The accounting profession is often seen as the “red-headed stepchild” of the financial services world.

Unlike the world of “high finance,” accountants tend to be much more conservative by their nature, in their work, and their lifestyles.

Even though CPAs earn a respectable salary (median income of $120,000+), CPAs generally do not flaunt their wealth or attempt to live extravagant lifestyles.

This begs the question from many who are deciding between accounting and finance: Can you build wealth and get rich in accounting or as a CPA?

While most CPAs in accounting won’t ever receive six-figure bonuses like many investment bankers, the above average pay coupled with their conservative nature makes accounting a very lucrative profession.

As another benefit, you don’t have to be the “cream of the crop” to make substantial money. Sure, finance professionals who work for hedge funds, private equity, or investment banks will make substantially more than most in the accounting world.

However, many of these individuals have been in the top percentile of their class, attended prestigious target universities, or earned an expensive MBA to land the job.

Therefore, it’s not really appropriate to compare the best jobs in finance to the average job of a CPA.

Ultimately, you should pursue a career in a field that you are passionate about and have the drive to be the best. Eventually, a high income and wealth will be the result of your hard work and value you bring to your employer.

Looking to transition from accounting to finance? Read the 3 Proven Strategies to help you move from accounting to finance.

Sure, you can get rich as a CPA… However, virtually anyone CAN build wealth

Building wealth takes decades of earning a respectable salary, living below your means, and consistently investing the excess.

Will you get “rich” overnight with this strategy? Absolutely not.

However, most “get rich schemes” are simply fallacies. More often than not, risky ventures or buying that lottery ticket won’t result in any sort of payout.

You don’t have to swing for the fences on every pitch to accumulate immense wealth.

Instead, simply by living below your means and on a budget and investing in low-cost index funds in tax-advantaged accounts, you can retire a multi-millionaire no matter your occupation.

Don’t get me wrong, a career as a CPA can be financially rewarding.

Experienced partners at public accounting firms can easily expect to earn $750,000-$1,000,000+ in annual compensation. C-suite executives at large, public companies can earn $1,000,000+ in base pay, bonus, and equity incentives.

Even if you never reach these sort of heights in your career, becoming a CPA can still reap financial success. According to the Journal of Accountancy, the median CPA earns over $120,000 per year before bonus.

With this kind of base salary, you should be more than able to support yourself and a family while investing for the future. Over time, you will inevitably accumulate substantial wealth and build financial independence in retirement.

Wealth Level #1: Accumulating $1 Million

For everyone on the path to building wealth, becoming a millionaire is the first step.

As Chris Hogan chronicles in his bestselling book Everyday Millionaires, only 6% of the American population or 7.2 million households have achieved millionaire status.

Although achieving a net worth of $1 million is hard, this feat is not impossible. Instead, accumulating this first level of wealth takes disciplined investing and time.

According to the National Study of Millionaires, 80% of millionaires surveyed accumulated their $1 million nest egg inside their employer-sponsored 401(k) plan. On average, reaching this milestone took 28 years.

Did they earn the big bucks? Nope! In fact, 33% never earned six-figures in any single year of their working life. Only 31% averaged $100,000 during their career.

The most popular career paths for millionaires? CPA was number 2 on the list! This provides evidence that CPAs do have the ability to “get rich” and build wealth.

However, a $1 million net worth may not be enough for everyone asking, “Can you get rich in accounting or as a CPA?”

After all, you may have a different threshold for defining wealth.

First, define what “rich” means to you

“Rich” is a relative term.

If you’re basing your career decision on which path will help you “get rich,” you’ll need to figure out what “rich” means to you.

For example, you could have $10,000,000 investment portfolio. Comparatively speaking, you’re rich by most standards. With a nest egg of this size, you could easily spend $600,000 to $800,000 in perpetuity without touching the principle.

This kind of income would afford an extravagant lifestyle. For virtually everyone, you’ll have achieved financial independence and eliminated the need to work any longer.

With this kind of income, you could join most any country club you wanted, drive any car you desired, vacation in Europe, and enjoy other luxuries life has to offer.

However, with a net worth of over $130 billion, Jeff Bezos would probably scoff at your “fortune.”

For most of us, we certainly don’t need $10 million (much less $130 billion) to maintain a high quality of life.

