PwC also has a focus on traditional audit services with ~41% of revenue coming from these activities. However, PwC still has a significant advisory practice that contributes to ~34% of revenues.

Working at the Big 4

Your experience at the Big 4 will largely depend on where you live. The local market focus and your service line impact the type of work you do and the clients you work on.

Your city often plays a key role in your experience

For instance, each firm has a significant presence in major hubs such as New York City, Atlanta, Chicago, Houston, and LA. The culture for local offices in the same city will be similar. However, the culture within the same firm can vary drastically across cities.

This is because each firm has similar clientele and recruits from the same target schools in different markets. Just like each city has its own “vibe,” the firms will often have similar feels.

If you choose to live and work in NYC, your clients will largely be focused on the financial services industry. By contrast, if you work in Houston, your clients will largely be concentrated in the energy industry. If you work out of one of the LA offices, your local market will probably be concentrated in technology and entertainment.

For the most part, your local office takes the culture of your local city and clients.

In New York, you may be expected to dress more formally and work longer “finance” hours. In LA, your clients’ office environment may be more casual. As such, you will probably be permitted to wear dressy/business casual if your client is less formal.

In some middle markets, there may only be one or two firms with a presence in your city.

Often, smaller offices will serve only 2 or 3 larger/public clients. Therefore, these offices can be much smaller and have a more familial atmosphere. After all, there’s a good chance you will meet all 50-100 people in these small offices.

By contrast, the Big 4 in larger cities have 1,000+ employees. It’s virtually impossible to get to know people outside of your team(s) or start class. Sure, there are plenty of happy hours, but you will often find yourself hanging out with your same circle.

Larger offices tend to have a much more “corporate” feel. Chronic under-staffing coupled with more transactions/available clients, and a scheduling team that views you as a number can mean longer hours. However, there’s often more opportunity for promotions or new experiences.

In smaller markets, you may be required to travel.

If you think a small city will be comprised of 40-hour work weeks, think again. While you will probably work fewer hours overall, you’ll still endure the horrors of “busy season.”

If there are only a few, smaller engagements in your city, you may also be required to travel to ensure you are hitting your “utilization rate.” The Big 4 carefully monitor your “utilization” or how many hours you work on specific clients. After all, YOU are a revenue-generator AND a fixed expense.

Therefore, there’s a good chance you’ll feel the squeeze of being overworked and underpaid to maximize profits for the partnership. If you’re in a smaller market, you will probably find yourself traveling throughout the year.

Ultimately, where you choose to live and work will play a huge role in your experience.

Your service line: audit, tax, or advisory

Another huge factor that drives your Big 4 experience is your service line.

Even though each firm tries to differentiate between their services, each largely employs similar techniques and processes to achieve their clients’ goals.

For instance, auditors must follow Generally Accepted Auditing Standards (GAAS) to ensure they appropriately document and report on their clients’ applicable financial reports and internal controls. This leaves little room for creativity. However, each firm will have refined processes under this auditing framework. The firms invest millions of dollars into training and tools necessary to conclude on and issue audit reports.

For those in advisory, standardized valuation procedures are in place to ensure uniformity within the profession. For those in tax, regulatory and IRS guidelines drive your decisions.

The Audit Busy Season

Working for the Big 4 ultimately means enduring long hours over extended periods of time. Each service line will have busier times.

The busy season for auditors occurs from January – March and can even extend into April. As you progress to manager and beyond, you may even pick up a 6/30 year-end client. This means your busy season could easily extend into July/August.

What does busy season look like for auditors?

Busy season consists of 70+ hour weeks, working 6-7 days per week on end. Clearly, this can cause an immense amount of stress.

Further Reading: Is Being a CPA Stressful?

During my experience, we generally worked from 8/8:30 until approximately 11PM. This was the routine Monday through Thursday. On Fridays and Saturdays, we worked an “abbreviated” 8 hour day. I was fortunate that my engagement was relatively “easy” as we didn’t work on Sunday until a few weeks before the filing deadline.

Plus, I was on one large, public client the entire year which kept me from enduring multiple back-to-back busy season clients.

However, other colleagues experienced much harsher realities in their work.

For other engagements, they worked into the early hours of the morning even on weekends. Some juggled multiple clients at the same time. When one client filed, the late nights didn’t end. Instead, they had to work to play catch-up on their other audit that had fallen behind.

Often, the life of the auditor is just one, long “busy season.” As soon as the audit is done, quarterly reviews must be performed. As soon as Q1 is finalized, planning and interim work must be done. Along the way, internal controls must be observed, tested, and documented.

