Global growth worries stemming from the novel coronavirus have shaken global markets. The possibility of a worldwide pandemic has caused uncertainty around supply chain disruption and consumer spending in the wake of the virus’ spread.

Stocks have precipitously dropped nearly 15% from the all-time highs of February 19, 2020 to the last trading day of the month. As investors look for safety, bonds have surged bringing the yield on the 10-year Treasury to below 1.2% – a record low.

So, what can we do to preserve our capital? Is this a buying opportunity or just an omen of markets to come.

1. Check your emotions at the door

We’ve all heard the old adage, “Personal finance is personal.”

When it comes to our money, we simply hate losing money. The theory of Loss Aversion has quantified that the pain of loss is 2x the enjoyment we receive for an equivalent gain. Therefore, our fear and pain of loss can cause us to make irrational decisions during sudden market declines caused by the coronavirus.

However, when it comes to investing, we must make decisions without these emotions. Fear and greed can both be enemies of successful investors.

In the heat of market volatility, avoid making any big decisions based on emotions. Instead, wait for calmer markets and for that sinking feeling in your gut to dissipate. Often, this can help you avoid making any drastic moves that will keep you out of the market’s inevitable rebound.

Similarly, being greedy during sharp market declines may not be the best strategy either. Sure, market declines can offer a great opportunity to steadily add to positions. Even Warren Buffett says to “be fearful when others are greedy and greedy when others are fearful.”

However, “backing up the truck” at the first sign of a market correction can leave you will little cash on the sideline to take advantage of further declines. Instead, continue dollar-cost-averaging into your retirement accounts. If you have extra cash, identify certain points at which you’ll leg into positions.

Adding to positions during market drops

While our first instinct may be to sell and avoid the potential for further losses, this is rarely a good long-term strategy. Instead, adding to positions at certain quantifiable points can help keep emotion out of the investing game.

For instance, when the market is down 10%, you could put 25% of your extra available cash balance for investing to work. If the market declines another 5%, add another 25% to your positions. When the market inevitably enters bear market territory (down 20%), put another 25% of your initial cash total to work.

With your remaining cash balance, you have a few options:

Keeping a minimum cash position at all times

You can continue holding as a minimum cash reserve. Always having a cash position in your portfolio could help you sleep better at night. However, you should have an emergency fund of 3-6 months of expenses saved elsewhere in addition to the cash in your brokerage accounts. Preferably, hold your emergency cash reserves in a high-yield savings account.

Waiting for further pullbacks

Alternatively, you could hold cash in anticipation for even deeper declines. With your remaining cash balance, you could wait for the off-chance of another 5%-10% decline. If/when the market reaches a 30%+ decline from recent highs, you could choose to put the last of your cash to work. After all, buying in tiers lowers your overall cost basis. However, you must remember there’s a pretty high likelihood the market may not ever reach a decline of 30%+. Even so, having available cash to put to work at lower levels is a disciplined strategy.

Waiting for a market turnaround

Finally, you could wait until the market actually rebounds to a certain price. After all, catching a “falling knife” can be quite difficult. Since the market generally stays at or near its all-time highs, waiting and buying on a rebound may be a prudent strategy. If you’ve legged into positions at certain marks (i.e. down 10%, down 15%, down 20%), you may want to wait until news changes and the market begins to act more positively.

For instance, if the market is down 20%, you may want to wait until a change in circumstance causes the market to rebound 10%. At this point, the market is still down 10% from recent highs. However, as the drivers of the market have shifted positive, you can reasonably expect to continue moving higher. At this point, you can put the remaining balance to work to take advantage of the market’s historical trend of staying at or near all-time highs.

2. Keep investing for the long-term

Given the extreme volatility caused by coronavirus fears, now would be a great time to reaffirm or reassess your long-term strategy.

Anyone can make money in a bull market. Over the last 10 years, markets have steadily appreciated. Sure, there have been a few periodic corrections. However, the trend has been largely positive.

This has obviously been great for investors. The issue is this can cause mass complacency.

Valuation of the S&P 500 and Nasdaq components have become increasingly stretched relative to historical trends. Bond yields are at historic lows with some global rates yielding negative rates. Many would argue the market has been “priced for perfection.”

This exuberance can often lead to overvaluation and set up investors for quick ride down on any bad news. Based on the sudden and drastic declines, the coronavirus fears was just the sensationalized news needed to topple markets in the short-term.

Your investing purpose

Even in light of the coronavirus fears and market correction, consider your purpose for investing and how stocks fit into your long-term investing strategy.

If you’re investing for retirement, you likely have a 10+ year time horizon. Even if you are currently retired, you likely need a portion of your portfolio to be invested to sustain your needs in for the next 10-20+ years.

According to various studies, no other asset class can compete with stocks over longer durations. Sure, there will be volatile times (just like now). However, the declines will soon reverse. Markets recover, and patient buy-and-hold investors will be rewarded.