According to CNBC, most Americans peg the threshold for being “rich” as having a net worth of $2.3 million. For those still working, a $300,000 annual salary catapults them into the “rich” category according to the survey.

Can a career in accounting help you build a $2.3 million nest egg?

In short, YES.

As a CPA, you should be able to comfortably live on your income while simultaneously investing to build wealth.

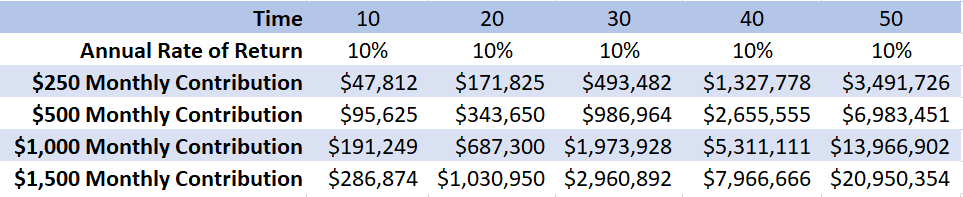

As shown below, by simply investing $500 – $1,000 per month, you should be able to accumulate $2.3 million by retirement.

If you earn the median CPA salary of $120,000 and put 15% away for retirement, you’d sock away $18,000 (or $1,500 per month). While it will take you 27.5 years to accumulate $2.3 million, you will build a large enough portfolio to be considered “rich” thanks to your career in accounting as a CPA.

However, more than likely you’ll get there much sooner as this example does not assume any employer matching or other assets (pension, primary residence, other real estate or investing).

What about a $300,000 salary?

As you would expect, jobs that pay $300,000+ are few and far between.

Unless you’re willing to commit to investing $150,000+ for medical school, law school, or a prestigious MBA program, landing a job that pays $300,000 will be tough to find. Even if you invested time and resources into one of these fields, the odds of landing this kind of job and pay is unlikely.

However, there are certainly CPAs that earn $300,000 or more per year.

For example, virtually every partner in a “Big 4” accounting firm earns more than $300,000 annually. After all, the average partner earns $750,000 with senior partners earning millions in the latter part of their careers. In order to make partner, you’ll need to obtain and maintain an active CPA. Clearly, these CPAs have found a path in accounting that led them to become rich based on CNBC’s survey.

However, the track to making partner is no cake walk. You’ll be overworked and underpaid for 12-15 years. You’ll inevitably work 70-80+ hours per week months on end. As you progress and begin achieving greater compensation, your client load will also expand and your “busy season” will probably extend into the spring and summer.

Plus, there’s no guarantee you’ll be granted partnership after you’ve sacrificed more than a decade for the firm.

Even if you make partner, you’ll still burn the midnight oil during busy season. Plus, you’ll have the added liability if something goes wrong.

If public accounting isn’t your long-term plan, you can still earn $300,000+ in industry.

Most CFOs, Corporate Controllers, Finance VPs, and CAOs at Fortune 500 companies earn more than $300,000. However, these roles are difficult to obtain and generally require several years of public accounting experience, coupled with a decade or more of diversified industry experience.

Careers outside of accounting for CPAs

Just because you obtain your CPA doesn’t mean you MUST work in audit, tax, or an accounting department in industry.

Plenty of opportunities exist for CPAs in more lucrative finance-oriented roles if accounting isn’t your goal. If your goal is landing a career in finance, consider these 3 Proven Strategies for How to Transition from Accounting to Finance.

Worst case, landing a stable gig in accounting can be a fall back option as you gain experience while pursuing opportunities more aligned with your long-term goals.

Identifying experiences outside of accounting

CPAs who have experience in corporate finance, valuation, or business modeling can distinguish themselves from the competition.

While the CPA license is certainly the “gold standard” in the accounting world, many of the skills and knowledge translates into areas of finance.

For instance, understanding the relationship between the income statement, balance sheet, and statement of cash flow is an important aspect of business modeling. This cash flow is used to determine net present value (NPV) or internal rate of return (IRR). These metrics help management determine the most lucrative investment to deploy capital.

Therefore, the return on investment for quality employees who have these skills is high. Subsequently, these employees tend to be better compensated.

Overall, the key is identifying roles that allow for experiences that more closely relate to finance rather than pure accounting. After all, plenty of hybrid roles exist for CPAs where accounting skills and finance experience collide.