The reality is there is little time to “coast” in the audit world.

The Tax Busy Season

Just like auditors experience a “big push” January – April, those who work in tax can feel similar pressures during this time.

Many tax accountants work alongside the audit team to ensure the provisions and disclosures correctly reflect applicable standards and disclosure requirements. Often, this requires they work similar hours as auditors.

Other tax CPAs also spend countless hours preparing and reviewing client tax returns during the January – April time-frame. As extensions are filed, the busyness could pick back up later in the year. Corporate tax returns can obviously be extremely complex and time-consuming to prepare.

For instance, GE filed a 57,000 page tax return in 2011 and paid no income taxes for that year. Clearly, that took an army of tax CPAs working overtime to prepare.

Advisory Busy Season

Unlike audit and tax, Big 4 advisors and consultants generally do not have a set “busy seasons.”

Although, some groups that perform valuations for financial reporting will be inundated with audit assist requests during the audit busy season. This can add many hours to the workload.

Instead, advisors and consultants generally work longer hours at more random times throughout the year. You may be staffed on an engagement for 2-3 weeks and be required to work 50-60+ hours with little notice in the middle of the summer.

However, when things are slow, you could literally have nothing to work on and/or be unassigned. This may lead to periods of time where you work a fairly standard workweek.

Overall, advisory is much more project-focused and dependent on deal flow. Because of this, the hours can often be unpredictable but probably average ~50 hours/week.

Why the Big 4 may be worth the long hours

For most of us, working long hours for fixed pay isn’t worth it longer term.

As a new hire, your hourly rate can be near minimum wage in some states during the peak times. Further, many CPAs don’t find the work engaging. To make matters worse, you may be surrounded by peers that complain frequently or have sour attitudes.

After all, nobody WANTS to spend 80 hours doing boring, monotonous tasks that don’t seem to add value.

So, why on earth would anyone stay more than 5 minutes at these firms?

The rewards can be great long-term

Why would anyone stay knowing the pay starting out is low and the hours are long?

Grinding out the years until you make partner (in 12+ years) can be a huge financial windfall. While 12 years is a long time, newly minted partners could easily be in their early-to-mid 30s. This means they have 20+ years to rake in the dough and retire with a pension and massive nest egg.

Partners at Big 4 firms can easily make $250,000 in their first year and average over $1 million annually later in their career. After all, the average partner at most Big 4 makes ~$700,000.

Clearly, this is a big carrot that is dangled in front of unsuspecting new hires. The dream of one day making partner and cashing in is hard to resist. After all, there are few other jobs (especially, the accounting profession) where you can make that much money.

Further, the exit opportunities for a seasoned partner can be even more lucrative. After all, the deal would have to be very enticing to give up such a cushy role. Therefore, most partners only leave to become C-level executives at large companies.

Often, ex-partners can easily clear $1M+ in total compensation in these roles. In addition, they will probably lower their total hours and focus on maximizing the profitability of a single company rather than servicing multiple clients.

Even if gaining entrance into the partnership isn’t on your horizon…

Putting in a few years at the Big 4 is a good way to build up your resume and gain valuable experience.

While the Big 4 aren’t known for investing in their people via salary and bonus, they do spend millions of dollars in training and development.

Most lucrative accounting-related exit roles have a public accounting prerequisite. Often, their preference is the Big 4 since most hiring managers in technical groups at the F500 are alumni of the Big 4.

Even if you work in an advisory group, employers understand the value of seeing a wide variety of clients during your time.

Further, the Big 4 have the ability to hire and train the “best and the brightest” in the financial services profession. Essentially, corporate America understands that these firms have pre-screened their future hires, trained them extensively, and conditioned them to work long hours for little pay.

Instead of investing in a new hire straight out of university (who is untested), they can poach a Big 4 candidate who already has their CPA and 2-3 years of work experience. Because the Big 4 pay is generally below market for industry, a 20%-30% pay bump is often enough to win over a candidate looking to escape the brutal hours.

As an added bonus, their 2-3 years of experience is really like working 3-4 years in a normal job thanks to all that unpaid overtime!

In the end, working at a Big 4 accounting and advisory firm can be a great place to start your career. You will inevitably work long, grueling hours. At times, you’ll probably regret your decision. However, working at a Big 4 firm can be a great long-term investment whether you choose to stay and make partner or find another opportunity outside of public accounting.