If you’re prone to panic, consider why you are fearful

Perhaps, the reason you are prone to panic is that you are investing money that you need in the next 5 years.

Often, when the market is rocketing higher, we can end up jumping on the bandwagon and investing money that we will need in the next few years. When the market suddenly drops, we realize that those gains did not come without additional risk. This can force panic selling as we try and recover the money we need in the short-term.

Therefore, the stock market is certainly for long-term money.

Historically, the overall market has averaged 10% annually. However, over any 1 or 2 year period, there is a chance you can lose money. In fact, market corrections similar to the one induced by the coronavirus occur every 8-12 months.

If you need your money in the short-term, you could be forced to turn your paper losses into realized losses. Obviously, this is not ideal. Instead, you would be much better of holding and waiting for the market to rebound. After all, markets usually rebound out of correction territory after 54 days.

If you buy high and sell low, you will drastically underperform a buy-and-hold investor who dollar-cost-averages every month. If market corrections cause you to lose sleep, consider holding a little more in cash to take advantage of the inevitable pullbacks.

A sudden market decline can really be an opportunity to test that your portfolio matches your long-term strategy, goals, and risk tolerance.

We’ve experienced global market scares before

Over the course of history, the market has reacted to a wide variety of sudden shocks. However, despite the volatility, the market has always barreled higher.

The market has endured the Wall Street Crash of 1929. In 1987, the DOW Jones lost nearly 23% in an event known as “Black Monday.” Along the way, we’ve experienced a variety of mini-crashes amounting to ~5% daily declines caused by issues in the junk-bond market or foreign stock markets. In the wake of September 11, 2001, global markets experienced drastic declines and billions of dollars were lost in the economy. We experienced the mortgage crisis of 2008-2009 known as the Great Recession which lasted nearly 19 months.

All along the way, the market has recovered, peaking at new all time highs.

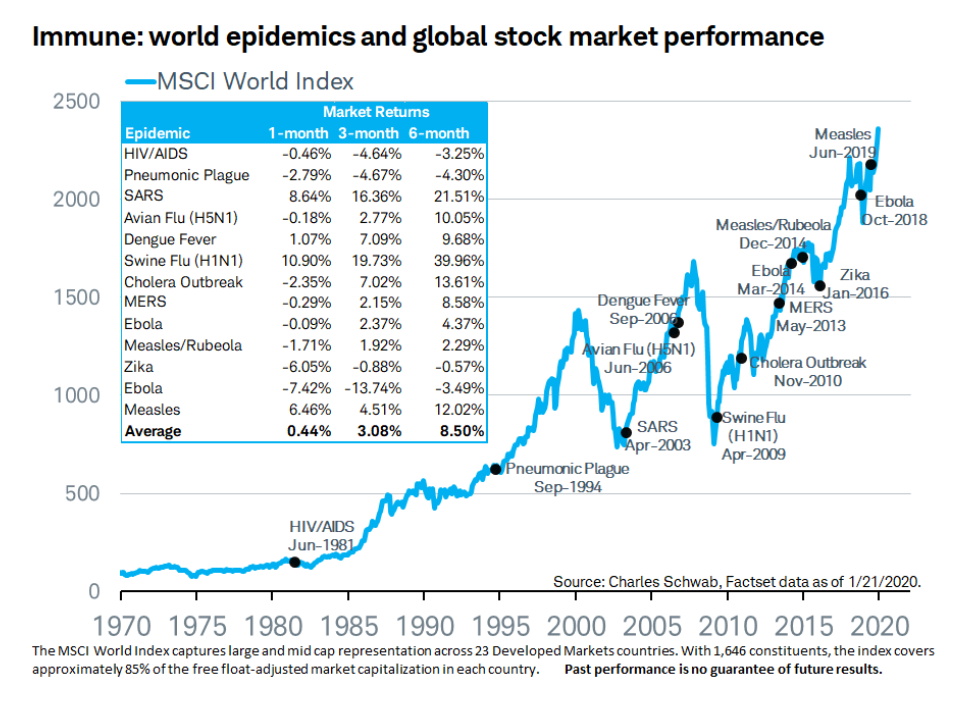

Previous market declines due to health scares – SARS, Ebola, avian flu

We’ve even experienced market volatility due to previous global viral outbreaks.

Below is a summary of epidemics followed by market performance:

In 2003, a similar viral outbreak known as Severe Acute Respiratory Syndrome (SARS) emerged from China. After an initially slow and criticized response by China, the outbreak was eventually contained. However, by the time of containment, SARS had infected nearly 8,000 worldwide and killed 800.

The spread had an impact on global markets. However, this was short-lived. After initial declines, the S&P 500 finished up nearly 15% after the first reported case of the deadly viral outbreak.