Valuation and Advisory Practices

For instance, the “Big 4” and other service firms have valuation and advisory teams that help solve complex issues for clients.

These groups provide valuable due diligence or asset valuation reports for mergers and acquisitions or other corporate transactions.

Working in these groups, you’ll learn to pull comparative market transactions (Market Approach), calculate the weighted-average cost of capital (WACC), or build financial models in Microsoft Excel (Income Approach) to determine fair value for clients.

Along the way, you’ll sharpen your financial modeling and finance skills while obtaining valuable Microsoft Excel experience.

While accounting skills are important, these types of experience on the resume can help you land roles in private equity performing valuation, in corporate development analyzing potential transactions, or in a financial planning and analysis (FP&A) group analyzing strategic business decisions.

These experiences correlate to increased pay

Generally, valuation and advisory analysts make substantially more than the equivalent level in audit or tax.

A valuation or modeling analyst with 1-2 years of experience will earn ~15%-20% more than an audit associate with the same experience. As you progress and reach manager and beyond, the pay tips even more in the favor of consulting or valuation specialists within these firms.

While the hours are still long when the deal flow is strong, the work probably appeals to a wider audience.

Plus, the exit opportunities available tend to be much more lucrative. Many of these associates with 4-5 years of experience can land senior analyst positions in private equity or in corporate development earning $120,000-$150,000+ in compensation.

Further, their overall earnings potential greatly expands as their career unfolds in these positions.

Therefore, you are much more likely to get rich as a CPA if you are working in this specialty rather than accounting.

The CPA is powerful in the accounting world; however, it’s simply a tool outside of the profession

If you know a pure finance role, investment banking, or private equity is your end goal, consider investing time and resources into other areas to increase your chances of earning a substantial salary.

An MBA with a finance concentration from a top-tier university will do more good to help you “get rich” when compared to a Master’s in Accountancy combined with the CPA. However, getting into (and paying for) a top program is easier said than done.

Obtaining other credentials will also be more beneficial if finance is your end game.

The Chartered Financial Analyst (CFA) certification is the equivalent “gold standard” in the finance community. Just like the CPA opens up the best doors in accounting (and some doors in finance), the CFA provides greater access to those lucrative careers in finance.

In fact, the average CFA charterholder earns $300,000 in total compensation. This is more than double the total compensation of the average CPA’s compensation. This kind of earnings potential greatly increases the likelihood you’ll reach whatever level of “rich” you desire when compared with becoming a CPA and working in accounting.

CFAs are generally found in portfolio management, equity research, investment banking, and corporate development.

Can you break into one of these areas and increase your chances of getting rich with the CPA? Sure, you may be able to land one of these roles. However, your background and experience will largely dictate the odds of success. After all, most of the target candidates for these roles do not come out of public or corporate accounting departments.

The bottom line

Getting rich and building wealth in accounting or as a CPA is certainly possible.

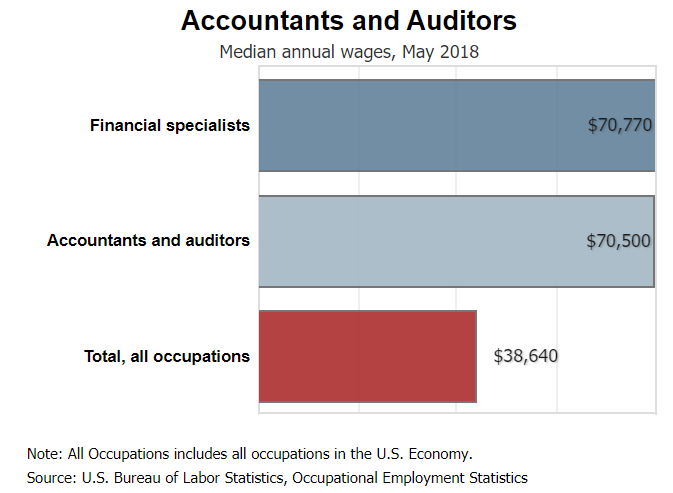

Based on the Bureau of Labor Statistics data and Journal of Accountancy, CPAs earn a median salary of $120,000. This is nearly 2x the median income of financial specialists, accountants, and auditors. Further, CPAs earn 3x the median income of all occupations in the United States.

However, CPAs who work outside of accounting in more finance-oriented roles have a greater likelihood of earning higher incomes and growing rich.