Other more recent events include MERS (2013), Ebola (2014 & 2018) and Zika (2016). Each of these outbreaks were met with similar market responses. As you can clearly see, once the market has had time to digest the information and public health responses have been implemented, the overall decline has been fairly muted in the long-term.

Difference with the novel coronavirus

While we’ve had previous viral outbreaks, there are some distinct differences.

As of the end of February 2020, the coronavirus has infected over 80,000 worldwide and killed nearly 3,000. Due to the delayed response in Mainland China, the virus spread far beyond the Wuhan province due to the up to 14-day incubation period.

In China, the manufacturing supply chain was greatly disrupted due to the government’s attempts to contain the virus. Chinese auto sales are down 92%. According to the New York Times, $29 billion in revenue has been lost by airlines. The outbreak has shuttered much of the local economies and caused fear in consumers.

By contrast, the SARS outbreak only infected 8,000 and killed around 800. It took 9 months to contain the spread.

In the United States, we have seen a fairly muted impact as if February 2020. However, if we begin to see a spread of the virus in the homeland, we may see a disruption in our normal routines.

Primary and elementary schools may shut down like Japan. Airlines and travel companies may see a decline in bookings. Malls, restaurants, gaming, and other community gathering places may see a significant decline in foot traffic as people avoid crowds. Even workplaces may insist employees work from home or begin laying off hourly employees. This could could be the predecessor of an economic recession or slowdown.

Clearly, coronavirus poses a significant threat to the global economy.

However, over the long-term, this too shall pass

The American economy is resilient.

In all likelihood, the market reaction will be a wonderful opportunity to buy stocks at a discount for the long run. In 5, 10, or 15+ years, this event will probably just a blip on the chart – just like the other health concerns that have come before.

Biopharmaceutical companies may develop antivirals or provide medications that allow the infected to recover sooner. Eventually, the news cycles will shift as viewers no longer.

Just like the market inevitably recovers from shocks, the global economies will eventually return to normalcy.

Therefore, don’t make any sudden pivots by selling into a large decline induced by fear!

Instead, invest for 5+ year periods.

Perhaps, the market scare has poked holes in your investment portfolio. You may now see that you are too heavily invested for your risk profile or current needs. When we begin seeing calmer markets, begin reassessing your asset allocation.

This could be a valuable learning opportunity as you invest for both your short and long-term needs.

3. Assess your asset allocation

If the market decline of 15%+ over the last week or two has made you uncomfortable, it may be time to reassess your asset allocation.

You could be invested too aggressively.

For some investors, being fully invested in stocks during market declines may cause you to lose sleep at night. Therefore, it may be best to keep some cash on the sidelines or hold a percentage of your portfolio in bonds or less volatile stocks.

Your asset allocation is totally dependent on your own financial situation and risk tolerance

If you’re younger and have a 10+ year time horizon, you’re much better suited to ride out volatility.

Instead of panicking, consider this as the “market on sale” and keep socking away money. During the downturns, your contributions into growth-stock funds will have even more buying power. In 10+ years, you’ll be thankful you bought when the market was on sale.

For older investors, you may realize that you can’t tolerate drastic declines. Instead, you need the money to sustain your lifestyle and pay bills. Selling at the lows early on in retirement, could introduce Sequence of Returns risk.

However, selling at the lows out of fear won’t be good for the long-term. Instead, with any new money, consider buying more stable, income-generating funds that are also “on sale.” For instance, index funds that track REITs, consumer staples, or utilities could provide stability and needed income.

Having a larger portion in cash could help you sleep better at night and leave more of your portfolio invested during declines. While income funds and cash won’t generate the long-term returns of growth funds, there will be much less volatility along the way.

Having cash on the sidelines can provide a war chest to deploy. Instead of being fearful, this could be the exciting opportunity to put capital to work.

4. Use the market reaction to coronavirus as education and experience

In all likelihood, the market decline on coronavirus fears will simply be another data point in market history.

As the S&P 500 powers higher over the next decade, we will remember the greed leading up to the 15%+ decline. We will also remember the fear of what the coronavirus meant to our global economy.

This can be an opportunity to study the markets. Explore historical trends and events.

Inevitably, history tends to repeat itself. In 5, 10, or 20 years, we will have other similar events. This could be your opportunity to learn. Next time we have a decline on health concerns, you will be better prepared to weather the volatility.

Coronavirus has certainly shaken investor sentiment. We’ve seen global markets plummet. Thousands of cases have resulted in hospitalizations. Hundreds of families have lost loved ones to complications of the virus.

However, markets are resilient. While the declines may be justified given we were due for a pullback after historic highs, the markets will continue chugging higher in the long-term.

Instead of panicking, use the recent market declines to learn to invest without emotion, invest for the long-term, assess your asset allocation, and use the coronavirus outbreak as a learning opportunity.

Pingback: Passive Investing During a Recession or Bear Market in 2020 - Traceview Finance